Warren Buffett recently announced his decision to step down as the CEO of Berkshire Hathaway (BRK.A +0.26%)(BRK.B +0.20%) at the end of 2025. That, however, doesn't detract from the massive wealth he has built over his 60-year tenure at Berkshire Hathaway. Between 1964 and 2024, Berkshire Hathaway generated a staggering 5,502,284% return compared to the S&P 500's total returns (including reinvested dividends) of 39,054%.

Buffett has also built a massive portfolio of over 40 stocks through Berkshire Hathaway over the years, and his investing acumen and proven track record attract a large following, especially among long-term investors. Buffett buys quality companies for the long term, many of which are dominant players in their respective industries, with strong management teams. Right now, the 10 Buffett stocks listed below are no-brainer buys (in no particular order).

Image source: The Motley Fool.

1. Amazon

Buffett didn't own Amazon (AMZN +0.49%) shares until 2019 when one of his investment managers bought them. In an interview with CNBC, Buffett even called himself an "idiot" for not buying the stock sooner. Amazon has remained a steady part of Buffett's portfolio since then, and the company has grown by leaps and bounds in the meantime.

Today, Amazon is not only the world's largest e-commerce player but also the world's largest cloud computing platform, with Amazon Web Services (AWS) dominating 29% market share in the first quarter of 2025. Since AWS is also Amazon's largest profit and cash driver, buying this Buffett stock today is largely a bet on artificial intelligence (AI) and cloud computing, two trillion-dollar markets in the making.

NASDAQ: AMZN

Key Data Points

2. BYD

When Charlie Munger, the late vice chairman of Berkshire Hathaway, prodded Warren Buffett to buy BYD (BYDD.F 1.63%)(BYDDY 1.09%) stock in 2008, not many had even heard of the company. Today, China-based BYD sells more electric and plug-in hybrid vehicles combined than Tesla (TSLA 0.16%) and is one of the largest electric vehicle (EV) battery makers in the world. In 2024, BYD sold 4.7 million vehicles compared to Tesla's sales of 1.8 million. BYD's recently launched Super-e platform outperforms Tesla's superchargers.

BYD's global sales jumped 39% year over year during the first five months of 2025, and sales outside China hit record highs. Its big investment plans in advanced EV technologies and key regions, such as Europe, make it a solid stock to buy.

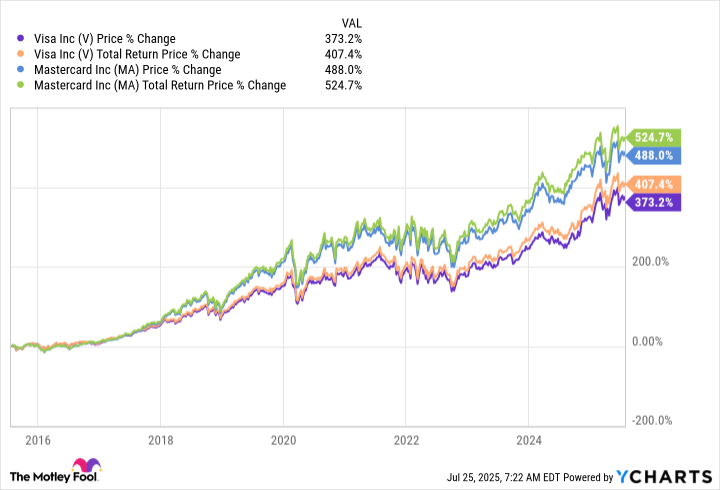

3. Visa

As the largest payments processing company in the world, Visa (V +0.19%) enjoys massive advantages of scale and network effects. In the 12 months ending March 31, 2025, Visa processed global transactions worth a staggering $16 trillion. Since Visa doesn't lend money or issue credit cards but simply earns fees on every transaction, it generates operating margins of over 60%.

Visa stock has been an immensely powerful wealth compounder over the years and should continue to generate big returns in the coming years, driven by its innovation in AI, value-added services such as fraud management and data analytics, and the global growth in digital payments.

4. Mastercard

Mastercard (MA 0.52%) and Visa hold a near-duopoly in the global payments processing market, and Buffett owns both stocks. Mastercard enjoys similar strengths to Visa and generated a 55% operating margin in 2024. But it has a much larger global presence than Visa.

In 2024, Mastercard generated 56% of its revenue from the Asia Pacific, Europe, Middle East, and Africa regions. That gives the company massive exposure to markets that are increasingly moving toward a cashless system. Also, almost 40% of its revenue comes from value-added services, which are now becoming a growth engine for the company. These two factors in particular make this multibagger Buffett stock a no-brainer buy today.

5. Chevron

Chevron (CVX +0.06%) is among the five largest holdings in Berkshire Hathaway's portfolio. The oil and gas major just acquired Hess in a $53 billion deal and now owns a 30% stake in the prized Guyana Stabroek Block, in addition to oil assets in the Bakken and Gulf of America (formerly Gulf of Mexico) and natural gas assets in Southeast Asia.

Chevron expects the Hess acquisition to drive "significant" production and free-cash-flow growth into the 2030s, which should also mean bigger returns for shareholders. Buffett loves dividends, and Chevron is one of the best oil dividend stocks, with a 38-year streak of annual dividend increases and a dividend yield of 4.5%.

