| Thursday's Markets | |

|---|---|

| S&P 500 6,909 (-0.54%) |

|

| Nasdaq 22,878 (-1.18%) |

|

| Dow 49,499 (+0.03%) |

|

| Bitcoin $67,373 (-2.41%) |

|

| Thursday's Markets | |

|---|---|

| S&P 500 6,909 (-0.54%) |

|

| Nasdaq 22,878 (-1.18%) |

|

| Dow 49,499 (+0.03%) |

|

| Bitcoin $67,373 (-2.41%) |

|

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

Wake up to the latest market news, company insights, and a bit of Foolish fun -- all wrapped up in one quick, easy-to-read email, called Breakfast News. Delivered at 7:30 a.m. ET every single market day. See an example of our weekday Breakfast News email & sign-up below.

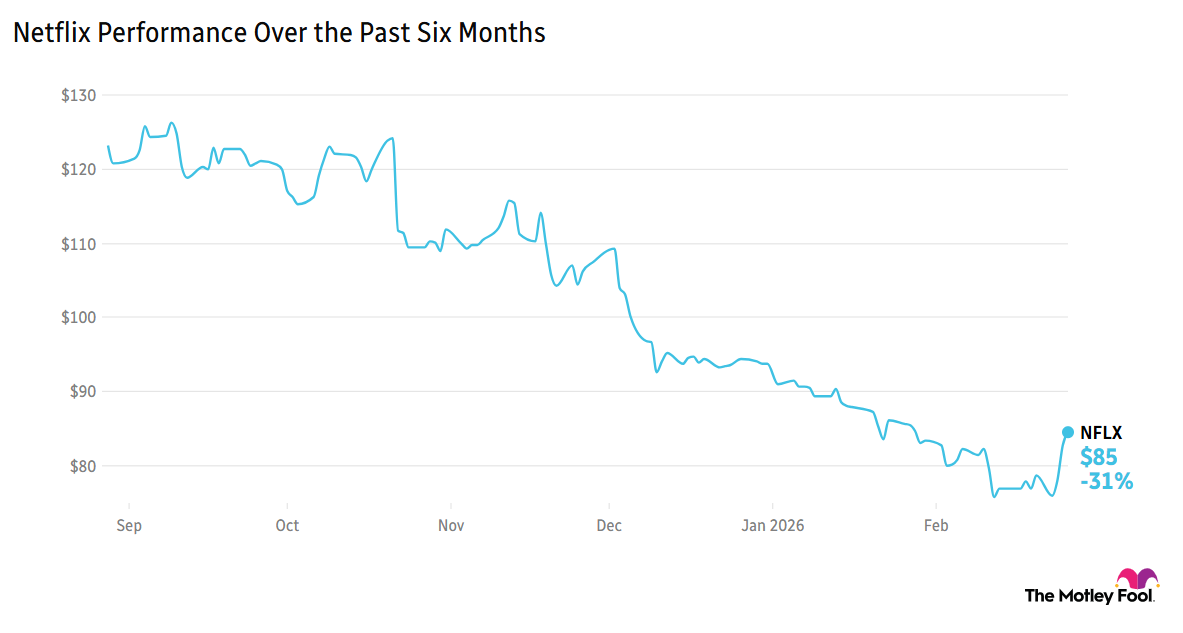

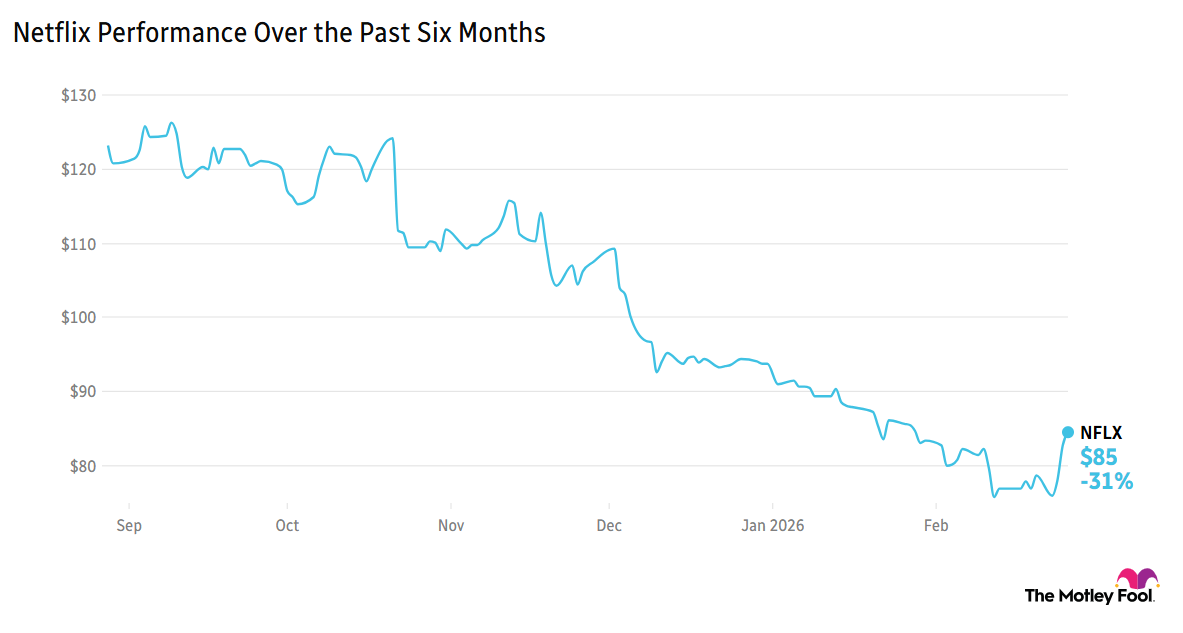

Netflix (NASDAQ:NFLX) has walked away from the bidding wars for Warner Bros. Discovery (NASDAQ:WBD), leaving Paramount Skydance (NASDAQ:PSKY) the winner with its all-cash offer of $31 per share. Netflix jumped more than 8% in pre-market trading, with Paramount up 6%. Warner fell nearly 2%.

Nvidia (NASDAQ:NVDA) fell 5.5% Thursday, helping push the Nasdaq down 1.2% on the day. Fourth-quarter beats on revenue and earnings -- with Q1 guidance lifted above analyst estimates -- failed to soothe wider fears over the valuation of artificial intelligence (AI) stocks. Nasdaq futures edged down a further 0.3% early this morning, with S&P 500 futures down nearly 0.4%.

Based on this month's market action, are you planning to adjust your strategy or stay the course?

Share with friends and family, or become a member to hear what your fellow Fools are saying!