Income taxes are a part of life for anyone who earns money in the United States, and for those who earn a high income, a big IRS bill is par for the course. That's because the United States has a progressive income tax system.

There are different tax rates that apply to different tax brackets, or income ranges. As you earn more money, the additional income you make is taxed at a higher rate.

The IRS has recently announced that the tax brackets are changing for 2026. This occurs in most years because of inflation, as tax brackets need to adjust upward to account for wage growth. With this change, you'll now have to earn more money before you end up paying taxes at the highest rate.

Here's how much you need to earn to be in the top tax bracket in 2026.

Earnings to be in the highest tax bracket in 2026

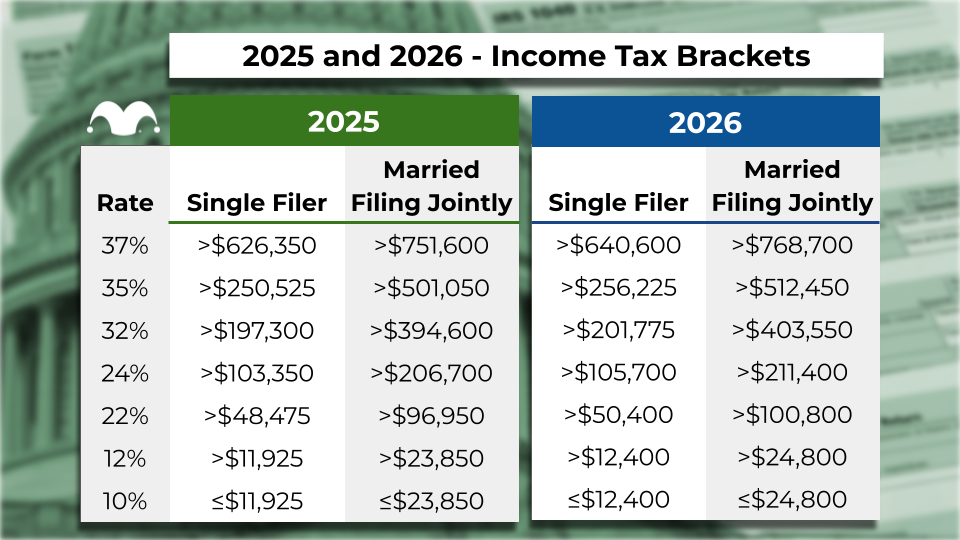

The chart below shows the tax brackets in 2026, as well as the 2025 tax brackets, so you can see how the income ranges are changing over time. It's worth noting that the 2026 tax brackets will not apply when you submit your tax return in April 2026, as the April tax return is for the income you earned this year. The 2025 brackets will still apply.

As you can see, in 2026 you will need to earn more income in order to move up into a higher tax bracket -- and the income that you need to be in the top bracket is therefore going to be higher.

While you'd find yourself in the top bracket after earning $626,350 as a single tax filer or $751,600 as a married joint filer in 2025, you won't pay the highest marginal tax rate of 37% in 2026 until you earn $640,600 if you're single or $768,700 if you file jointly.

You're only taxed at the highest rate on part of your income

While a 37% rate may seem pretty high, it's important to remember that you are only taxed at the highest rate of 37% on part of your income. Specifically, you only pay this rate on income above the threshold at which you cross into that tax bracket. For example, if you are a single filer with $700,000 in income, you don't pay 37% on the entire $700,000. Instead, you will pay it only on the portion of your income of $626,350.

Since the tax brackets are changing and you need to earn more to move up, federal income tax bills will go down for those whose incomes stay the same in 2026. Those who earn the highest income will benefit the most from these changes, since they will have more of their money taxed at the 10% rate, 12% rate, 22% rate, 24% rate, 32% rate, and 35% rate than they did in the past.

The standard deduction is also going to increase for the 2026 tax year, so those high earners who claim the standard deduction will get to subtract more of their money from their taxable income. The standard deduction is jumping to $16,100 for single filers, up from $15,750. For married joint filers, it's going up to $32,200 from $31,500.

Of course, many higher earners likely itemize instead of claiming the standard deduction, which means deducting for specific qualifying expenses like charitable contributions, mortgage interest, and state and local taxes.

Itemizing doesn't make sense unless your itemized deductions add up to more than the standard deduction. But the higher your earnings, the more chance there is of that happening, because it's more likely that you'll own expensive real estate or pay a large amount of state taxes. (However, even after changes due to the "Big, Beautiful Bill," there remains a cap on how much of a deduction you can claim for state and local taxes paid.)

Ultimately, you need to earn a lot of money to be taxed at the highest rate -- and in 2026, you'll need to earn a little more of it before the IRS starts taking a 37% cut.