15 Money Moves to Make if You're Becoming a Homeowner in 2022

15 Money Moves to Make if You're Becoming a Homeowner in 2022

Homeownership is a major financial commitment

Homeownership comes with huge costs and, typically, a long-term commitment to repay a mortgage loan.

To ensure buying real estate helps, rather than hurts, your efforts to increase your net worth, it's crucial to be financially prepared before you purchase a property.

That's why it's so important to check these 15 tasks off your to-do list if you're becoming a homeowner in 2022.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

1. Improve your credit score

A good credit score is necessary to qualify for the best mortgage rates -- or to make refinancing your home loan in the future possible if rates fall. Solid credit can also help you to set up utilities at your new home without having to make a large deposit that ties up your cash for years.

As a result, whether you're still shopping for the perfect house or have already become a new homeowner in 2022, you should work on improving your credit.

You can do this by paying down debt, correcting credit report errors, or asking creditors to work with you to remove negative information if you've made some credit mistakes in the past.

Previous

Next

2. Save up a hefty down payment

Making a down payment of at least 20% can help you qualify for a better mortgage rate and get a wider choice of lenders. It also allows you to avoid added monthly costs for private mortgage insurance (PMI).

PMI is typically required on small down payment loans to protect lenders in case of foreclosure. It doesn't directly benefit homeowners, but they have to pay for it anyway. A big down payment allows you to reduce mortgage costs by eliminating this PMI requirement, so your house will be more affordable.

If you've already bought a home with a small down payment, paying down your mortgage ASAP to bring the balance below 80% of your home's value can help you get rid of PMI faster. If you haven't made a purchase yet, make sure you try to save up as much as you can to put down.

Previous

Next

3. Prepare for closing costs

Closing costs are very expensive for most homebuyers, totaling around 2% to 5% of the loan's value.

If you're planning to become a 2022 homeowner, You'll want to save up for them ASAP so you can avoid a lot of last-minute financial stress.

Previous

Next

4. Declutter and plan for a move

Decluttering your current home can make your moving costs more affordable because you won't have to pay movers to transport as much and may even be able to rent a smaller truck if you're managing the move yourself.

Decluttering can also help you sell your home more quickly and at a potentially higher price by improving its appeal. And it can allow you to avoid paying for an expensive storage unit if you can't fit all your possessions into your new property.

Previous

Next

5. Shop around for a mortgage

Mortgage loan costs vary from one lender to the next. Shopping around can help you get the most affordable rate, so your home loan doesn't cost more than necessary.

By keeping your housing costs down, you'll reduce the risk of foreclosure and have more money left over for other financial goals such as retirement planning.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

6. Bulk up your emergency fund

Homeowners are responsible for surprise repair bills that landlords cover for renters. As a result, a generous emergency fund is especially important for anyone buying a home in 2022. You don't want to end up in debt because your furnace breaks or something else goes wrong with your property.

Homeowners also don't want to risk foreclosure if they experience a decline in income, making an emergency fund even more important if you're buying a place in 2022. Aim to ensure your fund can cover three to six months of living expenses -- including your new mortgage payment.

Previous

Next

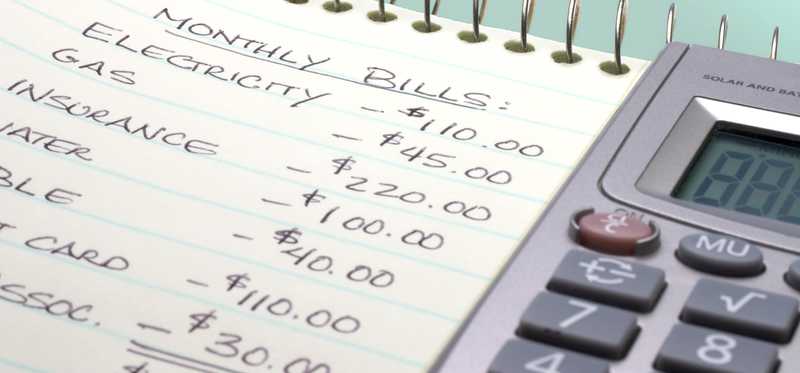

7. Create a budget that includes your housing costs

You'll need to make sure your housing costs fit comfortably into your budget.

It's best to rework your budget to accommodate your mortgage payment, property taxes, and insurance costs before you buy a home, so you're prepared for what paying your housing bills will actually mean for you. You can practice living on your new budget by saving any extra money above what your current housing costs are.

If you've already bought your home, there's no time to waste in making a budget that works around your new monthly mortgage payment.

Previous

Next

8. Research property tax appeal rules

Property taxes are a huge cost many homeowners pay.

In some cases, it may be possible to appeal your tax assessment to lower your rate. If you've bought a home this year or plan to, research this process to see whether it could save you money.

Previous

Next

9. Research tax breaks for homeowners

Homeowners may be entitled to new tax-saving opportunities, including claiming a deduction for mortgage interest paid and for property taxes. You'll need to itemize your taxes to claim these deductions.

Be sure to research how becoming a homeowner can change your tax situation, so you'll be prepared and ready to minimize what you pay the IRS when you file your 2022 taxes.

Previous

Next

10. Start a home maintenance fund

You don't want to constantly raid your emergency fund for routine maintenance tasks. So, if you're buying a home in 2022, start saving for maintenance costs now.

Ideally, you should put aside 1% of your home's value each year in a savings account earmarked for home repairs and basic upkeep. Even if you don't spend this much every year, you'll have the money there when big expenses creep up.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

11. Shop around for homeowners insurance

You'll need homeowners insurance to protect your property and assets. Shop around for a comprehensive plan that gives you the coverage you need at the right price.

It can take time to find the best coverage and understand all your options, so be sure to start looking for a policy early once you've identified a home to purchase in 2022.

Previous

Next

12. Compare utility costs

Utility bills can take a big chunk out of your monthly budget. As soon as you purchase a home, start researching your options. For example, in some parts of the country, you can shop around for electricity rates.

You should also be able to compare prices on other services such as Internet or phone. By taking a little time to find low-cost providers up front, you can ensure your bills are lower for years to come.

Previous

Next

13. Read HOA rules carefully

If you are considering buying a home in a neighborhood with a homeowners association, make sure you know exactly what the rules are.

Find out what fees you'll owe and whether you could be subject to special assessments that add costs. And make sure you understand when, if ever, you could be fined for violating HOA rules -- you don't want to be faced with unexpected expenses for not living up to the neighborhood standards.

Previous

Next

14. Read the fine print on mortgage loan terms

Before you commit to any mortgage loan, you'll want to read the fine print -- including learning about what up-front fees you'll pay and whether your interest rate can change.

A mortgage is a huge financial commitment, and you owe it to yourself to understand every detail.

Previous

Next

15. Change your addresses ASAP

Finally, be sure to change your addresses on all financial documents, including with your employer, for tax forms, and with any creditors or financial service providers.

You don't want to let anything slip through the cracks and end up missing a payment that damages your credit and hurts your finances over the long term.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

Make sure homeownership is the best financial move for you

Before you make a long-term commitment to pay on a home loan for decades, you'll absolutely want to ensure you are fully prepared for the major financial commitment you're taking on.

Whether you've bought a house already or plan to do so soon, taking care of these 15 tasks maximizes the chances that your purchase will be a positive one in the end.

The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.