15 Year-End Financial Moves It Absolutely Pays to Make

15 Year-End Financial Moves It Absolutely Pays to Make

Gear up for 2022

It's hard to believe that 2021 is wrapping up and 2022 will soon be upon us. But with that in mind, here are a number of essential financial moves it pays to check off your list before the new year begins.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

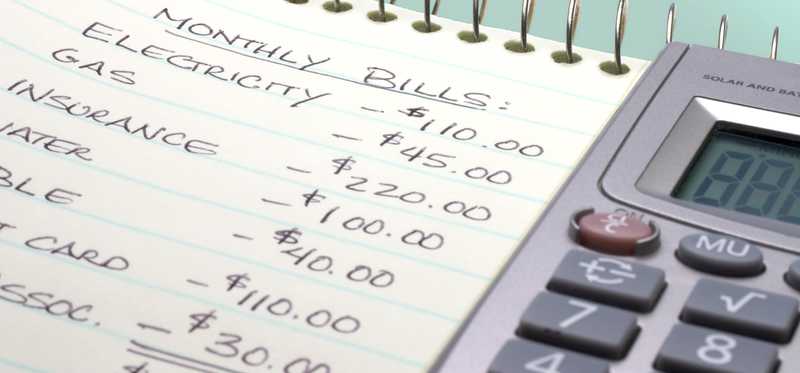

1. Review your budget

Following a budget is a good way to keep your spending in check and work toward different goals. But recent inflation may be driving your living costs up, so now's a good time to review your budget and make sure it's still accurate. If it isn't, make adjustments as necessary.

Previous

Next

2. Max out your IRA

You can technically sneak money into your 2021 IRA up until the tax-filing deadline in 2022, which isn't until mid-April. But if your goal is to max out, there's something to be said for getting the job done this year -- and not having to worry about it in the new year.

Previous

Next

3. Max out your 401(k) -- or at least make sure you get your full employer match

If your goal is to max out your 401(k) plan this year, you'll need to hurry. Unlike IRAs, you don't get a grace period for funding a 401(k). The money you want to contribute must be in your account by Dec. 31. That said, maxing out a 401(k) is difficult, so if you can't do that, then at least put in enough money to snag your employer match in full.

ALSO READ: 401(k) Limits Are Going Up in 2022. Here's What Retirement Savers Need to Know

Previous

Next

4. Pump more money into your HSA

If you have a health savings account (HSA), you can fund it up until next year's tax deadline. But if you're sitting on extra cash from a year-end bonus, it pays to sneak that money in now so you know it's done with. Plus, the sooner you fund that HSA, the sooner you can invest your money in it.

Previous

Next

5. Use up your FSA

If you signed up for a flexible spending account (FSA) for 2021, you may only have a little more time to use up your funds. Think about your near-term medical needs. It could pay to move up some doctor appointments or stock up on FSA-eligible medications before the year ends. That said, some FSAs do have a grace period, so you may get a couple of extra months to spend down your balance in 2022. You'll need to check the details of your plan to see if that applies to you.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

6. Review your brokerage account

The end of the year is a good time to give your investments a checkup. Take a peek at your brokerage account and make sure it's as diverse as you'd like it to be. It could be that the value of some of your investments shifted during the year, leaving you more heavily loaded in one segment of the market over others.

Previous

Next

7. Sell losing stocks strategically

If you're sitting on an underperforming stock, you may want to sell it before the end of the year. That way, you can use that loss to offset capital gains in your brokerage account this year. And if your loss exceeds your gains, you can use the remainder to offset some ordinary income.

Previous

Next

8. Ramp up your charitable contributions

If you'll be itemizing on your 2021 tax return, you may want to consider giving more money to charity in the coming weeks. That could result in a bigger write-off -- and more savings for you on a whole.

Previous

Next

9. Consolidate your credit card debt with a balance transfer

If you're struggling with credit card debt, a balance transfer is worth considering. Moving your debt over to a new card with a lower interest rate could make it much easier to pay off in the new year. You may even find a balance transfer card with a 0% introductory APR.

Previous

Next

10. Look into refinancing your mortgage

Right now, refinance rates are sitting at attractive levels. And so it could be a good time to swap your existing home loan for a new one. If you do, you might set yourself up for much lower mortgage payments in 2022.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

11. Make purchases for your business to offset income

If you own a business and have had a strong year, you may be facing a higher tax bill as a result. So if you have equipment or supplies you need to stock up on, making those purchases before the end of the year could really help your tax situation.

Previous

Next

12. Research your options for life insurance

You don't need to be wealthy to benefit from having life insurance. If there are people in your life who depend on you financially, or who could get hurt financially if you were to pass, then having life insurance is a smart bet. But buying life insurance is a process, so the sooner you get the ball rolling, the sooner you can get peace of mind -- or give peace of mind to the people you care about.

Previous

Next

13. Pay off a personal loan

If you're carrying debt from a personal loan but have the option to pay it off, doing so could help you start off 2022 with a clean slate. And if you can't pay down that debt completely, you may want to at least make a large dent in it so you're not as burdened in the new year.

Previous

Next

14. Check your credit report

Credit report errors are pretty common, and they also have the potential to damage your credit score. That could prove problematic if you're hoping to take out a loan in the new year. That's why now's a good time to check your credit report and make sure it's accurate. A good bet, in fact, is to review your report from all three credit bureaus -- Experian, Equifax, and TransUnion.

Previous

Next

15. Map out your goals for 2022

Maybe you've been toying with the idea of buying a home. Or maybe you're thinking of starting a business. Before the year is up, make a list of your goals for 2022 so you know what objectives to work toward.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, “I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of “5 Growth Stocks Under $49” for FREE for a limited time only.

Previous

Next

Start the new year off right

Before we know it, we'll be counting down the final seconds of 2021 and welcoming in 2022. Tackle these key items to help ensure that the coming year is a great one from a financial standpoint.

The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.