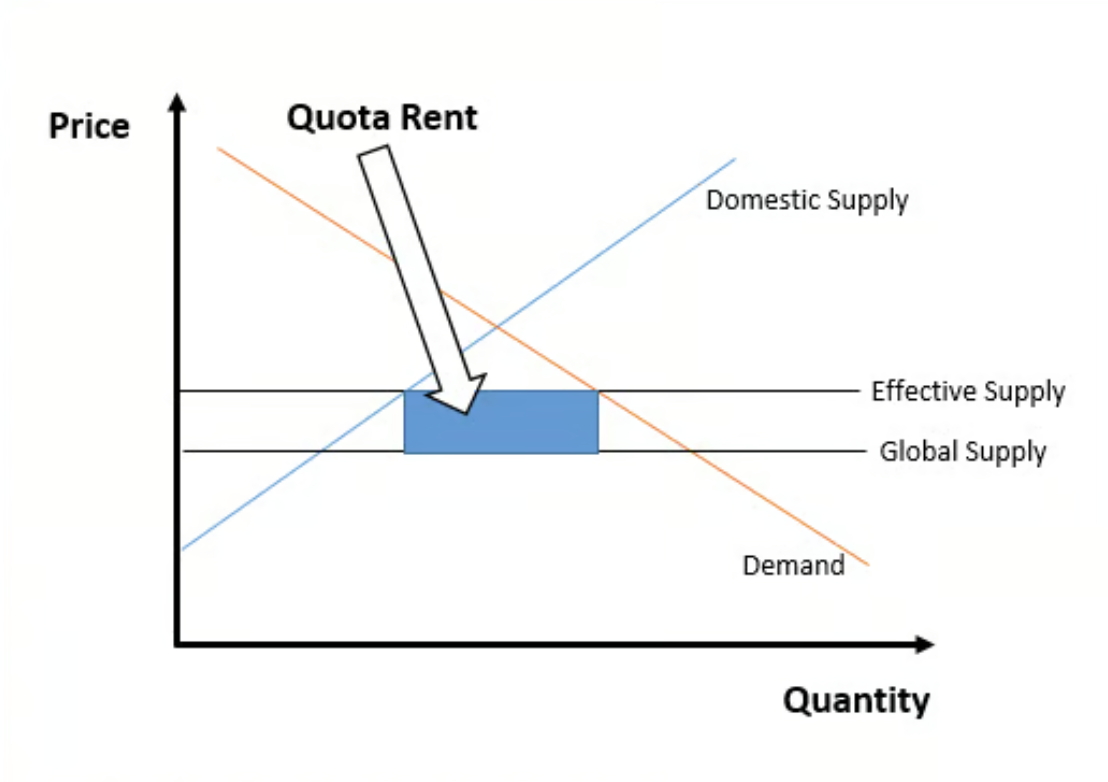

Sometimes external forces in the economy throw the supply and demand for a product or service out of whack. Trade quotas are a common and powerful example of one such external force. One way economists measure the inefficiency created through import quotas is through the calculation of "quota rent."

What is it?

Quota rent is the economic rent received by the owner of the imported good that is subject to the quota. To calculate quota rent, first calculate the economic rent, which is the positive difference between the domestic price of the good and the free market price from around the world. Next, multiply that economic rent by the quantity of the good imported, and you will have the quota rent.

How to calculate

Economists studying this quota would first calculate the economic rent of each piano on an individual basis. In this case, that works out to $3,000, calculated by subtracting the original free-market price of $5,000 from the new, post-quota price of $8,000.

To calculate the quota rent across all the German piano imports, the economist would multiply the economic rent of $3,000 by the new import numbers after the quota takes effect -- 30,000 in this case. That results in a quota rent of $90 million.

An example of the quota rent calculation

The calculation is easier to understand through an example. Let's say the U.S. imports 50,000 pianos from Germany every year at a free market price of $5,000 per piano. One day, however, the government decides to impose a quota on the number of German pianos to be imported, limiting total German piano imports to 30,000 pianos per year. The government hopes this new policy will help the burgeoning piano manufacturing industry in the U.S. increase its sales and stimulate job growth.

With the supply of German pianos restricted by the externally imposed quota, the price for a German piano rises thanks to a combination of lower supply and stable demand. In this case, the price jumps all the way to $8,000 per piano.

Quotas and consequences

The primary purpose of imposing import quotas is to protect the domestic industry. The natural consequence of import quotas, therefore, is that domestic producers of a given product benefit from reduced competition, while international producers lose business.

Consider the example above. If U.S. consumers demand 50,000 German pianos per year, but supply is limited to just 30,000, then German producers are missing out on 20,000 piano sales per year. Presumably, that gap will be filled by U.S. producers.

Related investing topics

For the piano producers in Germany, the quota knocks the natural balance of supply and demand out of whack, creating inefficiency in the marketplace. Quota rent is a representation of that inefficiency, describing the higher aggregate pricing of German pianos resulting from the artificially lower supply of the imported good.