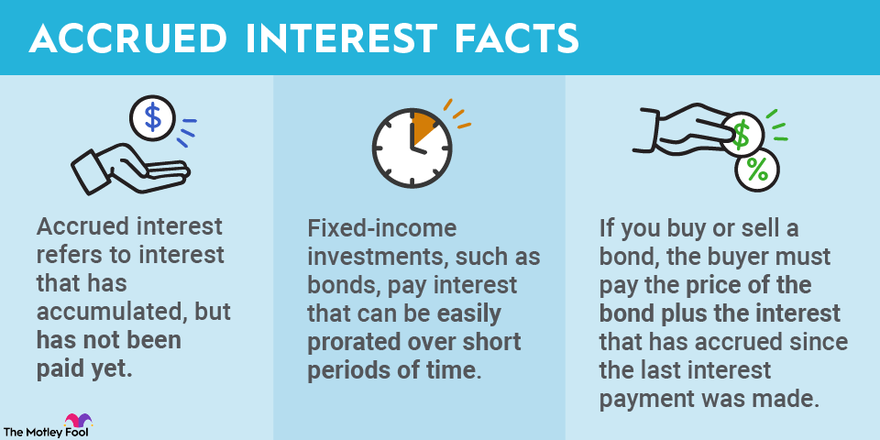

Accrued interest is the amount of interest owed on a loan that has accumulated but not yet been paid. If you take out a mortgage or make purchases on a credit card, you are typically charged interest in exchange for having access to funds.

On the other hand, if you purchase bonds, you lend money to the issuer and will receive interest payments at specified intervals. Accrued interest is the amount you are currently owed. It accumulates daily, and the amount due can vary depending on how early it's paid off.

Accrued interest vs. regular interest

The method for calculating interest payments on a loan or outstanding credit balance varies depending on the agreement.

Accrued interest agreements have fees calculated based on the current account balance and rate.

If you have a regular interest loan, also called a simple interest loan, the payment due will always be the same. A regular interest agreement establishes a set interest rate and usually a payment amount that spans the term of the loan.

The easiest way to think about the difference is a credit card versus a mortgage. With a credit card, you build up a balance and accrue interest that must be paid monthly. With a mortgage, there is an agreed-upon regular interest rate and you pay it while paying back the mortgage amount (principal).

How to calculate accrued interest

Credit card agreements generally use accrued interest and are calculated with a daily interest rate. This means the interest charged can vary based on the number of days in a month and can be slightly different than outlined below. Mortgages and other loan accounts generally calculate interest on a monthly basis.

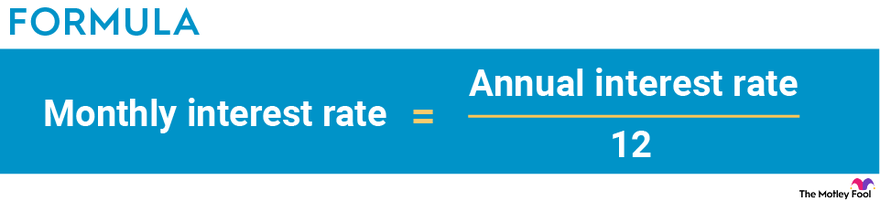

Calculating monthly accrued interest

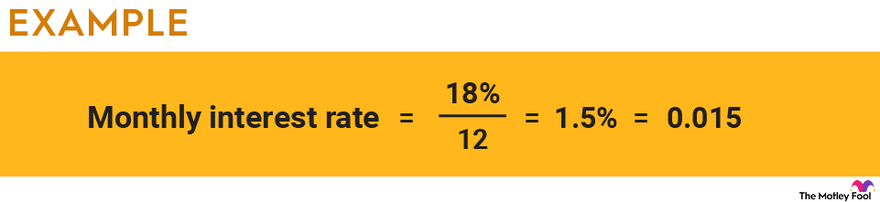

To calculate the monthly accrued interest on a loan or investment, you first need to determine the monthly interest rate by dividing the annual interest rate by 12.

Next, divide this amount by 100 to convert from a percentage to a decimal. For example, 1% becomes 0.01.

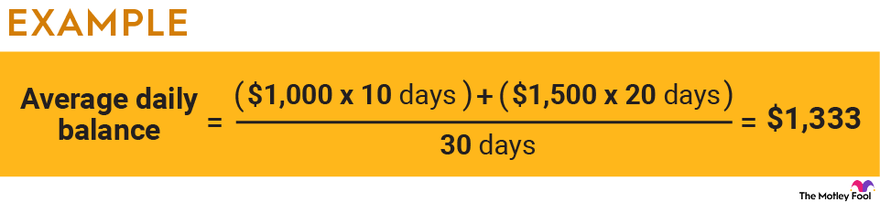

To determine the account's average daily balance, add up the principal balance on each day of the month and then divide by the number of days in the month. This is important to use with accounts that have fluctuating balances.

For example, if you had a $1,000 balance on an account for the first 10 days of a 30-day month and then borrowed an additional $500, your average daily balance would be:

If the account's principal balance did not fluctuate during the month, such as with a typical mortgage, the average daily balance is simply equal to the starting balance.

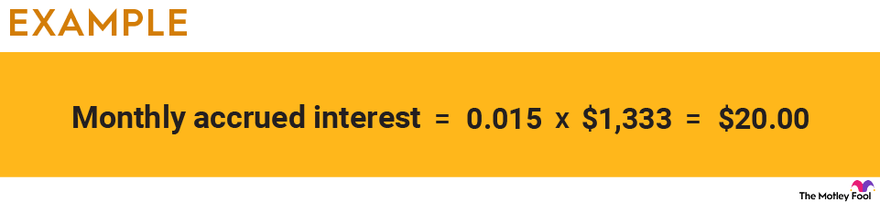

Finally, multiply the monthly interest rate by the average daily balance in order to calculate the interest that accrued during the month.

Let's say you have a loan account with the same $1,333 average daily balance as we calculated in the earlier example. If your interest rate is 18%, we can calculate your monthly interest rate and convert it into a decimal as follows:

Multiplying by the average daily balance gives us monthly accrued interest of:

Accrued interest in bonds

Accrued interest is also important to know in bonds. Issuers typically make payments on bonds every quarter or six months. In the meantime, the interest due in those payments accrues to you. If you sell the bond, the price you sell it for should take into account the accrued interest.

Let's say you have a bond position worth $10,000. It has an annual coupon rate of 5% and it makes payments every six months. You want to sell it, but it has been two months since the last payment, so you need to calculate your unpaid interest as of the settlement date.

To do this, you'll need to figure out the monthly interest owed and multiply it by two. The formula is $10,000 x .05 / 12 = $41.67. This means you have $83.33 of accrued interest. Make sure when you sell the bond that you take that number into account.

Related investing topics

Conclusion

In all investing, it is important to have a firm grasp on the basics. You probably won't have to do the calculations manually, but just knowing how much interest accrues on an account is important for borrowers and lenders.

As a borrower, you can use a monthly interest calculation to determine how much interest you'll be charged on your next credit card statement or how much of your next mortgage payment will be applied to interest. As a lender or investor, calculating your monthly accrued interest can help you estimate your future interest income and ensure you get the right price if you're selling a bond.