How to choose between a Roth 401(k) and a Roth IRA

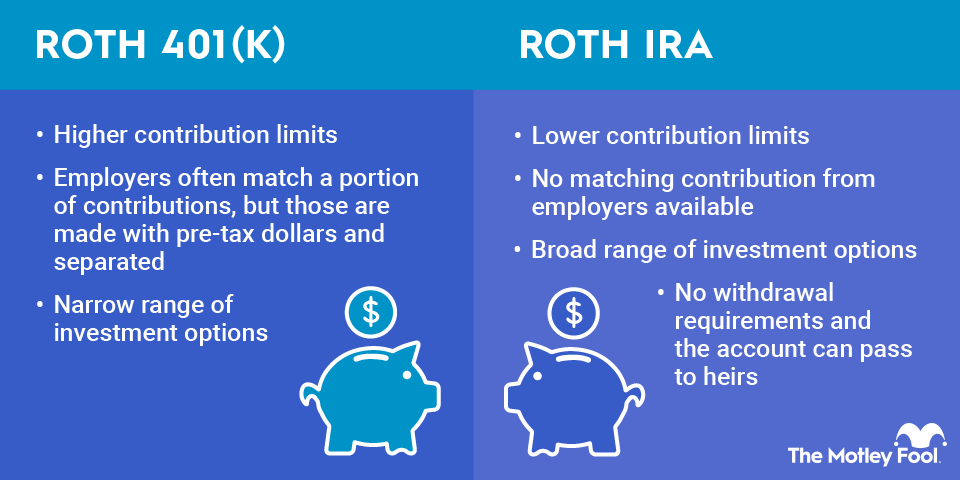

First things first: You don't have to choose between a Roth IRA and a Roth 401(k). You can contribute to both. This can be the best option if your employer offers a match, but you'd prefer a broader choice of investment options than a Roth 401(k) provides. In this scenario, you'd want to contribute enough to get the match and then put the remainder of your retirement funds into a Roth IRA until you hit the contribution limits.

Unfortunately, not everyone has a choice of Roth accounts. If your workplace doesn't offer a Roth version of its 401(k), the only way for you to get the benefits of a Roth is to contribute to a Roth IRA.

On the other hand, if your income is too high for you to contribute to a Roth IRA, a Roth 401(k) may be your only choice if you prefer to take tax-free withdrawals from your retirement account rather than make pretax contributions to a traditional account.

If your employer does not offer a match and you're eligible for both a Roth 401(k) and a Roth IRA, you'll need to weigh the pros and cons of each account type. If you want more investment choices, opt for a Roth IRA. But if you would rather have the convenience of a workplace account and don't mind a more limited choice of investment options, a Roth 401(k) is your best bet.