It seems the only constant when it comes to Social Security is change. Every year, Social Security undergoes changes, but few are as anticipated as the announcement of the annual cost-of-living adjustment (COLA). It's one change recipients look forward to because it usually means an upcoming benefit increase.

Typically, the Social Security COLA for the upcoming year is announced on Oct. 15, but due to the government shutdown, this year's announcement was delayed until Oct. 24. But the time has come, and the COLA is out. Starting in January 2026, Social Security recipients can expect a 2.8% boost to their monthly benefits.

Let's take a look at why the 2026 COLA is both good and bad news for Social Security recipients.

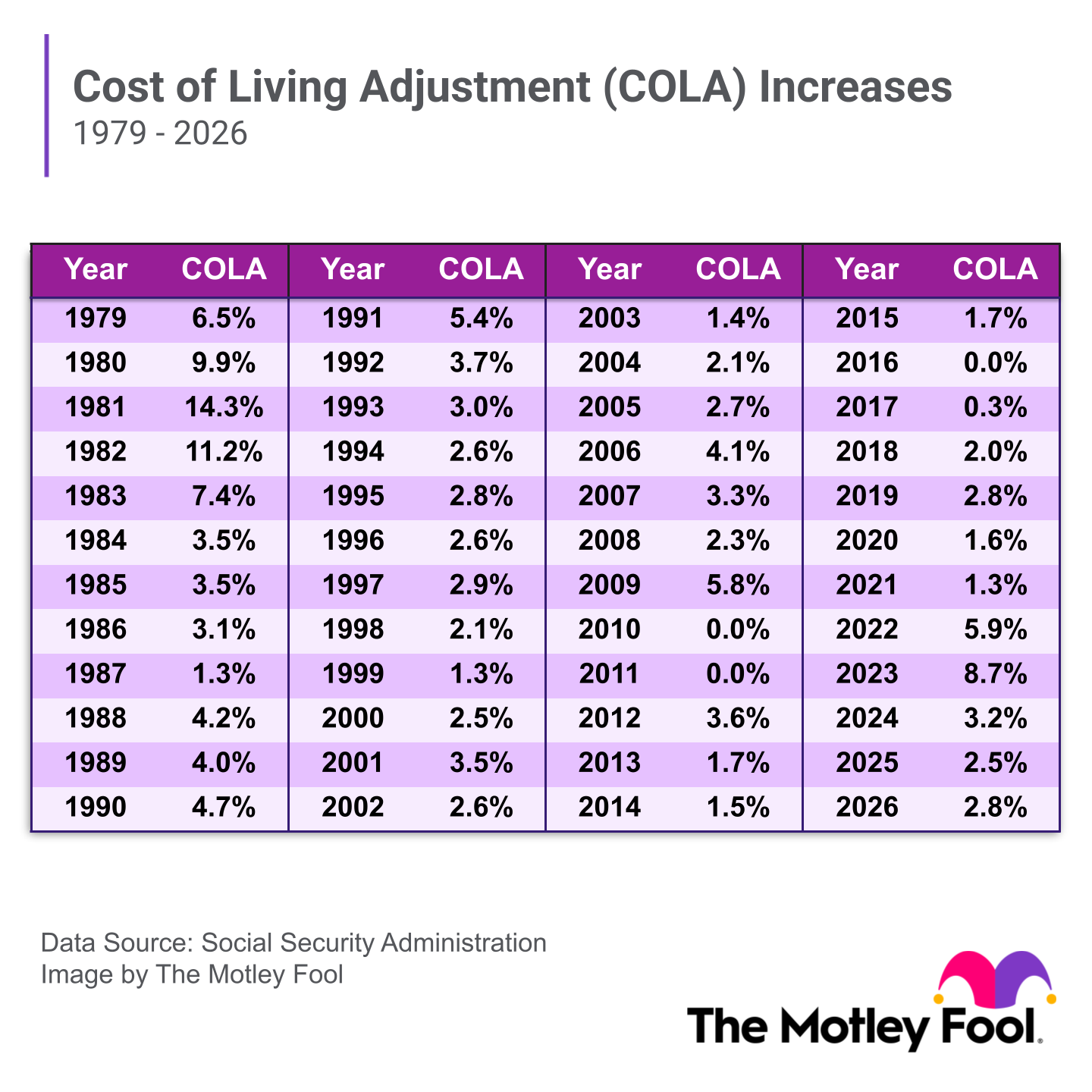

Image source: The Motley Fool.

How the annual COLA is calculated

It's not hard to look around and see the effects inflation has had on everyday items that people rely on. Seemingly everything from groceries to clothing to housing to healthcare has noticeably increased in price over the years. That's why the annual Social Security COLA is important. It's intended to offset the effects of inflation.

To determine how much to set the annual COLA at, the Social Security Administration (SSA) looks at the Consumer Price Index for Urban Wage Earners and Clerical Workers (CPI-W) data. The CPI-W is a monthly inflation metric published by the Bureau of Labor Statistics (BLS) that tracks changes in prices for common goods and services. (The BLS suspended operations because of the government shutdown, which is why the COLA announcement was delayed.)

Calculating the specific COLA is a three-step process:

- Average the CPI-W numbers for July, August, and September (Q3).

- Compare the current year's Q3 CPI-W average to the average of the previous year.

- Set the COLA as the percentage difference between the two, rounded up to the nearest tenth of a percentage point.

For example, the Q3 CPI-W average for 2024 was 308.729, while the average for 2025 was 317.265. This 2.76% increase is how we arrive at the 2.8% COLA for 2026.

If the Q3 CPI-W data for the current year is the same or less than the previous year's, there's no COLA, but benefits will never be decreased. It's uncommon, but it did happen in 2010, 2011, and 2016.

Why the 2026 COLA is good and bad news

The 2.8% 2026 COLA is higher than 2025's 2.5% COLA, but still lower than the average COLA of 3.7% since it became an annual occurrence in 1975. It is, however, right on track with the average COLA over the past decade. The past five COLAs have been 2.5% (2025), 3.2% (2024), 8.7% (2023), 5.9% (2022), and 1.3% (2021).

The good news is that the COLA increased, and any increase is better than no increase, as I'm sure many retirees would agree. The bad news is that, even with the 2.8% COLA, Social Security recipients may find their benefits' purchasing power continues to decline.

According to The Senior Citizens League (TSCL), the purchasing power of Social Security benefits has declined by 20% since 2010. That means every $100 in benefits received in 2010 would only buy around $80 worth of goods and services today. Needless to say, that's not ideal.

There could be a few reasons for this, but the main one is likely that the expenses retirees typically face aren't fully captured in CPI-W calculations. This means the true inflation that retirees face isn't exactly offset 1-to-1 by the COLA they receive every year.

Some people have recommended using a different metric to calculate the COLA, such as the Consumer Price Index for the Elderly (CPI-E), but there haven't been any concrete signs that the SSA plans to adjust its calculation method. For now, the best thing retirees can do is financially plan ahead to ensure their budget aligns with what the new COLA offers.