15 Ways to Stay Out of Debt in 2022

15 Ways to Stay Out of Debt in 2022

Don't get stuck with debt

Landing in debt can be problematic in several ways. First, it could create a scenario in which you're burdened with monthly payments and loaded up with interest charges. Too much credit card debt can also damage your actual credit score, making it harder to borrow money when you want or need to. If you'd rather steer clear of debt in 2022, here are some essential moves to make.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

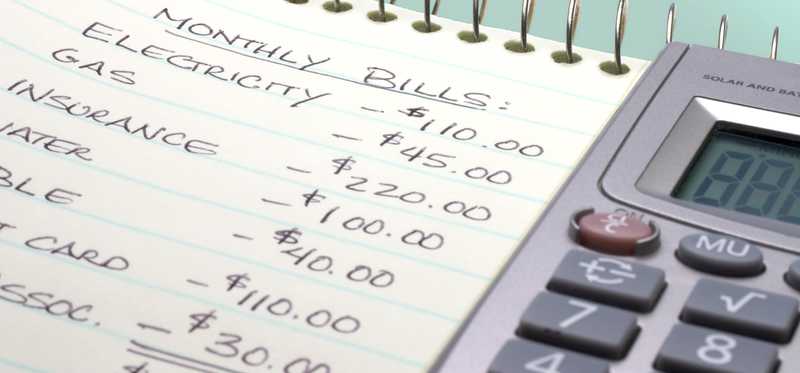

1. Follow a budget

A budget will help you manage your spending and figure out what your various bills cost you. And that could, in turn, prevent you from overspending in certain areas. You can set up a budget in a notebook, on your laptop, or by using a budgeting app.

Previous

Next

2. Prioritize your leisure spending

By the time you're done paying your essential bills, you may not have that much money left over for leisure. That's why it's important to prioritize your nonessential spending. Figure out where your money should go so you keep that spending in check.

Previous

Next

3. Choose home-cooked meals over restaurants

Restaurants are notorious for charging big markups on food. And eating out too often could lead you into debt. A better bet? Cook most of your meals at home, and save dining out for special occasions.

Previous

Next

4. Carpool to work

Gas prices have soared recently, making it more expensive to commute. If you're no longer working remotely, it could pay to put together a carpool to lower your fuel costs -- and avoid a scenario where you rack up a huge credit card tab because of them.

Previous

Next

5. Shop only with cash if you don't trust yourself with credit cards

The upside of using credit cards to shop is racking up cash back and reward points. But if you're worried you'll go overboard, leave those cards at home and shop with cash instead. If you don't bring extra money along, you'll force yourself to avoid impulse buys.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

6. Shrink your housing costs

Housing may be your largest expense. If you're worried it could help drive you into debt, see if there are ways to lower it. If you're a renter, you could try to downsize to a smaller space. And if you own a home, you can see if refinancing makes sense.

Previous

Next

7. Plan ahead for big events

You may have big events on your 2022 calendar, like a friend's wedding. Socking money away for those events in advance could help you avoid a scenario where you're forced to put related expenses on a credit card and pay it off over time.

ALSO READ: Borrowing for a Wedding? 3 Costs You Can't Afford to Overlook

Previous

Next

8. Research large purchases

Maybe you're planning to update your furniture or purchase new electronics for your home. It pays to do your research before buying these items, because the less you spend, the less likely you'll be to rack up debt.

Previous

Next

9. Use credit card rewards to pad your savings

If you have credit card rewards, you may want to convert them to things like gift cards or merchandise that allow you to enjoy life. But if you're worried about debt, and you can get cash back from your credit cards, send that money into your savings instead so you'll have it available to pay bills with.

Previous

Next

10. Have a complete emergency fund

Having money on hand for unplanned bills could be your ticket to avoiding debt. As a general rule, it's a good idea to sock away at least three months' worth of living expenses in a savings account. Even if you have stock investments or money in a retirement plan, you should make a point to have some cash at the ready in a regular savings account, where you can take withdrawals without repercussions.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

11. Boost your income with a side hustle

Boosting your earnings could make it easier to manage your expenses. And so it pays to pick up a side hustle that works for your schedule, whether it's tutoring, driving for a ride-hailing service, or designing websites in your spare time.

Previous

Next

12. Stay off of social media

Sometimes, people overspend due to peer pressure and then land in debt as a result. If you want to avoid having that happen, you may want to cut back on social media -- or stay away from it altogether. Social media often paints a misleading picture of other people's finances, which could lead you to make poor decisions for yours.

Previous

Next

13. Stop outsourcing home maintenance

Tempting as it may be to pay someone to stain your deck, mow your lawn, or do whatever other maintenance tasks are necessary for your home, all of those expenses could really add up. And so if you take on that work yourself, you might spend a lot less and lower your likelihood of ending up in debt.

Previous

Next

14. Check your credit card balances weekly

If you use credit cards, it's a good idea to review your balances every week. That way, if you see that they're getting too high, it'll signal you to cut back on spending and avoid a debt situation.

Previous

Next

15. Remind yourself why debt is so dangerous

Because consumer debt is so common, it's easy to regard it as no big deal. But actually, landing in debt could hurt your finances in a number of ways -- therefore, it wouldn't hurt to occasionally remind yourself of those negative consequences. If you're hoping to buy a home, for example, too much debt could make that difficult or impossible. And that's just one example. Think about your personal goals and how a pile of debt might impact them.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

Avoid the debt trap

People are often surprised at how easy it is to land in debt. Follow these tips to avoid that scenario -- and protect yourself financially.

The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.