15 Ways to Build Your Emergency Fund in 2022

15 Ways to Build Your Emergency Fund in 2022

If your emergency fund is lacking, the time to change that is right now

These are tough financial times for many, and you're in good company if you're considering whether your emergency fund is where it ought to be. If you're thinking about building up your emergency fund, or perhaps even starting one for the first time, you've come to the right place. Many Americans don't have an emergency fund at all, or would only be able to cover a few months of rent and other essential costs before their emergency fund runs dry.

Whether you want to whip your emergency fund into shape or start building your very first rainy day stash, here are 15 ways to get started in 2022.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

1. Set your savings target and build from there

The size of your emergency fund will be very personal to you and depend on various factors, including your regular outlay, your living expenses, your income, and your personal financial goals. For example, a college student who lives at home might require a different type of emergency fund from someone who is closer to retirement or is supporting a family. In an ideal situation, you will be able to put aside at least six months' worth of expenses. While an emergency fund is designed to cover a variety of unexpected situations, this is a good ballpark target to have.

ALSO READ: Should You Wait a Year to Start Saving for Retirement?

Previous

Next

2. Make it a habit to regularly contribute to your emergency fund

If you've already saved up a considerable amount of money and can simply funnel it into a robust emergency fund, you're ahead of the average consumer. But the reality is that most people won't be able to build an emergency fund overnight. Make a habit of regularly putting money into your emergency fund -- as much of a habit as paying your bills or investing. Even a relatively modest starting amount can form the solid foundation of an emergency fund if you regularly add to it over time.

Previous

Next

3. Your emergency fund should truly only be for a rainy day

Your emergency fund should not be treated like your regular savings account. In fact, you should never plan to touch your emergency fund except in the event of a true emergency. A job loss, a medical emergency, or an unexpected bill related to your home (e.g., water damage from a storm) could all be situations that would warrant a dip into your emergency fund.

ALSO READ: 3 'Safe' Places You Might Regret Keeping Your Money

Previous

Next

4. Cut back on discretionary expenses that might hinder you

If you're having a tough time getting your emergency fund in shape, there are a few ways you might be able to increase the amount of cash you have left over at the end of each month in order to build your fund faster. For example, one way might be to temporarily cut back on some of your discretionary spending and put that money toward your emergency fund.

Whether it's canceling a recurring subscription, cutting back on eating out, or changing travel plans, the pang you might feel in the short term from slashing some of these expenditures could yield significant peace of mind in the future if an emergency strikes.

Previous

Next

5. Schedule recurring payments to your emergency fund

Maybe your issue isn't generating the financial capital to build an emergency fund but remembering to contribute to it on a regular basis. If that's the case, there's an easy way to remedy that issue. Consider setting up biweekly or monthly payments to your emergency fund after you get paid so that you never have to think twice about it and can contribute to your rainy day stash on autopilot.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

6. Consider additional ways to make money that can maximize your savings

If you're finding it difficult to save enough money to put toward your emergency fund each month, you may also want to consider additional ways that you can make money to increase the amount of cash you have to work with. Taking on a side hustle can have a range of benefits, including maximizing your ability to save for retirement, invest, or reach other financial goals that you have set for yourself.

In the day and age of freelance platforms, tasking apps, and other potentially lucrative gig work, there's no shortage of side hustles that you can take on even with just a few hours of extra availability a week to earn hundreds or even thousands on top of your regular salary each month.

ALSO READ: 27% of People With Retirement Accounts Have Made This Mistake

Previous

Next

7. Pay down debt that is depleting your ability to save

If you're currently carrying debt -- whether from student loans, credit cards, or otherwise -- this can also impact your ability to save money to put toward your emergency fund. While you might not be able to pay down all the debt you owe at once, focusing on reducing and eliminating bad forms of debt (such as credit card debt) will not only give you greater financial flexibility but also make it easier to implement regular contributions to your emergency fund.

Previous

Next

8. Add to your emergency fund as you pull from it

No one likes to think an emergency will happen. But there's no avoiding the fact that unexpected events can and will appear in life. When those events occur and you do dip into your emergency fund, it's important to try to maintain that overall savings target you previously set for your rainy day stash.

ALSO READ: Don't Make Any Rash Investing Decisions Today Until You Check These 3 Boxes

Previous

Next

9. Differentiate your emergency fund from your nest egg

Your emergency fund should be completely separate from your financial nest egg. In other words, money that you are investing or saving for a trip, college, or retirement should not be considered part of your emergency fund. Keep your emergency fund in a completely separate account and only plan on withdrawing from it in the event that a true emergency strikes. You may rarely have to use it, but the knowledge that you have a robust emergency fund in place will provide tremendous peace of mind and financial security in the event an unforeseen calamity occurs.

