15 Retirement Savings Resolutions for 2022

15 Retirement Savings Resolutions for 2022

Make your future retirement security your 2022 resolution

If you're making resolutions for the new year, consider some forward-thinking ones that will help set you up for your retirement.

Your later years should be a time to enjoy life, but if you haven't prepared by saving and investing, you could end up coping with a lot of financial stress instead.

Making -- and sticking to -- resolutions for 2022 can help you avoid this fate and ensure you enjoy your golden years. Here are 15 resolutions you should consider as the new year begins.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

1. Make sure you're using the right retirement account

There are different kinds of tax-advantaged retirement plans you can invest in, and you'll want to make sure you're using the right one.

Workplace 401(k)s are often convenient and come with employer benefits such as help saving for the future. But they provide fewer investment options than IRAs and don't offer all the tax breaks that health savings accounts (HSAs) do. So you'll want to look at the pros and cons of each retirement plan.

You'll also need to decide if a traditional or a Roth account is a better bet for you. Traditional accounts offer a tax break in the year of your contribution, but withdrawals are taxable. Roth accounts do the reverse, with no up-front tax savings but tax-free withdrawals. If you expect taxes to go up for you later, a Roth account would be your better bet.

As 2022 begins, resolve to review your current retirement accounts and your savings goals to make sure you have the right plan for you.

Previous

Next

2. Claim all the tax breaks you can

Missing out on retirement savings tax breaks means giving up the chance to get the government's help investing for your future. Resolve to take advantage of as much assistance as possible by coming as close as you can to maxing out your 401(k) and IRA in 2022.

The specific savings that you realize by making tax-advantaged investments will depend on your tax bracket, but it can be significant. If you're in the 22% tax bracket, every $1,000 contribution you make could save you as much as $220 off your taxes.

ALSO READ: More Americans Will Qualify for This Extra $2,000 Tax Credit in 2022: Do You?

Previous

Next

3. Make sure you know what you're invested in

You need to not only save for retirement but also invest wisely for it.

Unfortunately, many people stick with their 401(k)'s default investment or don't really take the time to research all their options.

The right investments can make a big difference in how quickly your retirement account balance grows. Resolve to explore the options available to you in 2022. Research fees, past performance, risks, and potential future and choose the right mix of stocks, bonds, and other assets for your portfolio.

Previous

Next

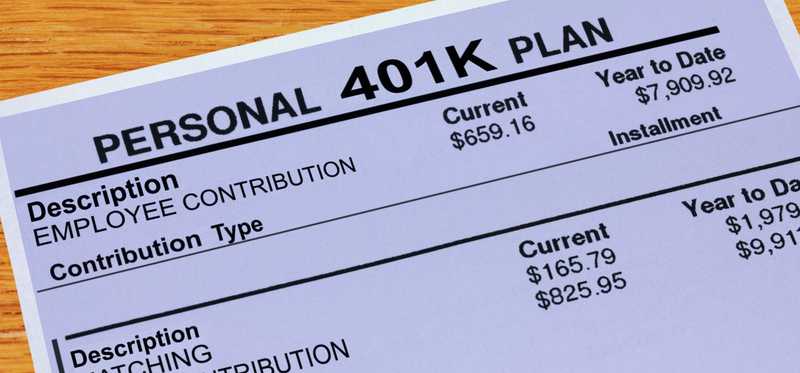

4. Understand the rules for your employer match

Most companies that offer a 401(k) provide matching contributions to it. An employer match is free money -- but you have to earn it by investing enough in your own account.

Some employers match 100% of contributions up to a certain percent of your salary, while others have different policies in place.

Resolve to learn your company's rules in 2022 so you'll know what you need to do to take advantage of the easiest possible approach to increasing your investment account balance.

ALSO READ: This 401(k) Mistake Could Cost the Average American $333,000

Previous

Next

5. Aim to earn the full amount of free matching funds

Once you know the rules for earning your 401(k) match, resolve to contribute enough to earn the full amount so you don't leave free money on the table.

Often, it's easiest to earn your match if you start making contributions ASAP because companies often limit how much they'll match each month.

