10 Stocks to Buy for a Biden-Harris Presidency

10 Stocks to Buy for a Biden-Harris Presidency

The best bets under the new administration

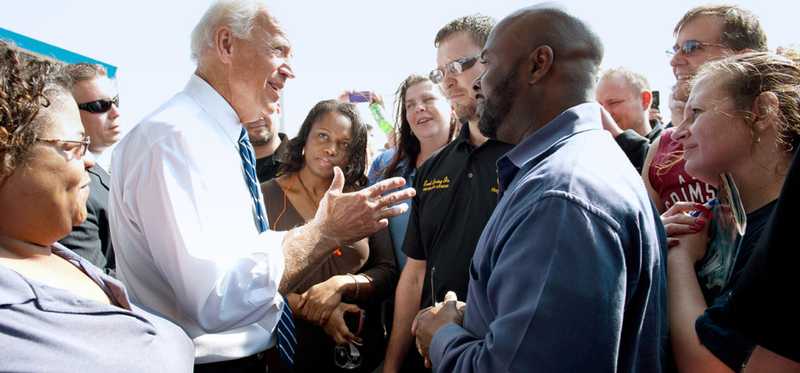

In just about a month, Joe Biden will become the 46th president of the United States. Political transitions almost always bring a change in policy and objectives, and this one is no different. Among the issues that Biden has pledged to focus on are climate change, infrastructure, and healthcare.

Investors are anticipating changes from a new administration, though we don’t know yet if Biden will have a Democratic Senate as there are still two outstanding races in Georgia. However, we do know where Biden intends to lead the country based on his policy positions. Keep reading to see 10 stocks that look poised to benefit for a Biden-Harris presidency.

5 Winning Stocks Under $49

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. I’d be sitting on a gold mine!” And it’s true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

1. Essex Property Trust

It’s no secret the country is facing a housing crisis. Home prices and rents have ballooned, especially in high-density urban corridors in the country, squeezing middle-class Americans. Biden supports a number of measures to eliminate zoning restrictions to allow for multifamily apartment construction in communities where it’s currently restricted.

One company that could benefit from such a shift is Essex Property Trust (NYSE: ESS), a real estate investment trust (REIT) focused on rental apartments in California and Seattle. The debate over housing density in California, in particular, is coming to a head, and pressure from the Biden administration could help push the state to allow more multifamily home construction. That would be a boon for Essex, giving it more high-value markets to expand into.

Previous

Next

2. CVS Health

The COVID-19 pandemic will be the most pressing challenge facing the Biden administration when it's inaugurated on Jan. 20, and the new president will have to deal with both an out-of-control health crisis and how to effectively distribute vaccines.

Among Biden’s plans to bring the crisis to a heel is to double the number of testing sites, expand testing capacity, and invest $25 billion in vaccine manufacturing and distribution.

CVS Health (NYSE: CVS) figures to be one of the winners in this push as the nation’s biggest drugstore chain has already played a big role as testing sites. Its stores will also be sites for vaccinations, as they are for flu shots.

Additionally, CVS should benefit from Biden’s broader healthcare initiatives, which include expanding the Affordable Care Act. Increased insurance coverage would also support CVS.

Previous

Next

3. Alstom

Biden plans to step up investments in mass transit, proposing to “provide every American city greater than 100,000 people with high-quality, zero-emissions public transit,” and to spark a second railroad revolution.

One of the companies most exposed to mass transit investment is Alstom (OTC: ALSMY), a French multinational company that makes a wide variety of transit vehicles, including trains, locomotives, and electric buses, as well as other necessary infrastructure components like signaling devices. It also provides maintenance and modernization services.

Alstom recently acquired Bombardier’s rail car business, increasing its exposure to the American public transportation market.

A Biden administration is more likely to increase support for state and local governments, which have been hit hard by the COVID-19 pandemic, adding to investments in public infrastructure.

Previous

Next

4. General Motors

As a part of its clean energy initiatives, the incoming Biden administration has set a goal of making the U.S. the world’s No. 1 manufacturer of electric vehicles, and it’s also making a push to support domestic manufacturing, including creating 1 million new jobs in the auto sector.

Both these goals favor General Motors (NYSE: GM), the iconic American carmaker that’s already making significant investments in electric vehicles. As a value stock, GM may also have an advantage over pure-play EV stocks that have already skyrocketed this year.

GM itself seems eager to welcome the Biden administration, as it issued a statement in support of the Biden electric-car initiative and withdrew support for a Trump proposal to loosen emissions standards.

Previous

Next

5. The Michaels Companies

Biden has promised to be tough on China but has also been dismissive of President Trump’s erratic approach to China trade policy, which has included slapping tariffs on Chinese imports, many of which American retailers depend on. Arts-and-crafts retailer The Michaels Companies (NYSE: MIK) may be a prime example of the trade war’s impact. The company previously acknowledged headwinds from tariffs and has taken steps to mitigate their impact, including sourcing products from other countries and raising prices. If Biden removes the tariffs, which seems feasible, Michaels is likely to be a winner.

