10 Companies Set to IPO in 2022: What to Watch

10 Companies Set to IPO in 2022: What to Watch

Get ready

2021 was a big year for initial public offerings (IPOs), with Robinhood Markets, Coinbase Global, and Rivian Automotive joining the long list of publicly traded companies. 2022 is shaping up to be another banner year for new issues with the S&P 500 near all-time highs, and many tech companies raring to go public after strong performances during the pandemic.

Keep reading to learn about 10 high-profile companies likely to go public next year.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

1. Instacart

Few companies have benefited from the pandemic like Instacart. The food delivery maven came in clutch for millions of Americans during the lockdowns, and as social distancing protocols have lingered.

There were rumors of an Instacart IPO in 2021, but that never materialized as the company said in November it was delaying going public in order to work on expanding its services. That includes building its brand and its advertising business, as the company sees the potential to reach $10 to $20 billion in annual advertising revenue.

Still, Instacart has its eye on a possible 2022 listing, though it could get pushed further back.

Previous

Next

2. Stripe

Payment processor Stripe may be the most valuable privately held start-up today. Investors have been eager for the company to go public for a while now, and 2022 could be the year.

In June, the company hired a legal advisor to help with early preparations for an IPO, but co-founder John Collison more recently played down those expectations, saying the company is "very happy as a private company."

In its most recent funding round in March, the company raised $600 million at a $95 billion valuation. With that kind of price tag, Wall Street is clearly eager to get a bite of Stripe.

Previous

Next

3. Reddit

The social media industry has exploded in recent years, and Snap and Pinterest have both staged successful IPOs, so it shouldn't be surprising to see Reddit throw its hat into the ring.

Reddit, which has enjoyed a surge in attention this year, thanks in part to the influence of its WallStreetBets forum, filed confidentially to go public earlier this month. While the site has a lot of traffic, the company has historically done little to monetize it, avoiding the ads that are typical on other social media platforms.

Still, the company reached a $10 billion valuation in the private markets earlier this year, and with many of its forums boasting millions of subscribers, the business has significant potential.

Keep an eye out for the S-1 filing, which should come over the next few weeks.

Previous

Next

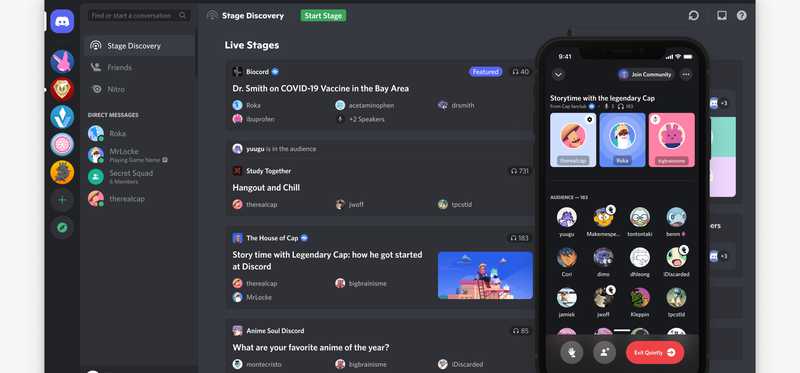

4. Discord

Among the tech companies that have surged during the pandemic is Discord, the messaging and video communications app that, like Salesforce.com's Slack, was created by online gaming entrepreneurs who couldn't find a suitable communications tech so they made their own.

Discord raised $500 million at a valuation of $15 billion back in September, and it has fielded acquisition offers from the likes of Microsoft, which reportedly offered to $10 to $12 billion for the company.

Still, it makes sense that Discord wants to tap an IPO market that's proven to be hungry for new tech issues, especially as the company's user base has swelled to 150 million monthly active users and its revenue tripled last year to $130 million.

Given that momentum, its valuation can easily move higher on the public markets.

Previous

Next

5. Databricks

A competitor to data analytics platforms like Alteryx and warehousers like Snowflake, Databricks is another of the more highly anticipated IPOs of 2022.

