The trick to saving for retirement is to make your money work for you. Almost nobody can save enough money to retire comfortably by simply hoarding it in a savings account.

But how you ultimately invest that money to make it work is up to you.

If you pick a solid strategy, you could multiply your savings over the years and decades. Yes, $100,000 could grow to become $1 million by retirement.

Don't worry, there are many ways to do it. Here are three smart investment strategies that will help, along with their pros and cons. That way, you can choose which strategy speaks to you. You may even find yourself dabbling in all three!

Image source: Getty Images.

1. Investing in growth

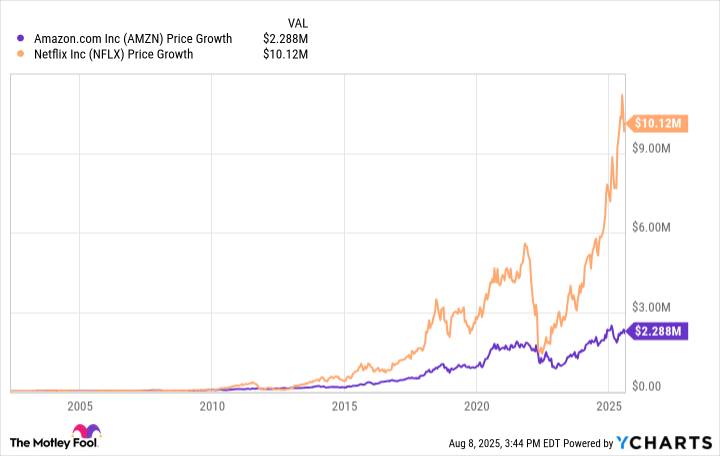

Investing in emerging companies and innovative technologies is probably the most exciting path to building wealth. If you find the right growth stock early on, say an Amazon or Netflix, you can turn modest sums into millions of dollars. Both companies have turned $10,000 investments into fortunes over their lifetimes.

The caveat here is that it's challenging to find those unicorn stocks, and even if you do, holding them often entails massive drawdowns over time that can test the mettle of even the most sure-handed investors. Over the coming years, up-and-coming opportunities in artificial intelligence, robotics, and other new trends will probably generate life-changing returns for those who hold the right stocks.

With such volatility, though, it's often wise to diversify your portfolio across a large number of different stocks, or to only devote so much of your total investments to growth stocks. Unfortunately, for every Amazon, there are a dozen companies that crashed and never recovered. The business world is ruthlessly competitive, so investors should understand the risks before putting their retirement savings into high-risk, high-reward stocks.

2. Collecting and reinvesting dividends

On the other end of the spectrum are proven, mature, profitable companies that earn more than they need, so they distribute some of those profits to shareholders as dividends. The best companies in the world can steadily grow, raising the dividends they pay each year. Some companies have increased their dividends for decades without fail.

These companies aren't as exciting as a Netflix-like stock in its earlier years, but slow and steady can be pretty powerful if you wait long enough. If you reinvest the dividends these stocks pay, you'll add an entire new layer of compounding that will help your portfolio grow. The downside to this strategy is that patience is a must. Investing in dividend stocks can be a slow crawl at first. It often takes many years to feel like things are "adding up."

But if you stick with it, dividend stocks could eventually make you wealthy and provide you with enough income to pay your bills without having to sell any shares.

3. Ride the S&P 500

Whichever investing strategy you choose, you don't necessarily need to worry about picking individual companies. That takes time and effort, and even then, you're probably going to pick some lousy stocks once in a while.

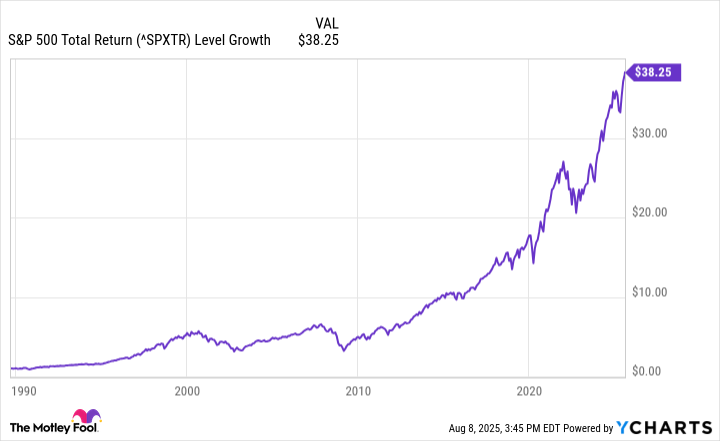

Instead, consider investing in the broader market by sticking with an S&P 500 index fund like the Vanguard S&P 500 ETF. The S&P 500 is an index comprised of 500 prominent U.S. companies that meet specific criteria for selection. The S&P 500 weighs the stocks in it by their market capitalization, so the better a stock does, the more influence it has. In other words, the index leans into the winners and away from underperforming stocks.

The S&P 500 doesn't go up every year. Occasionally, it drops quite a lot. But over the long haul, the S&P 500 has generated annualized returns of 8% and always recovered from every drop to reach new heights. That could turn $100,000 into $1 million in a few decades. Each dollar invested in the S&P 500 in 1989 has grown to over $38 today. Even most professionals fail to outperform the index consistently, so there is certainly no shame in going the simple route here.

Nothing about the stock market is risk-free, but the S&P 500 might be the most proven way to invest in the stock market successfully. Even if you decide to focus on growth stocks or dividend stocks, it never hurts to build the foundation of your portfolio around the S&P 500 first.