Michaels shares are also especially cheap, so any bump in profits is likely to push the stock higher.

5 Winning Stocks Under $49

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. I’d be sitting on a gold mine!” And it’s true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

6. iShares S&P Global Clean Energy

Renewable energy stocks have been climbing since Biden’s election, as the incoming president plans to rejoin the Paris Agreement and generally sees the climate crisis as an emergency, as opposed to President Trump’s lax approach to it.

Investors looking for broad exposure to the renewable energy sector would be wise to buy shares in an exchange-traded fund like iShares S&P Global Clean Energy (NASDAQ: ICLN). The fund includes a wide range of stocks with exposure to green energy, including fuel cell maker Plug Power, wind energy company Vestas Wind Systems, and solar power companies like First Solar.

Previous

Next

7. Vulcan Materials

Investors were anticipating a big infrastructure bill if Democrats swept the election, but that is less certain now as divided government seems likely. Still, much of the country’s infrastructure is dated and is in need of investment. That includes everything from improved highways to rural broadband access, and it would benefit the economy in a number of ways.

One company that stands to win from such an investment is Vulcan Materials (NYSE: VMC), a manufacturer of basic materials like asphalt, concrete, sand, gravel, and calcium. The stock is sensitive to spending on highways and road construction, as well as on buildings including housing and commercial and industrial facilities, and that gives the company significant upside if an infrastructure bill passes.

ALSO READ: 5 Unstoppable Trends to Invest $1,000 In for 2021

Previous

Next

8. Innovative Industrial Properties

Biden has proposed decriminalizing marijuana, and four states voted to legalize recreational marijuana in the recent election. The country continues to take steps to full-on legalization of marijuana, and that process is likely to accelerate under a Biden administration as opposed to seeing little progress under Trump.

One all-around winner from the industry’s growth is Innovative Industrial Properties (NYSE: IIPR), a REIT that owns marijuana-growing facilities. The stock delivers solid growth without the exposure to the other vicissitudes of the industry like commodity pricing and intense competition at the retail level, and it offers a solid dividend of 2.7%.

Previous

Next

9. Snap

Antitrust investigations into Facebook and Alphabet's Google are already in the works, meaning the Biden administration could be presiding over a period of upheaval in digital advertising.

It’s also no secret that the Biden campaign has had own its own problems with Facebook, as the campaign has repeatedly criticized it for spreading misinformation, fostering attacks on democracy, and failing to enforce its own rules around political ads and information around the election.

That could add momentum to the antitrust investigations against Facebook, opening up opportunities for smaller social media companies like Snapchat parent Snap (NYSE: SNAP). Snap’s growth has been surging lately as the company seemed to benefit from the earlier Facebook boycott, and it also looks well positioned to capitalize if Facebook is weakened and advertisers look elsewhere.

Previous

Next

10. Franco-Nevada

The monetary expansion during the pandemic is likely to last at least into the early part of the Biden administration, especially as the president-elect is likely to favor spending on projects like infrastructure that will help get the economy on its feet.

Gold tends to be popular at times of monetary expansion as investors see it as a hedge against a weakening dollar. Gold prices are up about 25% year to date, but one promising way to play gold is with Franco-Nevada (NYSE: FNV). Rather than a gold miner, Franco-Nevada is a streaming and royalty company. It finances miners in exchange for a predetermined percentage of their mine production. That gives it significant margins as the price of gold rises, putting in a strong position over the coming years. In its most recent quarter, it delivered a profit margin of 27%, which bodes well for the current expansionist policy from the Federal Reserve.

5 Winning Stocks Under $49

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by the Motley Fool. I’d be sitting on a gold mine!” And it’s true. And while Amazon and Netflix have had a good run, we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Simply click here to learn how to get your copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

Expect a bull market

Since Biden’s election, all three major indexes have hit all-time highs, while other major asset classes like real estate, gold, and cryptocurrency are also at record levels. The reopening of the economy next year as vaccines are distributed is likely to only supercharge the stock market further. “Recovery stocks,” like those in travel, entertainment, and restaurants, are likely to soar on pent-up demand.

If investors should have any concern about the stock market heading into a Biden administration, it’s that we’re in a bubble. While that may be true, stocks could continue to climb for years before the party’s over. With tailwinds coming from the end of the pandemic and investors feeling good about a divided government, stocks look poised for more gains next year.

Suzanne Frey, an executive at Alphabet, is a member of The Motley Fool’s board of directors. Randi Zuckerberg, a former director of market development and spokeswoman for Facebook and sister to its CEO, Mark Zuckerberg, is a member of The Motley Fool's board of directors. Jeremy Bowman owns shares of CVS Health and Facebook. The Motley Fool owns shares of and recommends Alphabet (A shares), Alphabet (C shares), Facebook, and Innovative Industrial Properties. The Motley Fool recommends CVS Health, First Solar, and The Michaels Companies. The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.