You can't necessarily afford to wait until the end of the year to start investing for your future if you want to max out your match. Begin investing early and resolve to invest enough each month to capture every dollar your company wants to give you.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

6. Bank your raises

If you get a raise in 2022, resolve to make the most of it by saving as much of the salary increase as possible for retirement.

Since you won't yet be used to spending the money from your pay increase, you can divert it easily to savings without missing it. If you get a 2% raise, for example, sign up to have your automatic 401(k) contribution increased by 2% before you ever get to take home that extra money.

This is one of the easiest ways to increase your retirement account contributions over time.

Previous

Next

7. Set a realistic retirement timeline

While retirement may seem far off in the future, you need to know what your target date is for leaving the workforce as this can affect your savings goals.

Unfortunately, many people are overly optimistic about how long they'll be able to work. And they end up underestimating what they must save as a result.

Resolve to take the time to carefully consider your desired retirement date in 2022 so you can make a realistic plan to prepare for your later years.

ALSO READ: There's a 51% Chance of Your Retirement Plans Going Awry. Here's Why

Previous

Next

8. Know how much income your investment accounts must provide

Another crucial part of setting the right savings goal is understanding how much income your investment account needs to provide.

Many people overestimate what Social Security will do to support them, and they underestimate how much to save because of it.

Resolve to check your mySocialSecurity account ASAP in 2022 so you can develop an understanding of what income will come from your retirement benefits, then calculate how much your investments will need to produce to supplement them.

Previous

Next

9. Rebalance your portfolio based on your risk tolerance

The right mix of retirement investments varies based on your age and how long it will be until you must begin relying on your accounts for income.

Unfortunately, far too many people stick with the status quo and end up with a portfolio that's either too conservative or too aggressive. Both risk your retirement security, so resolve to rebalance your portfolio to achieve the appropriate asset allocation in 2022.

Previous

Next

10. Avoid unnecessary fees

Do you know what fees you're paying for your 401(k)? What about for the different investments you own in your retirement accounts?

Fees eat away at your returns and can dramatically decrease the size of your retirement nest egg -- especially if you end up paying high fees over a long period of time.

Resolve to take a close look at your investments in 2022 to see if the costs are justified or if there are less expensive alternatives that could help you accomplish the same investing goals.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

11. Prioritize saving for your future in your budget

If you want to save enough for a secure retirement, you'll need to make investing for your future a priority. So resolve to build your budget around hitting your retirement savings goals in 2022.

You should treat retirement savings as an essential bill you must figure out a way to pay, before spending on discretionary expenses. That's because building a nest egg is necessary to avoid living in poverty after leaving the workforce.

Previous

Next

12. Break down big retirement savings goals

Do you know exactly how much to invest each month in order to meet your retirement savings target and have enough invested to provide the income you need once you quit working?

If you don't, resolve to figure it out ASAP in 2022. By breaking down your big retirement savings goal so you know how much to invest each month, you can ensure you're on track.

Previous

Next

13. Automate your retirement investing

Automatically contributing money to your retirement accounts ensures you won't miss a contribution because you spent the money on something else.

You can not only have money taken out of your paycheck and put into your 401(k) but can also arrange to have funds automatically transferred to IRAs on payday.

By doing so, you'll ensure you're saving enough without any extra effort on your part. Resolve to set up these automatic contributions in 2022 so your money will effortlessly work for you.

Previous

Next

14. Keep track of your progress

If you aren't already tracking your retirement savings efforts, resolve to make 2022 the year you start doing that.

By keeping track of whether you're on target to hit your savings goals, you can make adjustments if things go wrong. You'll also be more likely to stay motivated as you see that you're getting closer to achieving your objectives.

Previous

Next

15. Be smart about the financial advice you take

Finally, resolve to take financial advice only from trusted professionals who have your best interests at heart.

Following investing tips on social media or getting advice from advisors who may be acting based on their desire to earn commission could only end up steering you wrong.

Since you're ultimately the person responsible for securing your retirement, it's up to you to get the best advice to make the choices you need to build the future you deserve.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

Set the retirement resolutions that make sense for you in 2022

You may have accomplished some of these retirement savings tasks. But if you haven't, consider setting a resolution to check them off your list in 2022.

If you take care or most or all of these steps, you can build the nest egg you need to have a comfortable retirement even after your paychecks stop coming for good.

The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.