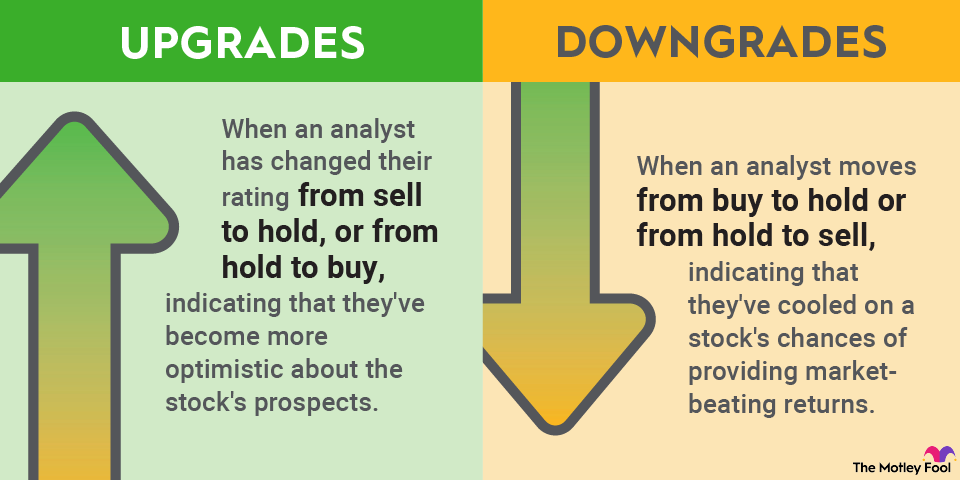

What does a downgrade mean for stocks?

A stock downgrade occurs when an analyst moves from buy to hold or from hold to sell, indicating that they've cooled on a stock's chances of providing market-beating returns.

When a stock is downgraded, it can prompt traders to sell the stock on the assumption that others will be doing the same. The collective result of this selling can push down the stock price, sometimes dramatically.

A downgrade can sting for investors who own a particular stock, since it often results in a lower stock price. But for long-term investors who disagree with the analyst's conclusion, the lower price offers an opportunity to buy the stock at a discounted price, potentially boosting returns if the analyst turns out to be wrong.

Downgrades can occur in reaction to news, just like upgrades -- for example, if a company whiffs an earnings report and misses expectations. Analysts also sometimes downgrade a stock due solely to valuation. If an analyst believes a stock has increased in price too much to be justified by the underlying company's profits, the analyst could downgrade the stock despite no change in the company's long-term prospects.

While stock upgrades and downgrades often drive trading activity in a stock, long-term investors should think for themselves. Analysts' opinions can be useful, but they're far from the only thing to consider.

Related investing topics