Every October, the Social Security Administration announces what the following year's cost-of-living adjustment, or COLA, will be. Those COLAs are designed to ensure that retirees' monthly benefits payments rise in sync with the prices people pay for everything from groceries to housing to medical bills. But unfortunately, many retirees feel like the buying power of their benefits has shrunk over time, despite the annual hikes.

Social Security recipients had to wait a few extra days for the reveal this year due to the ongoing government shutdown, but the Social Security Administration finally received the last piece of data it needed to calculate 2026's COLA on Oct. 24.

The result: Retirees will receive a 2.8% increase to their benefits starting in January. And again, most retirees say that won't be enough to keep up with the actual changes in their cost of living. Here's why they're right to feel that way.

Image source: Getty Images.

What goes into your COLA calculation?

One of the best measures we have for determining how much things cost, and how that has changed over time, is the monthly Consumer Price Index, a metric created and tracked by the Bureau of Labor Statistics. That's why Congress adopted the CPI as the official measuring stick for Social Security COLAs in the 1970s.

Specifically, the Social Security Administration bases its COLAs on the third-quarter year-over-year increase in the Consumer Price Index for Urban Wage Earners and Clerical Workers, or CPI-W. The CPI-W is meant to track the expenses of a large subset of the population measured by the more commonly cited CPI-U. It tracks the typical spending of households with at least one full-time employee in a clerical or wage-earning occupation.

The third quarter, of course, is July through September, and the government shutdown put some roadblocks in the way of the BLS performing its calculation of the September numbers, but it ultimately found a tick up in inflation to 2.9%. Combined with slightly slower price growth in the preceding months, that resulted in a COLA of 2.8% for 2026.

For the average retiree, who received $2,008 in benefits in August, they'll see their monthly payments increase by about $56 next year.

54% say that's not enough

In a recent survey of 2,000 retirees conducted by The Motley Fool, 54% of respondents said a 2.8% COLA would not be sufficient to keep up with the cost of living. And 68% said the COLA would help very little or not at all when it comes to covering their essentials like food, shelter, and medical care.

The data backs up that sentiment.

First of all, U.S. inflation has started ticking back up after reaching a low in May. That's likely tied to new trade policies established by President Donald Trump in April that placed steep new tariffs on most imports. Businesses have slowly been raising prices to offset their additional costs, and that trend may continue for several more months as businesses acclimate to the new environment. As a result, inflation could continue to outpace the 2.8% COLA through most of 2026.

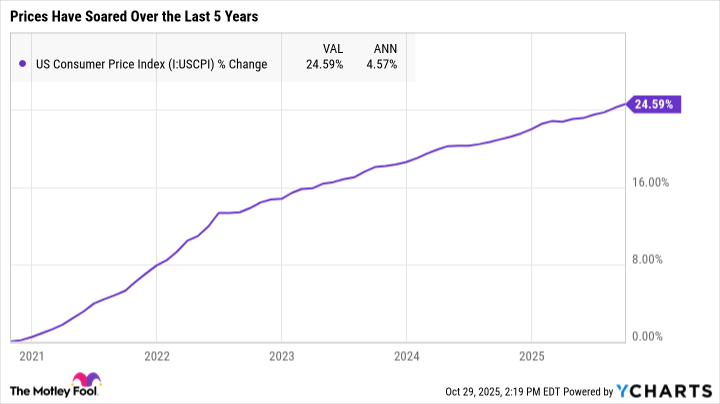

Second, the higher inflation we're experiencing today comes on top of the huge surge in prices we've seen over the last five years. The CPI-U is up nearly 25% since the end of October 2020. That's an average annual inflation rate of 4.6%.

US Consumer Price Index data by YCharts

Finally, digging into the numbers shows the CPI-W probably does a poor job of tracking the actual expenses of seniors on Social Security. After all, it's meant to track households headed by working-age people, not retirees. Line items that hold heavier weight in most seniors' budgets, like shelter, utilities, and medical care services, are all climbing faster than the overall CPI-W number.

On top of all that, retirees have experienced a steep increase in the cost of their health insurance. Most retirees 65 and older are on Medicare. Medicare Part B premiums increased 5.9% this year to $185. But the increase could be even bigger next year, with current projections calling for a $206.50 Part B monthly premium. So $21.50 of the average $56 per month COLA -- more than a third of it -- will immediately be sopped up by a single rising healthcare expense.

That's not going to slow down much in the future, either, with expectations for an average annual increase of 7.3% through 2034.

As the annual COLA fails to keep up with the rate at which many seniors' actual expenses have risen, it's more important than ever for retirees to budget wisely and optimize their withdrawals from their retirement accounts. For those who have yet to reach retirement, the last few years highlight the importance of saving and investing on your own, so you can reduce your reliance on Social Security later.