| Thursday's Markets | |

|---|---|

| S&P 500 6,833 (-1.57%) |

|

| Nasdaq 22,597 (-2.03%) |

|

| Dow 49,452 (-1.34%) |

|

| Bitcoin $65,592 (-3.64%) |

|

With markets closed Monday for Presidents' Day, Breakfast News will be back in your inbox on Tuesday, Feb. 17.

| Thursday's Markets | |

|---|---|

| S&P 500 6,833 (-1.57%) |

|

| Nasdaq 22,597 (-2.03%) |

|

| Dow 49,452 (-1.34%) |

|

| Bitcoin $65,592 (-3.64%) |

|

With markets closed Monday for Presidents' Day, Breakfast News will be back in your inbox on Tuesday, Feb. 17.

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

Wake up to the latest market news, company insights, and a bit of Foolish fun -- all wrapped up in one quick, easy-to-read email, called Breakfast News. Delivered at 7:30 a.m. ET every single market day. See an example of our weekday Breakfast News email & sign-up below.

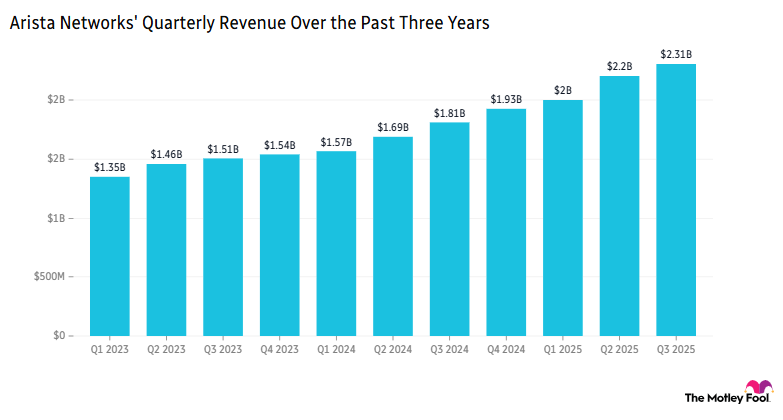

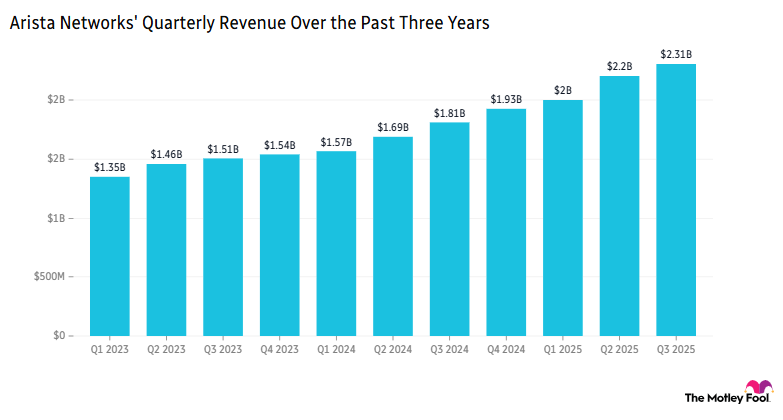

Arista Networks (NYSE:ANET) surged over 10% in pre-market trading after quarterly results showed high demand for Ethernet network switches and routers as businesses push ahead with artificial intelligence (AI) infrastructure spending.

Trucking and logistics stocks fell sharply yesterday, as a new AI-related platform threatens to disrupt the industry, making the sector the latest area of the stock market to come under pressure this week from AI jitters.

This Friday the 13th, we’re asking…

What stock in your portfolio would you describe as "jinxed" -- and why do you still hold it?

Share with friends and family if you dare, or become a member to hear what your fellow Fools are saying. Fun fact: Every year is guaranteed to have at least one Friday the 13th, but never more than three… 2026 will see another in March and November!