The 15 Most Expensive Real Estate Markets in America

The 15 Most Expensive Real Estate Markets in America

"Expensive" is relative: These cities top the list when more than price is in the calculations

The National Association of Realtors says the median sales price of an existing single-family home ended the year at $361,700, with double-digit annual appreciation recorded in two-thirds of the 183 markets the big trade group follows.

So, where are houses the most expensive? Well, "expensive" is relative, based on how much one can really afford to pay. Same thing with "affordability." There is a multitude of lists of high-priced markets, but not many that combine the two.

The following list from RealtyHop uses both price and income data to create the February 2022 version of what the investor-focused listing service calls its RealtyHop Housing Affordability Index, ranking the nation's 100 most populous cities.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

1. Miami, Florida

A median home price of $589,000 means it would take 78.71% of the median household income of $43,401 to support a projected mortgage of $2,846.82, including taxes. And that makes Miami -- population 454,000 -- the most expensive city in the country, the RealtyHop report says.

Previous

Next

2. New York City, New York

No. 2 on the list is New York City. A median home price of $970,000 would require 77.98% of the median household income of $68,259 to support a projected mortgage payment of $4,435.97 in America's largest city, home to about 8.4 million residents.

Previous

Next

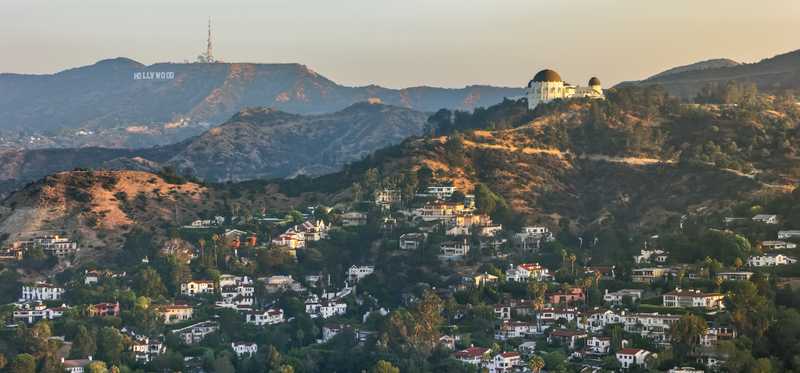

3. Los Angeles, California

Los Angeles is third on the RealtyHop list of most expensive/least affordable residential markets. This city of four million residents saw a February median home price of $925,000, yielding an estimated mortgage payment of $4,250.09 a month, which would consume 74.2% of that median household income of $68,733.

ALSO READ: Why the Housing Market Will Stay Strong for Years to Come

Previous

Next

4. Newark, New Jersey

Just across the Hudson River from the Big Apple is Newark, New Jersey, a city of about 281,000 residents. The median home price here is only $385,000. However, with a median household income of $38,517, it would still take 72.33% of the budget to support a monthly mortgage payment of $3,812.18.

Previous

Next

5. Jersey City, New Jersey

Newark's neighbor, Jersey City, is similar in size with a population of about 261,000, only more expensive. Its February median home price was $699,000, and it posted a household income of $77,422 on RealtyHop's list. The share of income needed for homeownership at those levels is 59.09%, significantly lower than the top four but still high enough to place it fifth on this list of the top 100 most expensive markets.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

6. Long Beach, California

This Los Angeles County city of more than 450,000 people had a February median home price of $699,500 and median household income of $69,700. An estimated monthly mortgage of $3255.47 would require 56.05% of that income.

ALSO READ: Why Investing in Real Estate is a Surefire Way to Make You Richer

Previous

Next

7. Hialeah, Florida

This Dade County, Florida, neighbor of Miami has about 223,000 residents and ranks seventh in this list. Hialeah's median home price of $379,950 would eat up 55.18% of the median household income of $38,976 to support RealtyHop's projected mortgage of $1,792.19.