Having just reached a $38 billion valuation, it's now aiming to grow its vision of a "data lakehouse" by investing in companies that adopt its technology through a new venture fund.

CEO Ali Ghodsi has said that the company is IPO ready, but he has been mum about specific plans to go public. At a valuation of $38 billion, the company would certainly be one of the biggest IPOs of 2022 if it occurs.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

6. Mobileye

Autonomous vehicle (AV) technology may have been overhyped, as visions of self-driving cars have so far gone unfulfilled.

But investors will want to pay attention to Mobileye, the lidar company that Intel is planning to spin off in an IPO next year.

Intel acquired the company four years ago for $15.3 billion, and it could fetch a valuation as high as $50 billion as the division's sales have tripled since the acquisition, reaching nearly $1 billion.

The Mobileye IPO will also give investors a true, pure-play AV tech company to invest in for the first time.

Previous

Next

7. Impossible Foods

Beyond Meat shares skyrocketed after its IPO in 2019, which bodes well for fellow plant-based meat company Impossible Foods.

CEO Pat Brown told Forbes in November that the company will eventually go public, though he wouldn't specify the timing.

Impossible Foods was last valued at $4 billion, though the company was in the middle of raising $500 million at a valuation of $7 billion in October. Such a round would likely delay a public offering, but the company may also want to take advantage of the bull market while it's available.

Beyond Meat was worth more than $12 billion at one point, so there's reason to believe that Impossible Foods could top $7 billion if its numbers are strong.

Previous

Next

8. Airtable

Low-code software specialist Airtable is yet another tech IPO investors are looking forward to next year.

The company just raised $735 million at a valuation of $11 billion, but investors are still hopeful that the company will go public next year.

The fast-growing company has more than 300,000 customers, and low-code development is expected to become the dominant way to create applications over the next decade, putting Airtable in an enviable position.

The company has tamped down expectations of IPO, but as its valuation grows it will get more difficult to stay private.

Previous

Next

9. Klarna

Buy now, pay later (BNPL) has become a big business as the valuations of companies like Affirm Holdings have soared, while Block took over Afterpay for nearly $30 billion, and PayPal Holdings launched its own BNPL offering.

2022 is expected to see another major BNPL player, Klarna, which is best known for offering a BNPL program with four payments. The company's U.S. customer base doubled in 2020 to 20 million, and its valuation reached $45 billion in its most recent funding round.

Klarna CEO Sebastian Siemiatkowski said the company was closer to going public than it was a few years ago, but he was also wary of market volatility.

Previous

Next

10. MasterClass

One of the more unique companies to come across investors' radars is MasterClass. The company offers online classes, often taught by celebrities or experts in their fields, in a wide range of subjects like negotiations or cooking.

It benefited from increased screen time during the pandemic, as Americans searched for new ways to spend their time.

MasterClass' valuation tripled in a funding round earlier this year, reaching $2.75 billion, and with its differentiated positioning, the company is likely to attract attention in an IPO.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

Expect another active year

With the S&P 500 near all-time highs and tech stocks continuing to trade at lofty valuations, expect another healthy year for IPOs, as companies look to cash in on strong demand.

Though many of these companies haven't openly confirmed their intentions to go public in 2022, there's a good chance that most will: Privately held companies almost always go public eventually, as this gives insiders and employees an opportunity to cash out.

With the economy recovering from coronavirus and many consumers flush with cash, the market looks ripe for more new issues.

Teresa Kersten, an employee of LinkedIn, a Microsoft subsidiary, is a member of The Motley Fool’s board of directors. Jeremy Bowman owns Alteryx, Block, Inc., Pinterest, and Snap Inc. The Motley Fool owns and recommends Affirm Holdings, Inc., Alteryx, Beyond Meat, Inc., Block, Inc., Coinbase Global, Inc., Intel, Microsoft, PayPal Holdings, Pinterest, Salesforce.com, and Snowflake Inc. The Motley Fool recommends the following options: long January 2022 $75 calls on PayPal Holdings, long January 2023 $57.50 calls on Intel, and short January 2023 $57.50 puts on Intel. The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.