Interest rates have stayed low far longer than nearly anyone predicted. That has been a major source of annoyance for bond-market participants, many of whom had placed their bets on a quick rise in rates once the economy started to pick up steam. Indeed, when the Federal Reserve made its first rate hike in more than four years at the end of 2015, many thought it would be just the beginning of a stream of similar increases throughout 2016. Yet even though the Fed continued to defy expectations, rate moves elsewhere in the bond market showed the pressure that central bank officials will face going into 2017.

Image source: Getty Images.

The Fed stayed firm

The Federal Reserve keeps an iron grip on rates for short-term debt, and it sustained its policy of reluctance to push interest rates higher at a faster pace than the economy could endure. The central bank entered the year with a target Fed Funds rate of 0.25% to 0.5%, and that's where the rate stayed into the last month of 2016. Many expect the Fed to boost interest rates at its December meeting, but similar expectations were prevalent in March, June, and September, only to be quashed by various factors.

There's been no shortage of events that have made the Fed reluctant to move. Early in the year, the appearance of an economic slowdown led officials to wait beyond an expected March increase. The U.K. Brexit vote to leave the European Union might have played a role in the Fed's holding off on a June rate hike. By September, caution about not wanting to be too quick to clamp down on economic growth made the decision to keep holding rates steady seem natural.

3 Month Treasury Bill Rate data by YCharts.

Toward the end of the year, bond market participants started looking for a short-term rate increase. With the Fed already having downgraded the market's expectations from four rate increases to two increases and then to one, most believe the Fed can't afford to do nothing all year long.

Long-term rates perk back up

One hallmark of the Fed's success has been that it has managed to keep control not just of short-term rates but also of interest rates on longer-term debt. However, that all changed after the presidential election in November. As you can see below, rates on 10-year Treasury bonds fell throughout the first half of the year, as it became clear that the Fed would be slower than expected in boosting short-term rates. Yet the 10-year rate spiked higher by more than half a percentage point following the election, and that sent rates to their highest levels of the year, approaching the 2.5% in December.

10 Year Treasury Rate data by YCharts

The rise in rates corresponds to a big jump in the stock market. Major stock market benchmarks hit new all-time record highs in the last month of 2016, and many blame the drop in bond prices as a factor in pushing more investors toward stocks.

Inflation expectations start to edge higher

One interesting aspect of the bond market involves the relationship between traditional bonds and inflation-indexed bonds. These special bonds feature interest payments and face value at maturity that adjusts with the Consumer Price Index. As you can see below, rates on 10-year Treasury Inflation Protected Securities didn't rise as much as traditional bond yields.

10 Year Treasury Inflation-Indexed Security Rate data by YCharts.

The fact that inflation-indexed bonds didn't see their rates climb more sharply points to the idea that inflation is likely to pick up from current levels over the next 10 years. Many investors are increasingly optimistic that the economy could produce big growth opportunities in the near future, and that could start to stoke inflationary pressures that have long been dormant. If so, the protection that inflation-indexed bonds provide will become even more valuable.

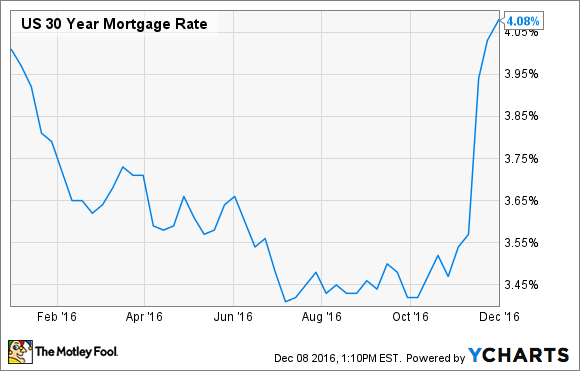

Mortgage rates start climbing

Finally, mortgage rates pushed higher once long-term rates started to climb. Rates on the 30-year mortgage fell quickly to begin the year, but the election sent them back higher by more than half a percentage rate, jumping above the 4% level and spurring some concerns about whether housing markets will be able to deal with a longer-term rising rate environment.

US 30 Year Mortgage Rate data by YCharts.

Interest rates didn't move the way many had expected in 2016, but some of the pressures that have finally started to produce movement toward the end of the year have dramatic implications for 2017 and beyond. For now, investors can expect some interest rate volatility in the short term, but beyond that, market participants have gotten burned so many times that they're largely finding it impossible to make good predictions over the long run.