The big day is nearly here! One week from today, on Oct. 24, at 08:30 a.m., ET, the U.S. Bureau of Labor Statistics (BLS) will release the long-awaited September inflation data, which is the last bit of information needed for the Social Security Administration (SSA) to calculate the 2026 cost-of-living adjustment (COLA).

Normally, Social Security's retired workers, workers with disabilities, and survivor beneficiaries would know how much their payout is rising for the upcoming year. The BLS releases inflation data between the 10th and 15th of every month. But due to the federal government shutdown, the reporting of most economic data has been indefinitely delayed.

Although the government shutdown is ongoing, as of this writing in the late evening of Oct. 14, some furloughed workers at the BLS are actively compiling inflation data to release the September inflation report on Oct. 24. The SSA has also confirmed that it'll be announcing the 2026 COLA that day.

Image source: Getty Images.

While this should be a time of celebration for the seniors who rely on Social Security to cover at least some portion of their monthly expenses -- who doesn't enjoy seeing their monthly payout increase year after year? – three numbers are creating something of a nightmare scenario for aged beneficiaries.

Here's why Social Security's COLA is so important

From the mailing of the first retired-worker benefit check in January 1940 through 1974, there wasn't any rhyme or reason to Social Security COLAs, which was a big problem.

During the 1940s, benefits remained static; but the price of goods and services that retired workers purchased with their Social Security income continued to climb. This resulted in a pretty steady loss of buying power and led to the largest-ever COLA on record -- a 77% boost in monthly payouts passed along by Congress in 1950.

Social Security's near-annual cost-of-living adjustment is effectively the mechanism by which the SSA attempts to combat the effects of inflation (rising prices) to ensure the program's more than 70 million traditional beneficiaries don't lose purchasing power.

Beginning in 1975, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) became Social Security's inflation-measuring tool. It's reported as a single figure each month by the BLS, which makes for easy year-over-year comparisons to decipher if prices for a wide swath of goods and services are rising (inflation) or falling (deflation).

If prices collectively rise from one year to the next, Social Security beneficiaries receive a "raise."

The one quirk is that Social Security's COLA calculation only accounts for CPI-W readings from the third quarter (July, August, and September), which is why the September inflation report holds such high importance.

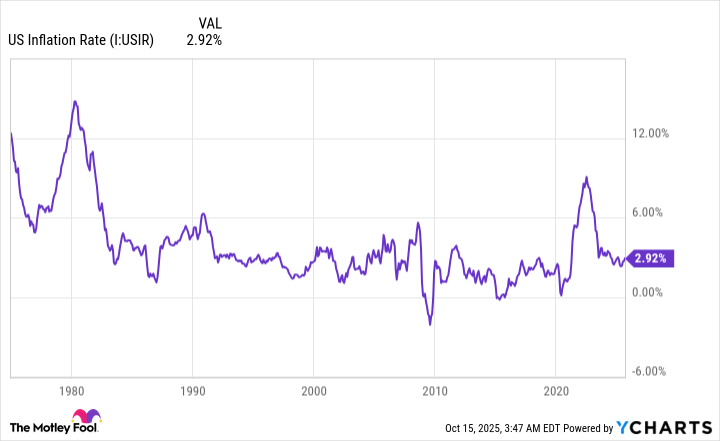

A higher prevailing rate of inflation has beefed up Social Security COLAs over the last four years. US Inflation Rate data by YCharts.

Another above-average Social Security raise is likely in 2026

Although the SSA is expected to reveal a laundry list of changes a week from now, including a projected increase in the payroll tax earnings cap and the maximum monthly payout at full retirement age, it's Social Security's COLA that's the headline figure.

Based on two independent estimates leading up to the Oct. 24 reveal, next year's raise should come in above average, when compared to the average COLA of 2.3% over the last 16 years.

Nonpartisan senior advocacy group The Senior Citizens League (TSCL) has been somewhat steadily increasing its COLA projection throughout the year. What began as a call for a 2.1% raise in 2026 in mid-January has climbed to a forecasted 2.7% bump in monthly benefits for the upcoming year.

Meanwhile, independent Social Security and Medicare policy analyst Mary Johnson believes beneficiaries will enjoy a slightly more robust 2.8% hike in the new year.

For the average retired worker, a 2.7% or 2.8% COLA would lift their monthly payout by $54 to $56. As for the typical worker with disabilities and survivor beneficiary, a $43 to $44 respective monthly payment increase would be in order.

Perhaps most importantly, both TSCL's and Johnson's forecasts point to the fifth consecutive year where beneficiaries receive a cost-of-living adjustment of at least 2.5%. The last time this happened was 1988 through 1997, when COLAs clocked in between 2.6% and 5.4% each year.

However, this potentially history-making moment may be marred by three stubborn numbers.

Image source: Getty Images.

This trio of numbers points to a loss of buying power for Social Security income next year

While an above-average cost-of-living adjustment looks to be on tap for 2026, seniors are staring down three unsightly numbers that will, in all likelihood, partially or fully offset the payout boost they're to receive. These numbers are:

- 3.6%, which is the trailing-12-month (TTM) inflation rate for shelter, ended August 2025, based on the Consumer Price Index for All Urban Consumers (CPI-U).

- 4.2%, which is the TTM inflation rate for medical care services, ended August 2025, per the CPI-U.

- 11.5%, which represents the projected increase in the Medicare Part B premium for 2026 from the latest Medicare Trustees Report.

Compared to working-age folks, seniors spend a higher percentage of their monthly budget on shelter and medical care expenses. Unfortunately, prices have been stubbornly climbing in these two expense categories at a faster pace than the COLAs retired workers have been receiving from Social Security. Unless shelter and medical care service costs decline notably in the coming months, next year's payout boost won't be enough to offset two of the most-important expenses for seniors.

The estimated double-digit percentage increase in Medicare's Part B premium is a big concern for dual enrollees -- those enrolled in traditional Medicare who are currently receiving Social Security benefits. The Part B premium, which covers outpatient services, is almost always deducted from a Social Security recipients' monthly payout.

If the Medicare Trustees' estimates proves accurate, the Part B premium will climb by $21.20 per month next year, with even larger increases for high earners. Lifetime low earners might see their entire 2026 Social Security cost-of-living adjustment offset by this double-digit percentage jump in the Medicare Part B premium.

These three numbers add up to one unpleasant reality for seniors: another year where their Social Security income likely loses purchasing power.