Buckle up, because the most anticipated Social Security announcement of the entire year has arrived!

Based on nearly a quarter-century of annual surveys by Gallup, between 80% and 90% of retired-worker beneficiaries rely on their Social Security income to cover at least some portion of their expenses. Knowing how much they'll be receiving in the upcoming year is of high importance for Social Security's more than 53 million retired workers.

With the big reveal just days away, here are the seven things you need to know about Social Security's 2026 cost-of-living adjustment (COLA).

Image source: Getty Images.

1. It's been delayed by the federal government shutdown

The first thing worth noting is that this isn't your typical COLA reveal.

Normally, Social Security's near-annual raise is announced between the 10th and 15th of October each year. This reveal coincides with the release of the September inflation report from the U.S. Bureau of Labor Statistics (BLS).

Since 1975, the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) has been the inflationary yardstick that the Social Security Administration has used to calculate annual COLAs and pass "raises" along to beneficiaries to counteract the effects of inflation. However, the quirk of Social Security's COLA calculation is that it only accounts for CPI-W readings from the third quarter: July, August, and September.

Though the September inflation report was scheduled to be released on Oct. 15, the federal government shutdown cancelled these plans. Due to the inability of lawmakers in Congress to pass federal funding legislation, most economic data reports are delayed indefinitely. This includes the September inflation report from the BLS.

2. The September inflation report and COLA reveal will occur on Oct. 24

While most economic reports remain delayed on an indefinite basis, some furloughed workers at the BLS headed back to work over a week ago to begin compiling data for the September inflation report. The BLS plans to release this report on Friday, Oct. 24, at 08:30 a.m. ET.

Typically, the Social Security Administration would reveal the upcoming year's COLA mere minutes after the BLS publishes the September inflation report. While it's not guaranteed that this happens this time around, the SSA has committed to announcing the 2026 COLA on Oct. 24.

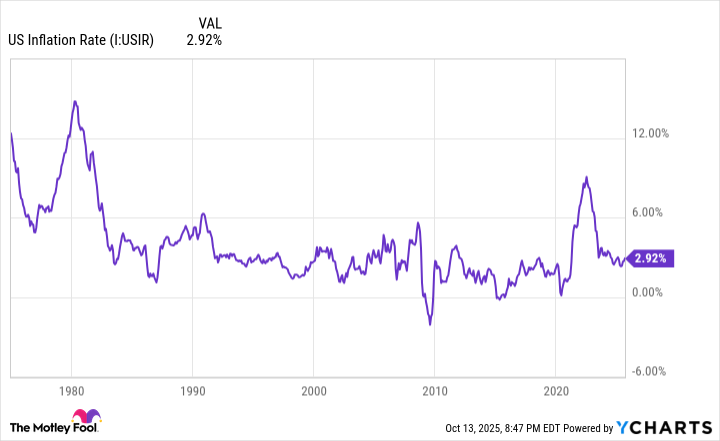

A higher prevailing rate of inflation has led to more meaningful COLAs over the last four years. US Inflation Rate data by YCharts.

3. The 2026 raise is expected to do something not witnessed since 1997

Although Social Security's 2026 raise isn't going to be breaking records on a nominal-dollar increase or percentage basis, it's nevertheless set to make history in the upcoming year.

Following a rapid increase in U.S. money supply during the COVID-19 pandemic, the prevailing rate of inflation in the U.S. picked up in a big way -- and so did Social Security COLAs. From 2022 through 2025, beneficiaries enjoyed respective annual raises of 5.9%, 8.7%, 3.2%, and 2.5%, which are well above the average COLA of 2.3% since 2010.

If (the big "if") Social Security's 2026 cost-of-living adjustment comes in at or above 2.5%, which seems likely at this point, it would mark the first time since 1997 that recipients have received five consecutive payout increases of at least 2.5%.

4. Independent estimates have narrowed down to a 2.7% or 2.8% increase next year

According to nonpartisan senior advocacy group The Senior Citizens League (TSCL), the cost-of-living adjustment for 2026 is projected to come in at 2.7%. This is a notable jump from the 2.1% boost TSCL was forecasting for 2026 back in mid-January.

Meanwhile, independent Social Security and Medicare policy analyst Mary Johnson, who retired from TSCL last year, is calling for a slightly higher 2.8% COLA in the new year.

Depending on which estimate you prefer, the average monthly retired-worker check would climb by $54 to $56 in 2026, while the average payout for workers with disabilities and survivor beneficiaries would each jump $43 to $44 per month, respectively.

President Trump at the United Nations meeting in September 2025. Image source: Official White House Photo by Daniel Torok.

5. Social Security's 2026 COLA will receive a "Trump bump"

You might not realize it, but President Donald Trump's tariff and trade policy is going to be responsible for providing a modest lift (call it a "Trump bump") to Social Security payouts in the new year.

A December 2024 study released by four New York Federal Reserve economists via Liberty Street Economics (Do Import Tariffs Protect U.S. Firms?) examined Trump's tariff policy with China in 2018-2019 for clues as to how businesses would fare given his current usage of tariffs. What they found was a reliance on input tariffs.

An input tariff is a duty placed on an imported good that's used to complete the manufacture of a product in the U.S. Input tariffs can make it tougher for domestic businesses to be price-competitive with imported goods, and they often result in higher prices being passed onto the consumer. This leads to an uptick in the prevailing rate of inflation, and ultimately a beefier cost-of-living adjustment for Social Security's more than 70 million traditional beneficiaries.

6. A key silver lining will be missing, which is going to hurt dual enrollees (Social Security and Medicare)

While Social Security's 2026 COLA is set to make history in one respect, it's going to be more of the same for retirees when it comes to seeing their raise gobbled up by other expenses.

For instance, Social Security will be missing an important silver lining for a third consecutive year in 2026. Following a rare decline in the Medicare Part B premium in 2023, which allowed dually enrolled beneficiaries (those enrolled in traditional Medicare who are also receiving Social Security benefits) to hang onto more of their income, the Part B premium rose 5.9% in both 2024 and 2025.

The latest annual Medicare Trustees Report points to an 11.5% estimated increase in the Part B premium to $206.20/month next year. This double-digit percentage jump has the potential to offset the entire 2026 COLA for lifetime low earners.

7. The buying power of Social Security income is likely to decline (again!) in 2026

Lastly, retirees are likely to see the purchasing power of their Social Security income continue to dwindle next year.

Although the CPI-W attempts to mirror the inflationary pressures program recipients are contending with, it's inherently flawed. It's an index that tracks the costs that matter to "urban wage earners and clerical workers," and not the 87% of Social Security beneficiaries who are age 62 and above, as of December 2024.

Retirees often spend a higher percentage of their monthly budget on shelter and medical care services than working-age Americans. Not only does the CPI-W fail to account for the added importance of these two spending categories, but the trailing-12-month inflation rate for shelter and medical care services has often been higher than the near-annual COLAs beneficiaries receive. This scenario points to a continued loss of buying power for Social Security income in 2026.