12 of the Best Vacation Rental Towns for Landlords

12 of the Best Vacation Rental Towns for Landlords

Location and demand drive the deal for these 2022 hot spots

Vacation rentals can be a great source of income -- and provide the investors themselves with a place to stay when they need a change of scenery. The pandemic certainly hasn't changed that desire to get away. And the dramatic growth in remote work has increased the demand for short-term rentals in some particularly desirable areas.

AirDNA predicts overall demand to increase 14.1% in 2022 after recovering to pre-pandemic levels in 2021. However, the short-term-rental data analytics firm also expects average daily rates to decline by 4% due to increasing supply and changing seasonality patterns.

So, with that in mind, here are 12 towns across America that could present prime opportunities for profitable investments in vacation rentals in 2022. For this list, we used data from AirDNA and Vacasa (NASDAQ:VCSA).

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

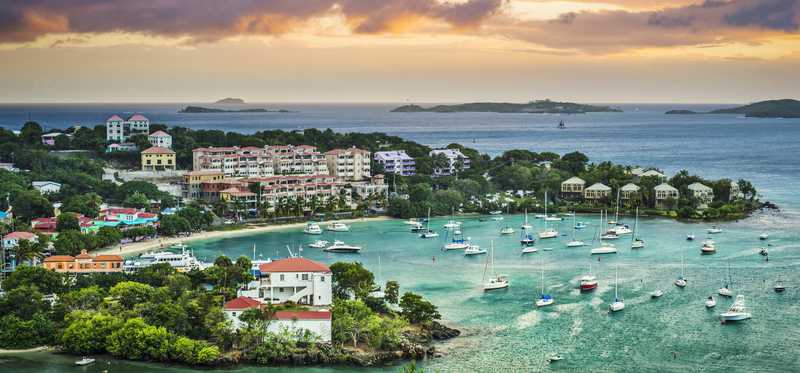

1. St. John, U.S. Virgin Islands

St. John is the smallest of the three major U.S. Virgin Islands. Beaches, snorkeling, and diving are big attractions, as are charter tours, colonial and ancient historical sites, and hiking trails -- just Caribbean life in general. AirDNA gives St. John an investability score of 100 and ranks it as the top spot for investment among what it considers medium-sized markets.

Previous

Next

2. Gatlinburg, Tennessee

Gatlinburg held the top spot in Vacasa's rankings for buying a vacation home in 2021, and the attraction is still there. The biggest attraction of all is its location in the Great Smoky Mountains, of course. But this small town has grown into a big tourist draw, with scores of local and national restaurants and shops and a wide range of accommodations. It doesn't hurt, either, that the national park itself is the country's most visited and that it's all an easy drive from much of the nation's population.

Previous

Next

3. Lahaina, Hawaii

Lahaina also got a 100 in investability from AirDNA and was the top-ranked destination among large short-term rental markets. Located on the west side of Maui, Lahaina has been the capital of the Hawaiian kingdom, a whaling village, and now the location of classic island dining and luaus. All this has made Lahaina a very pricey market, but one that still promises strong revenue growth for those who can afford to buy into the action.

Previous

Next

4. Ludlow, Vermont

Skiing, waterfalls, hiking, and maple syrup are four reasons this small town nestled in the Green Mountains attracts vacationers and short-term residents in general. Shops, galleries, and excellent restaurants also have popped up over the years. Along with healthy living, Vacasa says Ludlow offers a typical cap rate of 5.2% for investors in its rental market.

ALSO READ: What Is the Difference Between Capitalization Rates and Overall Rate of Return?

Previous

Next

5. Charleston, South Carolina

Charleston has become an international tourism draw in recent years, with its combination of history encapsulated in preserved plantations and downtown neighborhoods and its haute cuisine scene that has enamored diners and editors of glossy travel, food, and lifestyle magazines alike. AirDNA gives the Holy City (so nicknamed for its picturesque old churches that dominate the peninsula on Charleston Harbor) a 99 score in investability.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

6. Palm Springs, California

Legendary desert resort town Palm Springs still ranks high among travel destinations and, according to Vacasa, still yields a cap rate of 5.9% despite a hefty median home sale price of $539,370. The big draws are hot springs, golf courses, spas, fine shopping and dining, and hiking, biking, and horseback riding in the Sonoran Desert's Coachella Valley surrounding the town.

Previous

Next

7. Kennebunkport, Maine

Kennebunkport is about 80 miles north of Boston, helping make this quaint coastal town a longtime holiday refuge for the rich and famous -- including former presidents Bush and family -- and enough other folks to capture a 99 investability score from AirDNA. This also is the kind of accessible, bucolic, picturesque location that seems particularly well-positioned to benefit from the remote work trend.

ALSO READ: You Can Now Invest in Vacation Rental Properties for as Little as $250

Previous

Next

8. Big Sky, Montana

Big Sky is a community with a permanent population of about 3,000 people but a steady stream of visitors for its skiing, fly-fishing, whitewater rafting, hiking (including guided on horseback), and, of course, close-up views of the Rocky Mountains.

About 45 minutes to the south is Yellowstone National Park, and while the entry price can be steep -- Vacasa puts the median home sales price at $850,000 -- a cap rate of 4.8% means profitability can happen quickly.

Previous

Next

9. Marathon, Florida

The key to Marathon's attraction is its location. Heading one way down the Overseas Highway (U.S. 1), this city of about 8,700 year-round residents occupies 13 islands about 45 miles from Key West and, going the other way, about 90 miles from Miami.

There are a few attractions, such as dolphin research centers and bird and sea turtle rescue centers, but the big draws are the beaches, reefs, mangrove creeks, fishing, and boating and the quaint shops and restaurants downtown. AirDNA gives Marathon a score of 100 in investability.

Previous

Next

10. Dauphin Island, Alabama

Dauphin Island holds down the number four spot in Vacasa's list, with a 6.8% cap rate for investors. It's also one of the big reasons that Alabama's little piece of the Gulf Coast is a big draw for vacationers. Dauphin Island has long been a favored destination for family-friendly beach stays -- heavy on the fun in the sand and surf, with side servings of visits to the Dauphin Island Sea Lab and Audubon Bird Sanctuary.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

11. Nashville, Tennessee

Nashville is the home of country music -- and not just in the studios. Live performers show their stuff nightly in clubs lining the streets in the Lower Broadway district.

Of course, the Grand Ole Opry House, Ryman Auditorium, NFL football, NHL hockey, Vanderbilt University, and a general boomtown atmosphere have helped earn Nashville an AirDNA investability score of 100. Music City also has one of the highest revenue potential scores on that list, at $126,331 a year.

Previous

Next

12. Seaside, Oregon

Vacasa likes Seaside for its 5.2% cap rate and average gross rental revenue of $45,000 a year for investors in this coastal community's short-term rental properties.

Nestled on the Pacific about 80 miles northwest of Portland, thousands of visitors a year come just for the razor clams, and there's a 100-year-old seaside promenade that provides a view of the oceanfront homes. There's even an aquarium where you can feed seals.

Previous

Next

A big country with lots of choices

America is a big country with enormously diverse communities, large and small, that attract visitors looking for short-term properties in which to stay a while, providing long-term investment opportunities for the landlords who host them.

Marc Rapport has no position in any of the stocks mentioned. The Motley Fool has no position in any of the stocks mentioned. The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.