Source: Keoni Cabral via Flickr.

Social Security helps millions of older Americans make ends meet in retirement, and the ability to take Social Security benefits as early as age 62 is something that the majority of eligible recipients take advantage of. Yet many of those who take early Social Security benefits don't understand all the implications of doing so. While taking benefits early can be the right choice in some cases, you should know everything you give up by doing so before you make that key decision.

To make it easier for you to learn about Social Security and early benefits, we've put together several important points about claiming early. Take a look at them and incorporate what you read into your decision about what's best for you in your personal situation.

1. Your benefits get reduced when you take Social Security early, but you get more payments.

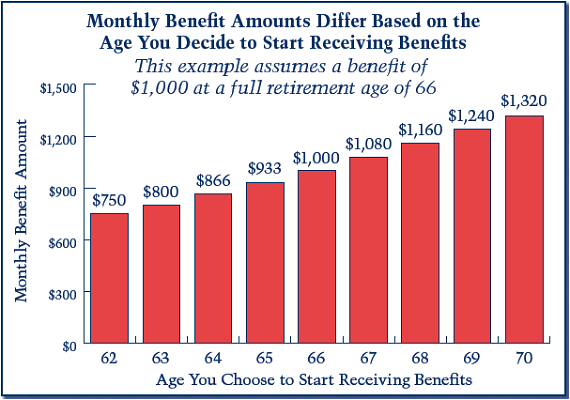

Claiming early reduces the amount of money you get. For every year from 66 to 63 that you take benefits early, you'll lose $6.67 for every $100 in monthly benefits you'd get. The final year from 63 to 62 results in a further $5 reduction, meaning that those who retire at 62 get just $75 for every $100 they would receive if they waited until the current full retirement age of 66.

Source: SSA.

The trade-off, though, is that you get as much as four extra years of payments by claiming early. Whether that offsets the reduced amount depends on a host of factors, including how long you live and whether you have survivors who will make claims of their own on your work history.

2. Those who file for early benefits can't use some valuable Social Security strategies.

Some strategies to boost total Social Security payments aren't available to those who file for early benefits. For instance, the file-and-suspend strategy involves having a higher-earning spouse file for benefits, allowing the lower-earning spouse to claim spousal benefits while the higher-earning spouse earns delayed retirement credits that will boost the eventual monthly payment. Yet those who file for benefits early aren't allowed to suspend them, resulting in permanently lower monthly payments and preventing them from getting the full advantage of the strategy. Similar restrictions prevent early filers from claiming spousal benefits without simultaneously getting benefits based on their own work histories.

Survivors benefits depend on your decision on claiming Social Security. Source: SSA.

3. Early benefits have an impact on your survivors.

The Social Security Administration calculates survivor benefits based on the actual benefits you receive. Therefore, if you file early, you'll reduce the amount your survivors will receive. Obviously, if you don't have eligible surviving family members, or if those family members will get more based on their own eligibility for Social Security, then early filing won't harm them. Still, in some cases, it can be smart to avoid filing early from a whole-family perspective even if it results in your receiving less in benefits during your lifetime.

4. You can forfeit Social Security benefits if you work and file early.

If you still work and collect early Social Security benefits, you can be subject to forfeiture rules. Those age 65 or younger who earn more than $15,720 lose $1 in benefits for every $2 in income they earn above the limit. Those deductions are taken out of monthly checks and can result in your not receiving payments in a given month.

Forfeiture isn't permanent, as the SSA recalculates your benefits as if you had retired one month later for every month of benefits you forfeit. Nevertheless, it's often easier to wait until full retirement age to claim benefits if you intend to work, as once you reach age 66, you can work as much as you want and still keep all your Social Security money.

5. One-size-fits-all analysis is inconclusive.

Financial analysis typically leads to the conclusion that many people would be better off by waiting, but it's hard to incorporate factors like opportunity cost and differing wishes during various stages of your retirement years. Those who can invest and get large investment returns might be better off claiming early as long as they can handle the risk involved, and if you anticipate health problems making it impossible to enjoy higher benefits later in life, then you might want to err on the side of filing early. Making an uninformed decision, though, can lead you to regret not having waiting until later in your retired years to start taking Social Security.

It's important to make the most of your Social Security benefits. As long as you understand the potential downsides of taking benefits early, you should be able to make a more rational decision about what Social Security strategy is right for you and your family.