Don't Bet on Luck. 15 Ways to Ensure a Comfortable Retirement

Don't Bet on Luck. 15 Ways to Ensure a Comfortable Retirement

It's all in your hands

If your goal is to enjoy a comfortable retirement, you can't just leave things to chance. Rather, you'll need to plan carefully and take specific steps to meet that objective. Here are a few important ones to start with.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

1. Understand how much replacement income you'll need

Part of retiring comfortably involves having realistic expectations about how much income you'll need. As a general rule, it's good to assume that you'll need 70% to 80% of your former earnings once your career wraps up. But you'll need to adjust that figure to account for your desired retirement lifestyle.

Previous

Next

2. Don't claim Social Security too early

You get a range of choices when it comes to signing up for Social Security. Age 62 is the earliest age you can file, but claiming benefits before full retirement age (which is 66, 67, or somewhere in between, depending on your year of birth) will result in a reduction. Waiting until full retirement age will result in a higher guaranteed benefit -- for life.

Previous

Next

3. Delay your Social Security filing

For each year you delay your Social Security filing past full retirement age, your benefits get an 8% boost. That incentive runs out once you turn 70, but if you hold off on claiming benefits until then, you'll snag a nice increase that will give you more financial flexibility.

ALSO READ: The Best Reason to Take Social Security Long Before Age 70

Previous

Next

4. Start saving from a young age

The more robust a nest egg you bring into retirement, the more comfortable a lifestyle you'll manage to pull off. And your ticket to amassing a lot of savings could be to start funding your IRA or 401(k) plan from a young age. Doing so will give your money extra years to benefit from investment growth.

Previous

Next

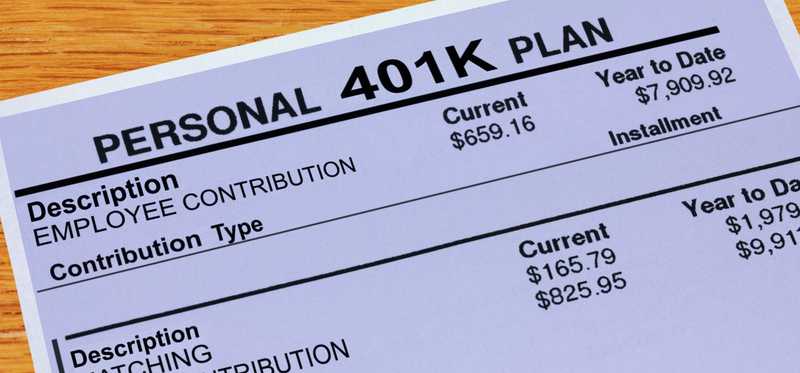

5. Claim your full 401(k) match

Many companies that offer 401(k) plans also match worker contributions to some degree. It pays to snag your employer match in full and boost your savings that way.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

6. Invest your retirement plan aggressively

Your retirement savings shouldn't just sit in cash. Rather, you should invest that money so it grows into a much larger sum over time. And if you want to enjoy substantial growth, you'll need to consider loading up on stocks or stock-based index funds.

Previous

Next

7. Don't lose too much money to investment fees

Investment fees can eat away at the returns you generate in your retirement plan -- so it's best to keep them to a minimum. That generally means sticking to low-cost index funds, which are passively managed, rather than paying the higher fees that come with buying actively managed mutual funds.

Previous

Next

8. Don't tap your nest egg early

It's possible to take an early IRA withdrawal penalty free if you're using the money to pay for higher education or a first-time home. But the more money you remove from your savings, the less you'll have for retirement. If you want to ensure that you have plenty of money available as a senior, you'll need to commit to leaving your nest egg alone until your career is done with.

Previous

Next

9. Read up on Medicare in advance

Many seniors are caught off guard when they realize the costs they're liable for under Medicare. A better bet? Educate yourself on Medicare ahead of retirement so you can account for those expenses accordingly.

Previous

Next

10. Contribute to a health savings account

Healthcare can be a major expense during retirement, but one way to make it more manageable is to have dedicated savings for it. That's where a health savings account (HSA) comes in. To qualify for one, you must be enrolled in a high-deductible health insurance plan. But the great thing about HSAs is that they're triple tax-advantaged. Contributions are tax free, investment growth is tax free, and withdrawals are tax free as long as they're used for qualified medical expenses.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

11. Set a budget specifically for retirement

Your living costs in retirement may differ from the expenses you incur while working. It's a good idea to establish a specific retirement budget so you can see what bills you'll be on the hook for.

Previous

Next

12. Downsize your home

Housing can be a major expense. If you're an empty nester by the time retirement rolls around, downsizing may be feasible. And it could serve the important purpose of freeing up lots of cash for other things, including leisure.

Previous

Next

13. Move to a state with low -- or no -- income taxes

Taxes can be a big burden for retirees. You can minimize them by moving to a state with a low income tax rate. Better yet, look at moving to a state that doesn't have an income tax at all.

Previous

Next

14. House your retirement savings in a Roth account

The great thing about Roth IRAs and 401(k)s is that your withdrawals in retirement will be yours to enjoy tax free. And getting more of your money could mean having more leeway with spending.

ALSO READ: Here's Why It Pays to Save in a Roth Retirement Plan in 2022

Previous

Next

15. Plan to work part-time

You may decide to maintain a more expensive lifestyle in retirement -- one that includes a lot of nightlife and travel. Or, you may enter retirement with a nest egg ending a little shy of what you'd like it to be. A part-time job could be a great source of supplemental income. Plus, working part-time is a great way to fill your days without having to spend a lot of money.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I’d be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

Set yourself up for a great retirement

The strategies you employ in the course of your planning could spell the difference between a comfortable retirement and a challenging one. It pays to put these tips to work, because they could set you up for the retirement of your dreams.

The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.