Previous

Next

10. Determine the best type of savings account to hold your emergency fund

How and where you keep your emergency fund is completely up to you, but it's better not to keep it in the form of a stash of cash stored under your bed. Part of improving your financial health is to make your money work for you. One way of doing this is to keep your emergency fund in a high-yield savings account, so you can benefit from compounding returns on your rainy day fund over a period of years on top of your regular contributions.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

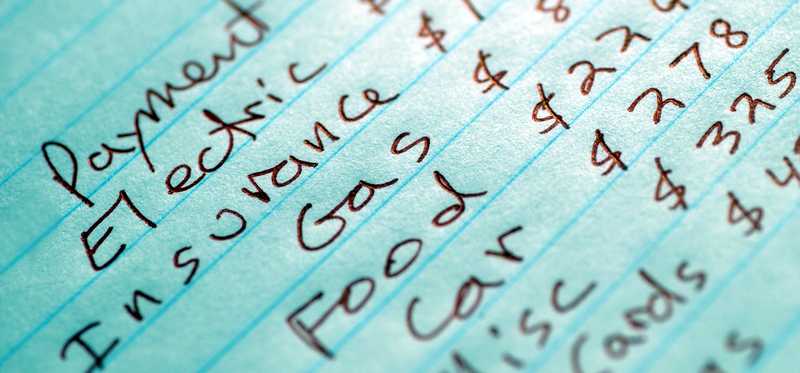

11. Incorporate building your emergency fund into your monthly budget

Another way to ensure a month doesn't go by without you adding to your emergency fund is to incorporate it into your monthly budget. Just like you set aside a slice each month for things like rent, your car payment, utilities, food, subscriptions, and other purchases, allocate a certain amount of your budget toward building your emergency fund.

Rather than leaving things to chance and only putting what you have left over at the end of each month toward your emergency fund, building a rainy day stash into your budget can help you fight the urge to overspend and ensure you allocate your income more wisely.

ALSO READ: Should Your Emergency Fund Include Essential Expenses Only?

Previous

Next

12. You don't have to start big, but consistency is key

If you're currently in a situation where money is tight, you might be wondering how you're going to build your emergency fund at all. As with most aspects of one's financial life, consistency is a vital factor. Even if you're only able to set aside a few hundred dollars a month to start, starting small and increasing your contributions as you can will still help you build your rainy day fund up to where you want it to be.

Previous

Next

13. Put cash back rewards toward your emergency fund

Another creative way to generate more cash to put toward your emergency fund is to utilize your credit card rewards. If you currently have one or more credit cards that generate cash back after purchases, most credit card issuers will let you use those funds in a few different ways. Often, you can choose to have that money transferred to your bank account or sent to you in the form of a check.

ALSO READ: Suze Orman Says This Is How to Prepare for a Recession

Previous

Next

14. Evaluate your monthly outlay and assess what might be open to change

If you are struggling to find enough money to contribute even a modest amount to an emergency fund each month, you may want to take a second look at your budget. For example, something as simple as regularly ordering from your favorite restaurant and having the food delivered to you can cost you anywhere from hundreds or thousands of extra dollars per year.

No one's saying that you should stop frequenting your favorite local spot. Even so, taking a hard look at your monthly outlay and seeing if there are any areas that might be open to modification could enable you to cut back here and there and generate additional cash for things like saving, investing, and building your emergency fund.

Previous

Next

15. Expand your emergency fund as your financial needs change

What might constitute a robust emergency fund for you at present could look completely different from your ideal emergency fund five to 10 years from now. As you build and maintain your emergency fund, evaluate it from time to time to ensure that the money you saved up will still suffice to meet your needs if an emergency hits. For example, a job change, expanding your family, or any other major life event can determine whether or not your emergency fund measures up adequately to your current circumstances.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

Preparing for a stronger financial future

Building a solid emergency fund is one very important part of having a detailed financial plan. Just as an emergency fund can give you greater security if life takes a turn, there are other ways you can also build a stronger financial future.

Make saving the rule rather than an exception. Regularly add to your investment portfolio in all types of markets. Always aim to live well below your means even if your income rises. Outline your financial goals clearly and take consistent, gradual steps to achieve those goals.

The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.