12 Markets Most at Risk for a Housing Correction

12 Markets Most at Risk for a Housing Correction

What goes up also comes down

Limited housing stock, low interest rates, and fervent demand from homebuyers have pushed home prices to record levels over the past few years. But there are signs the tables could be turning.

Slowed sales activity and higher interest rates are curbing demand and leaving certain markets that are seeing excessive home growth susceptible to a housing correction. According to recent data, these 12 markets are most at risk for a pullback in home prices.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

1. Toledo, Ohio

The Rust Belt has made a big comeback over the past two years as jobs recover and people look for more affordable cities to call home.

Toledo, Ohio, was one of the beneficiaries of the trend, having its median home prices grow 55% over the past five years, but there are signs the market is turning. Home price growth is down 18% year over year (YOY). Its housing stock outpaces job creation, putting it in a tough spot for future home price growth.

Previous

Next

2. Rochester, New York

Rochester has seen double-digit home price growth for several years now, but the market appears to be leveling out. Sufficient supply for housing, as it relates to jobs, and a recent uptick in homes for sale has caused home prices to dip 17% YOY.

Previous

Next

3. Detroit, Michigan

Detroit has made an incredible comeback from its demise during the '08 recession. Over the past few years, it's consistently been on the lists for the fastest-growing markets while seeing some of the highest levels of home-flipping activity and home-flipping profits.

While demand has quickly outpaced supply as the city redefines and redesigns itself, it appears buyers aren't willing to pay the estimated 48% premium. Home prices have fallen 15% over the past year. Given the already-fragile state of the city's housing market, Detroit is still susceptible to a housing market correction.

ALSO READ: The House Flipping Statistics Investors Should Know in 2021

Previous

Next

4. Phoenix, Arizona

Pheonix has remained among the fastest-growing markets in the country, with insatiable demand for housing pushing home prices up 27% YOY.

While the city remains in a housing shortage, some experts believe home prices have reached their peak, considering homes are selling at a 51% premium, making the market extremely overvalued. This puts the market at risk of a market correction if -- or when -- demand starts to cool.

Previous

Next

5. Boston, Massachusetts, suburbs

The suburban cities of Worcester and Springfield outside of Boston, Massachusetts, saw a huge jump in home price growth over the past two years as people moved away from the city. But as people return to the big city, these suburbs are at risk of losing out on recent gains. CoreLogic puts it among the highest risk for a market correction, and home prices have already fallen 5% YOY.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

6. St. Louis, Missouri

St. Louis has become well known for its affordable cost of living, but recent shortages in homes have caused home prices to surge. However, just outside of the city, Saint Claire County is among some of the highest-risk counties for underwater mortgages, where homeowners owe more than their homes are worth.

An estimated 18% of housing stock in the county is at risk or already underwater.

ALSO READ: The U.S. Has a Housing Shortage -- Here's What Investors Need to Know

Previous

Next

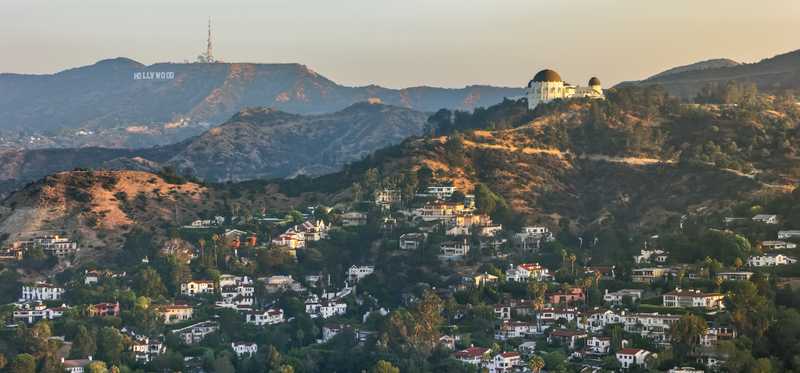

7. Los Angeles, California

The cost of living in Los Angeles has been a growing concern for decades now. Home costs in Riverside County, just outside the city, require 52% of average wages for housing, putting it in a vulnerable position in the event of a pullback.

Lowered demand as of late and sky-high home prices mean Los Angeles could be at a breaking point for home values as home prices have declined 5% YOY.

Previous

Next

8. Memphis, Tennessee

Like much of the country, Memphis' home prices have taken off in recent years, with a 55% gain in median home values over the last five years.

A study conducted by Florida Atlantic University placed Memphis as the 17th-most overvalued market in 2021, with homes selling at a 46% premium. However, there are clear signs the market is cooling. More homes are being listed for sale, and home prices have faltered because of it. Home prices are down 4.6% YOY.

ALSO READ: 3 Charts That Show Why The Housing Market May Be Starting to Cool

Previous

Next

9. Chicago, Illinois

Big cities are seeing residents and demand for real estate return in big ways as concerns over the pandemic wane. However, Chicago's overproduction of condo developments has led to an oversupply in housing in the city, thus hurting the growth at which demand is returning.

Cook, De Kalb, Du Page, Kane, Kendall, Lake, McHenry, and Will counties, which surround the Greater Chicago area, are considered among the most at risk for a market correction, according to Attom Data, with home prices already down 3.7% YOY.

Previous

Next

10. Boise, Idaho

Boise has become one of the hottest cities in the country over the past decade. While still small in size, Ada County, where Boise lies, has seen the median home price triple since 2011. It's an extremely competitive market with a lot of investor activity.

However, its sufficient supply in relation to job opportunities and being the most overpriced market in the country makes it extremely vulnerable to a housing correction.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

11. New York City suburbs

New York is seeing a huge resurgence in demand after residents left at the start of the pandemic. That means surrounding markets -- particularly more rural, suburban markets in Connecticut, Delaware, and parts of New Jersey -- could face declining home prices as people return to the city.

According to Attom Data Solutions' fourth-quarter 2021 data, Kent and Sussex counties in Delaware; and Bergen, Essex, Hunterdon, Middlesex, Ocean, Passaic, and Sussex counties in New Jersey were most susceptible to a market correction.

Rockland County, just outside the city, is the most expensive market as it relates to median income, requiring 57% of average local wages to purchase a home. Bridgeport-Stamford and Hartford, Connecticut, also made the list, according to CoreLogic.

Previous

Next

12. Philadelphia, Pennsylvania

Philadelphia's home prices are being pushed up from a lack of housing supply but at a far lower rate than most other major metro markets. Homes are trading at around a 10% premium right now, although the market is showing signs of cooling.

Camden County, New Jersey, a suburban market outside of the city, is the second-highest county for homes at risk of foreclosure. That puts Philadelphia at the top of the list for cities most at risk for a market correction, according to Attom Data.

Previous

Next

Overpriced markets could pull back

The markets most at risk for a housing market correction are those that lack long-term demand, have sufficient housing supply in relation to demand and job opportunities, or have experienced inexplicable home price growth in recent years.

These markets are among the topmost at risk, but many others could follow suit if the market turns.

The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.