Previous

Next

8. San Francisco, California

No big surprise that the City by the Bay has a lofty median home price of $1.23 million. A relatively high median income of $124,375 still means it would take 54.01% of the household income to manage that monthly mortgage payment of $5,597.72 in this City of about 875,000 residents.

Previous

Next

9. San Diego, California

Southern California's most southern big city -- population 1.4 million -- posted a February median home price of $849,450 by RealtyHop's calculations. That would require 53.86% of the median household income of $88,123 to support a projected mortgage of $3,955.61.

Previous

Next

10. Anaheim, California

This Los Angeles suburb of about 350,000 souls has a current median home price of $750,000 that would require 52.78% of the median household income of $79,374 to accommodate a projected mortgage payout each month of $3,491.22.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

11. Oakland, California

RealtyHop says this San Francisco Bay city of about 425,000 residents has a current median home price of $746,500. That price would consume 52.35% of the median household income of $81,508 to accommodate a projected monthly mortgage payment of $3,555.90.

ALSO READ: Suze Orman's Warning for Homebuyers Worried About Rising Rates

Previous

Next

12. Irvine, California

This master-planned community of about 275,000 people between Los Angeles and San Diego comes with a big price tag of $1.02 million for the median-priced home. That would require 50.42% of the median household income of $116,275 at a projected mortgage payment of $4,885.34.

Previous

Next

13. Santa Ana, California

Like Irvine, Santa Ana is in California's Orange County. This community of about 310,000 people has a median home price of $660,000, requiring 50.16% of the median household income of $73,160 to cover what RealtyHop says is a projected monthly mortgage payment of $3,058.17.

ALSO READ: How to Double Your Money Investing in Real Estate

Previous

Next

14. Boston, Massachusetts

At the center of one of America's most historical -- and priciest -- markets, Boston has a population of about 676,000 and a median home price of $699,999. RealtyHop's projected mortgage of $3,224.05 would consume 49.39% of the median household income here of $78,327.

Previous

Next

15. San Jose, California

With a population of just over a million, the capital of Silicon Valley had a February median home price of $999,950 and projected monthly mortgage payment of $4,703.05, which would exhaust 46.56% of the city's median annual income of $121,216.

5 Stocks Under $49

Presented by Motley Fool Stock Advisor

We hear it over and over from investors, "I wish I had bought Amazon or Netflix when they were first recommended by The Motley Fool. I'd be sitting on a gold mine!" It's true, but we think these 5 other stocks are screaming buys. And you can buy them now for less than $49 a share! Click here to learn how you can grab a copy of "5 Growth Stocks Under $49" for FREE for a limited time only.

Previous

Next

Big cities, big prices, and big affordability questions

With the lone exception of Boston, all these markets are in and around Los Angeles, San Diego, San Francisco, New York, and Miami. Investors looking for deals to flip or rent might find better pickings elsewhere. And you might start thinking small.

The recommended maximum percentage of household income to support a mortgage -- or pay the rent -- is usually about 25%. On RealtyHop's list, you'd have to get down to number 75 -- Pittsburgh -- to reach that level.

The Motley Fool has a disclosure policy.

Previous

Next

Invest Smarter with The Motley Fool

Join Over Half a Million Premium Members Receiving…

- New Stock Picks Each Month

- Detailed Analysis of Companies

- Model Portfolios

- Live Streaming During Market Hours

- And Much More

READ MORE

HOW THE MOTLEY FOOL CAN HELP YOU

-

Premium Investing Guidance

Market beating stocks from our award-winning service

-

The Daily Upside Newsletter

Investment news and high-quality insights delivered straight to your inbox

-

Get Started Investing

You can do it. Successful investing in just a few steps

-

Win at Retirement

Secrets and strategies for the post-work life you want.

-

Find a Broker

Find the right brokerage account for you.

-

Listen to our Podcasts

Hear our experts take on stocks, the market, and how to invest.

Premium Investing Services

Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.