Last week, Intuitive Surgical's (ISRG 0.66%) shares hit a new high after the company reported much higher than expected profits and revenue for the first quarter.

In this clip from the Market Foolery podcast, Chris Hill, Simon Erickson, and Matt Argersinger explain how Intuitive Surgical's business model works, how much sales popped last quarter, and a few reasons why Wall Street likes the stock so much (and why it keeps showing up as a recommendation in our Rule Breakers service).

A transcript follows the video.

This podcast was recorded on April 20, 2016.

Chris Hill: Intuitive Surgical's shares are hitting a new high today after first-quarter profits came in much higher than expected. Revenue, also higher than expected. This is one of those quarters, Simon. (laughs) This is why you own this stock, for quarters like this.

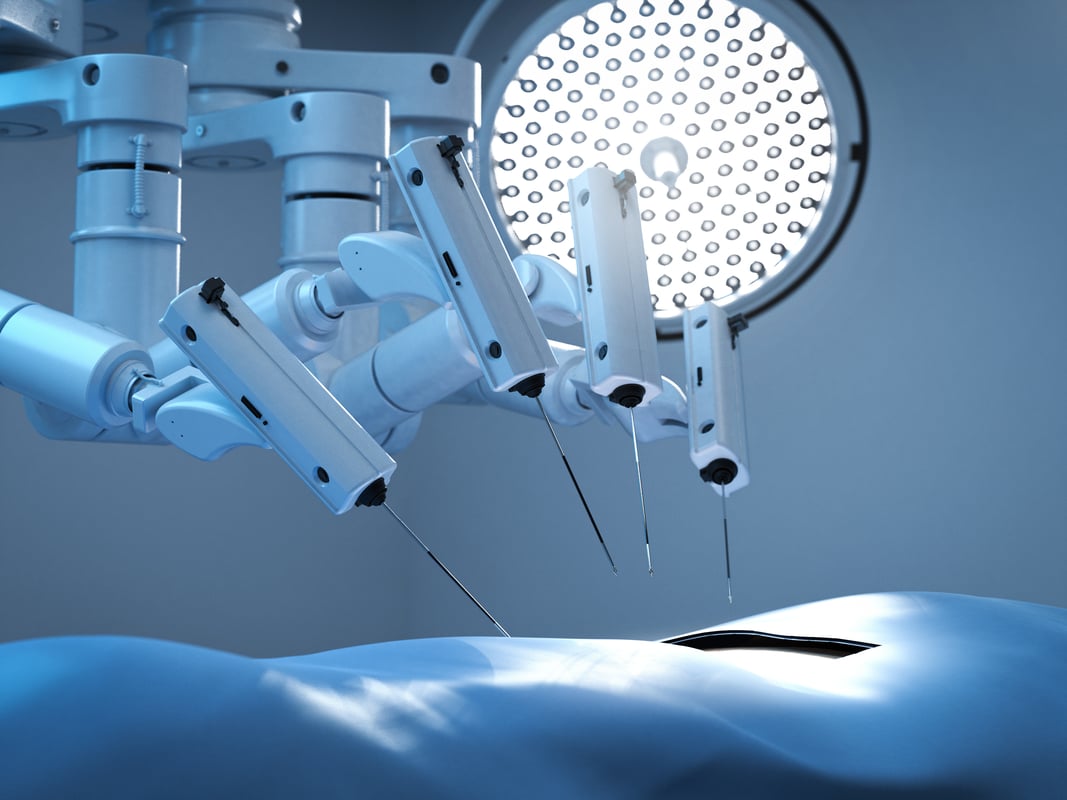

Simon Erickson: Oh, yeah. Beautiful "razor and blades" model that we've seen here with Intuitive Surgical. Even better, when the razors and blades are both really expensive. Matty, you mentioned the Renaissance earlier, talking about Yahoo. Let's talk about the da Vinci systems that Intuitive Surgical is selling ...

Hill: Oooh, nice.

Erickson: ... for robotic surgery.

Matt Argersinger: (laughs) Well done, Simon.

Erickson: They shipped 110 da Vinci systems in the quarter. By a 3 to 1 margin, they're selling their newest Xi systems. These are the more expensive, more utility, the table moves underneath them, able to do more procedures. So, you're selling at the high end of the systems, which is great, when the "razors" are the most expensive razors you can sell. And then, looking at the "blades," they're just selling more and more consumables to compliment those. We saw the number of procedures up 17% in the previous quarter, and then 14% in the previous year. Mostly from general surgery, in the abdomen, skin, stuff like this, and urology, too. So, they're expanding what the da Vinci system can actually be used for, also. This is great. They're seeing further growth in 2016. This is exactly what you want to see in a company like that.

Argersinger: And, we'll use the Renaissance again here. If you look at the stock, I didn't realize it was sitting at an all-time high, but this was -- go back to 2012, there was a really big slowdown. They were almost in that transition phase to the new platform. And there were all these questions of cannibalization: People are used to the old platform, why would they move on to the new one? Plus, I remember Andrew Left from Citron had a short report around that same time, and the stock got really butchered at that point. But gosh, it's up, it's almost doubled since that low.

Erickson: And like you said, the company's at an all-time high now. P/E is still at 40, which is rich by many investors' bloods. But keep in mind also, 75% of revenue is now from recurring sources. Great to see. The instrument and accessory revenue is growing 16%-plus here. That's even higher than the top line is growing. So, you've got a modelable company. Wall Street likes predictable, modelable companies, and they're willing to give those P/Es that are high, like in the 40 range.

Hill: I'm reminded a little bit of Caterpillar (CAT 1.19%), from the standpoint of, if you think about who their customers are, it's huge businesses, it's countries that are making major purchases, and they have to be planned out, in some cases, years in advance. And in the case of Intuitive Surgical, albeit on a smaller scale, you have kind of the same thing going on, where hospitals are saying, "OK, do we want to write a seven-figure check for this surgical system? If so, when do we want to write it? We have to plan for that." All that sort of thing. So, just selling a few extra machines in a given quarter makes all the difference in the world.

Erickson: Huge up-front costs. And you look at those customers, you were talking about Caterpillar, you're using machinery that's going to be constructing a giant construction project, putting up a building, doing something really big -- it has to be dependable for you. Quality and brand really matters for a company like that. Intuitive Surgical, probably the most important industry of all, healthcare, for something that has to do well, you want to go with a company that's a leader. Intuitive Surgical has been at this for years. It's been multiple recommendation on the Rule Breakers scorecard, as we just saw that platform growing. I think it's in a great place right now.