Image source: Enterprise Products Partners.

Individual retirement accounts, or IRAs, are wonderful savings vehicles. That's particularly true for the Roth variety, which allow you to avoid taxation when you pull money from the account. But there are some stocks that shouldn't live in an IRA of any kind. Here's one you might want to own and why I'd never put it in an IRA.

The middleman

Enterprise Products Partners (EPD 0.16%) is a giant midstream energy company. It owns the pipes and other facilities that sit between where oil and gas are pulled from the ground and where they get used. That includes nearly 50,000 miles of pipelines as well as a broad portfolio of storage, processing, and terminal facilities.

What makes this portfolio so interesting, however, is that Enterprise largely operates as a toll taker. So it gets paid when customers move products through its system. The price of oil and gas, and other refined products, isn't nearly as important as the volume of what gets pushed through its pipes. So, in some ways, much of Enterprise's business is shielded from volatile commodity prices.

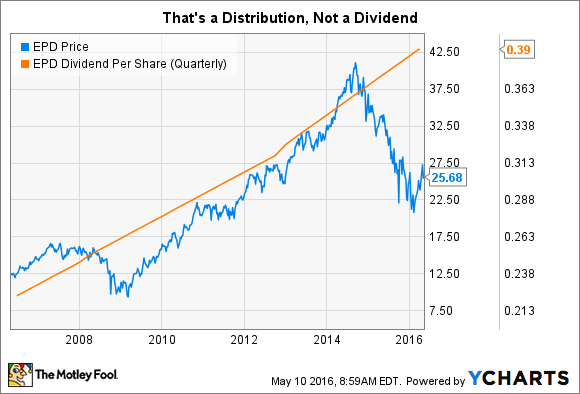

Which helps explain why Enterprise has managed to keep increasing its distribution each quarter even though oil and gas prices are in the dumps. (Its quarterly increase streak is up to 47, by the way.) Management's decision to grow at a consistent, and somewhat modest, pace has been a big help, too, since it kept Enterprise from getting overextended during the energy industry's salad days. With a distribution yield of over 6%, you should strongly consider taking a deeper dive here.

IRAs and taxing complications

But here's the thing: Notice I didn't say dividend yield. That's because Enterprise is a limited partnership. It's a special type of corporate structure that functions as a pass-through entity. That allows the partnership to avoid taxation at the partnership level because it passes most of its tax issues through to unitholders, who deal with the taxes at their personal tax rates. That's part of the reason limited partnerships have relatively high distributions.

But when it comes to an IRA, there's a big complication. IRAs are meant to handle passive income like dividends, interest, and capital gains. Since limited partnerships pass through their tax issues, the income unitholders receive is considered earned income. You are, after all, a "partner" in the business.

There are limits on how much earned income an IRA can receive ($1,000) before you have to start filling out additional tax forms for the IRA to inform the government how much "unrelated business income tax" you owe. That's the fun term for the tax you have to pay on earned income in an IRA. It's a potential mess that's just not worth dealing with.

Image source: Enterprise Products Partners.

You can't avoid taxes twice

Making your taxes even more complicated is enough of a reason to avoid putting a great company like Enterprise in an IRA, but there's more. One of the nice things about a limited partnership is that unitholders get the benefit of things like depreciation charges. So a good deal of the income that a partnership generates will be considered a return of capital. That reduces your cost basis and defers taxation until you sell the shares -- at which point you'll benefit from lower capital gains taxes.

In other words, there's a built-in tax shield in the limited partnership structure. Putting a limited partnership into a tax-advantaged account pretty much cancels out that benefit. For example, in a traditional IRA you'd actually turn tax-advantaged income into taxable income when you pulled it out of the IRA. That doesn't sound like a good idea.

But what about Roth IRAs, since money pulled from these accounts doesn't get taxed? This isn't a good idea, either. You can't "double up" your tax benefits. So by putting a limited partnership in a Roth you are, in effect, losing out on one of the biggest benefits of the limited partnership structure. Put taxable bonds in a Roth IRA and leave Enterprise in your taxable account where you'll get the benefit of the tax shield... and avoid the whole unrelated business income tax issue.

Great company, not right for retirement accounts

Enterprise Products Partners is a great company for generating retirement income, with regular "pay raises" along the way. But an IRA or Roth IRA is a lousy place to own it. Putting this limited partnership in either of these accounts could create additional tax headaches and reduce the inherent tax benefits of the partnership structure. Which is why I'd never put Enterprise, or any limited partnership, in an IRA.