Our goal here at the Motley Fool is: To help the world invest. Better.

In that spirit, we've devoted a large portion of our time this September to letting the world know what it means to invest. Financial literacy isn't one of our country's strong suits, and we'd like to do what we can to change that.

In that spirit, I'll be spending this week and next revealing three of The Motley Fool's most oft-recommended stocks among our premium services, and three stocks our analysts think you should be wary of.

Yesterday, I highlighted one little-known stock our analysts are very bullish on. Today, I'm going to focus on a much more recognizable company that our analysts think you need to be wary of.

Coffee, anyone?

Back in 2006, Green Mountain Coffee (Nasdaq: GMCR) bought out a small company named Keurig. The move seemed to be a great one for the company. Keurig makes the at-home coffeemakers that have become ever more present in American homes, and Green Mountain supplied the coffee that was used in the machines.

For a while, this seemed like a no-brainer investment. Between 2009 and 2011, revenue grew 237% and net income nearly quadrupled. If you were paying attention to your friends' kitchens, it wasn't hard to see why this was happening: Lots of people were enjoying the ease of Green Mountain's brewing system. It's not all that different from what SodaStream (Nasdaq: SODA) is doing to at-home carbonated beverages these days.

But starting in 2011, some of the senior analysts at our premium services thought something was amiss. The coffee field has one heavyweight, Starbucks (Nasdaq: SBUX), and lots of smaller players like Caribou Coffee (Nasdaq: CBOU) and Peet's (Nasdaq: PEET).

With two of Green Mountain's K-Cup patents expiring this month, the company no longer has a stranglehold on the at-home brewing system as it once did. Our John Del Vecchio sounded the alarm back in January 2011, saying the market wasn't appreciating the serious threat of losing the patents, and claiming that the company's strategy of aggressive acquisition would eventually come back to haunt it.

It wasn't long before Matthew Richey at Motley Fool Alpha was joining the parade. Richey recommended shorting the stock, saying he "truly believe[s] Wall Street is whistling past the graveyard when it comes to next year's looming expiration of Green Mountain's K-Cup patents. Green Mountain knows it's going to face a deluge of unlicensed competition, and it's scrambling for a solution."

But they were wrong... kind of

If you aren't familiar with what "shorting" a stock means, here's a quick primer. If there's a stock that you really don't like, as our analysts felt with Green Mountain, you essentially have two choices: You can short it, or you can just not buy it.

By shorting a stock, you are betting that it will go down. Unfortunately, because a stock could hypothetically rise infinitely, shorting opens you up to losing more than 100% of your invested money. Therefore, when you are shorting a stock, even if you are right about where the price will go in the long term, you could stand to lose a lot in the short term. And as many an investor has learned before: "The market can remain irrational longer than you can remain solvent."

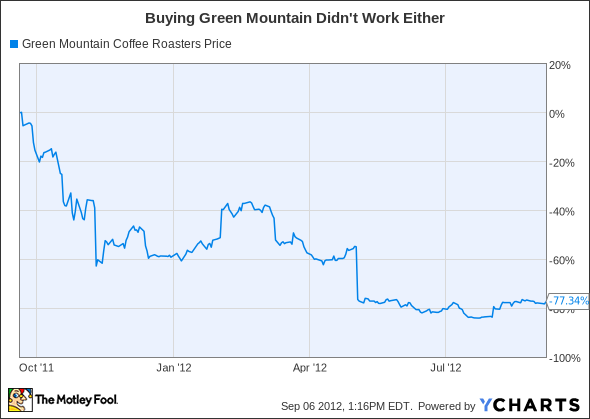

That helps explain why most of the services that bet against Green Mountain back in 2011 lost money. Here's a look at what the stock did while Alpha was shorting it.

In the end, Alpha was correct in its hypothesis, but was too early with its timing. Starting in September 2011, the company has experienced setback after setback. Take a look at what's happened to its stock since then.

In fact, in May of this year, our own co-founder David Gardner was forced to move Green Mountain, which has still earned him a good return since 2009, from a core holding in his Rule Breaker service to the penalty box, where he suggests investors not buy into it.

A better way

Clearly, if you're a beginning investor, shorting a stock may not be for you. And even some seasoned investors think it's rather silly to do. You can find out more about Green Mountain by getting a copy of a special premium report on the company.

Better yet, if you'd like to continue using the Fool as a source to improve your knowledge of the financial world, jump over to our special page: InvestBetterDay.com. On Sept. 25, we're taking a day to celebrate the art of investing, and we encourage your participation. Head on over to the site now to continue your own personal investing voyage.