NYSE: CVX

Key Data Points

6. Occidental Petroleum

Buffett has been buying shares in Occidental Petroleum (OXY 1.05%) hand over fist and now owns over a 28% stake in the oil and gas giant. High debt, especially after the $12 billion CrownRock acquisition last year, has been the biggest deterrent for investors in this stock.

Occidental, however, is steadily repaying debt, and management has set a goal to not only maximize free cash flow in 2025 but also sustain "strong cash flow generation potential over the next several years." While CrownRock will boost its oil and gas production, Occidental expects its Oxychem chemical business to become a bigger growth driver in the future. That makes it a compelling stock to buy now.

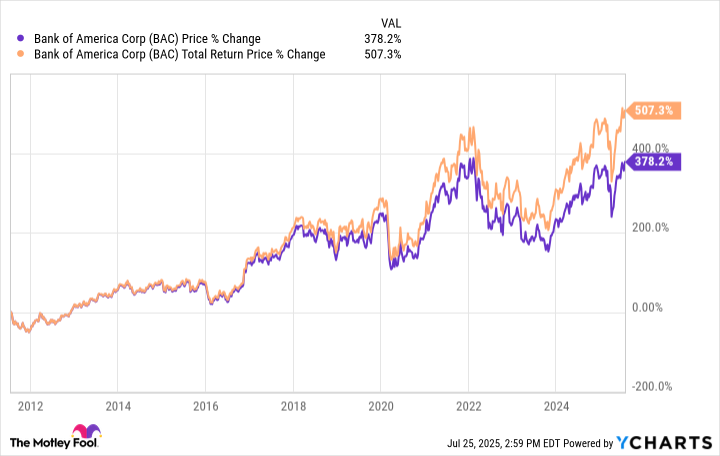

7. Bank of America

Bank of America (BAC +0.72%) is the second-largest bank in the U.S. with the highest retail deposit market share. The bank has clocked 26 consecutive quarters of growth in net new checking accounts, with deposits crossing $2 trillion in the most recent quarter. Other businesses, such as investment banking and asset management, have also posted strong growth in recent quarters.

Buffett has made an absolute killing in Bank of America stock since he first bought it in 2011. It is currently Berkshire Hathaway's third-largest holding. With the bank recently announcing a fresh buyback program worth a staggering $40 billion and increasing its dividend by 8%, it's a solid stock to buy.

8. Kroger

Berkshire Hathaway owned a 7% stake in Kroger as of April 28, 2025. Kroger is the largest supermarket chain in the U.S., with over 2,700 stores. It also owns more than 2,200 pharmacies and 1,700 fuel centers. It's a recession-proof business that generates steady cash flows, a good chunk of which goes to shareholders.

Kroger recently increased its dividend for the 19th straight year and has grown its dividend at a compound annual growth rate of 13% since 2006. Although Kroger's planned merger with Albertsons fell through, its private-label brands, e-commerce, and loyalty programs continue to gain traction. As a defensive, dividend-paying consumer stock, Kroger is a no-brainer Buffett stock to buy.

9. Coca-Cola

Buffett first bought shares in Coca-Cola (KO 0.09%) in 1988 and is a big fan of its namesake soft drink. Coca-Cola is the largest beverage company in the world, selling 200 brands in 200 countries and territories. Of those, 30 are billion-dollar brands. Coca-Cola makes beverage concentrates and syrups and uses its extensive bottling partner and vendor network to manufacture, package, and sell products globally.

Coca-Cola has generated a net income margin of over 20% for six consecutive years and is targeting 4% to 6% growth in organic revenue and 7% to 9% growth in currency-neutral earnings per share in the long term. Coca-Cola is also a Dividend King, having increased its dividend for 63 consecutive years. The earnings and dividend growth potential make it a compelling stock to buy.

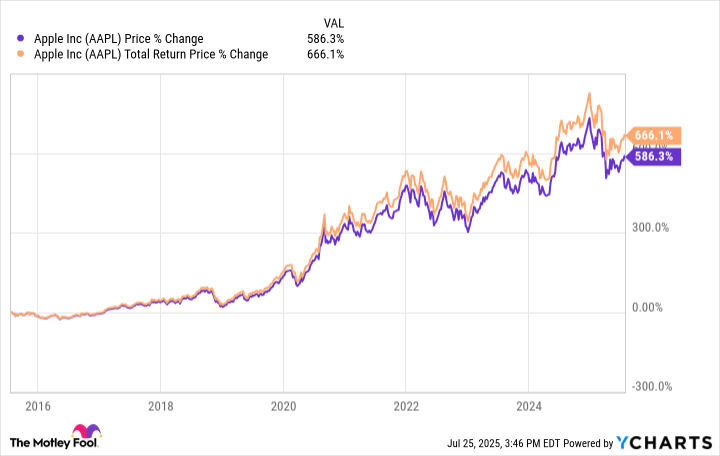

10. Apple

Apple (AAPL 0.93%) is the crown jewel of Berkshire Hathaway's portfolio. At over 20% of the portfolio, Apple is Buffett's largest holding. Apple's unparalleled brand power, an ecosystem that locks in consumers to its products and services, and strong balance sheet are the biggest reasons why Buffett loves the stock.

In 2024, Apple generated 57% of its sales outside the Americas. Overall, while iPhones were its highest-selling product, with a 51% share of total net sales, 25% of sales came from services, including the App Store, cloud services, and advertising. This is a rapidly growing, high-margin business. Apple is also expanding its product line and financial services while aggressively integrating AI into its value chain. These growth catalysts make Apple a solid Buffett stock to buy now and hold.