Roth 401(k)s and Roth IRAs are retirement savings accounts that allow you to contribute with after-tax dollars and take tax-free withdrawals in retirement. They're an alternative to traditional 401(k)s and traditional IRAs, both of which allow pretax contributions but require you to pay tax on withdrawals.

While the tax benefits are the same, Roth accounts also have several important differences. By understanding how each type of account works, you can figure out if a Roth 401(k) or a Roth IRA is the better choice.

Differences between Roth 401(k)s and Roth IRAs

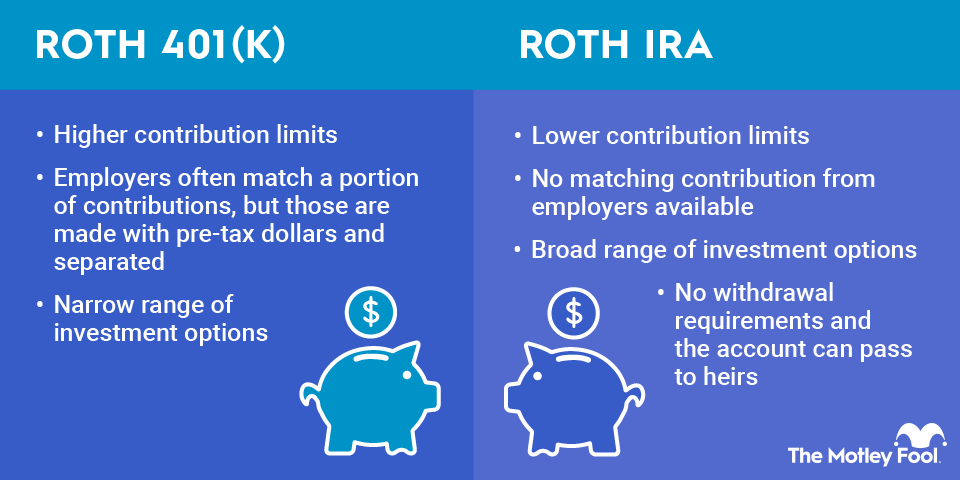

Here are the three main differences that separate Roth 401(k)s from Roth IRAs:

- Individual/employer accounts: Employers administer Roth 401(k) plans. Your employer must offer this type of plan for you to contribute to one. A Roth IRA is an account you can open on your own.

- Eligibility: Roth IRA income limits prohibit higher earners from contributing. Roth 401(k)s don't have income limits.

- Contribution limits: Roth 401(k)s have higher contribution limits than Roth IRAs.

How Roth plans work

Roth 401(k)s and Roth IRAs only accept after-tax contributions. Neither provides a tax break in the year the contributions are made. With traditional 401(k)s and IRAs, you can deduct contributions from your taxable income, saving you money on taxes for the current year.

Even though you don't get a tax break up front with Roth plans, they have a few significant advantages over the traditional options. Roth plans provide you with tax-free income when you retire. You can also withdraw your own contributions at any time. The early withdrawal penalty only applies if you withdraw earnings before age 59 1/2.

Let's say you've invested $5,000 through a Roth 401(k) or a Roth IRA, and the balance has grown to $6,000. You could withdraw your $5,000 in contributions penalty-free, but not the $1,000 in earnings. With a traditional 401(k) or IRA, early withdrawal penalties apply whether you're taking out contributions or earnings.

Pros and cons of Roth 401(k)s vs. Roth IRAs

Both types of Roth plans offer a few notable benefits. Here are the advantages of Roth 401(k)s over Roth IRAs:

- Many employers offer a 401(k) match, which can add to your Roth 401(k) contributions. That's a benefit you won't get with a Roth IRA.

- Roth 401(k)s have higher contribution limits than Roth IRAs.

- There are no income limits to be eligible for a Roth 401(k). High earners can't contribute to Roth IRAs.

Here are the advantages of Roth IRAs over Roth 401(k)s:

- You can open a Roth IRA whether or not you have access to a workplace retirement plan. A Roth 401(k) is only an option if your employer offers it.

- Roth IRAs provide a broad range of investment options, including stocks, bonds, and ETFs. Roth 401(k) investments are more limited and determined by the plan sponsor.

Related retirement topics

How to choose between a Roth 401(k) and a Roth IRA

First things first: You don't have to choose between a Roth IRA and a Roth 401(k). You can contribute to both. This can be the best option if your employer offers a match, but you'd prefer a broader choice of investment options than a Roth 401(k) provides. In this scenario, you'd want to contribute enough to get the match and then put the remainder of your retirement funds into a Roth IRA until you hit the contribution limits.

Unfortunately, not everyone has a choice of Roth accounts. If your workplace doesn't offer a Roth version of its 401(k), the only way for you to get the benefits of a Roth is to contribute to a Roth IRA.

On the other hand, if your income is too high for you to contribute to a Roth IRA, a Roth 401(k) may be your only choice if you prefer to take tax-free withdrawals from your retirement account rather than make pretax contributions to a traditional account.

If your employer does not offer a match and you're eligible for both a Roth 401(k) and a Roth IRA, you'll need to weigh the pros and cons of each account type. If you want more investment choices, opt for a Roth IRA. But if you would rather have the convenience of a workplace account and don't mind a more limited choice of investment options, a Roth 401(k) is your best bet.