What Is Accrued Interest?

Key Points

- Accrued interest grows daily and varies if paid off early, affecting loans and credit costs.

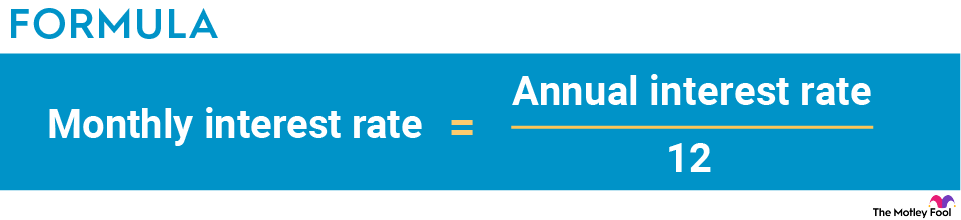

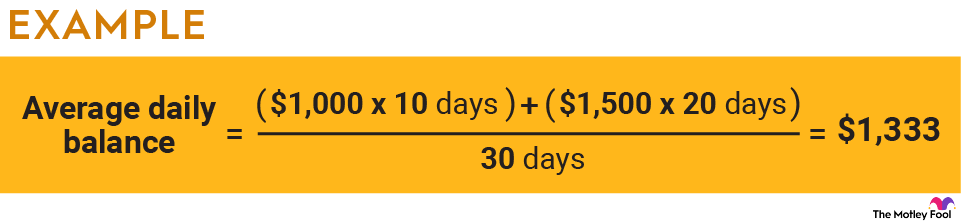

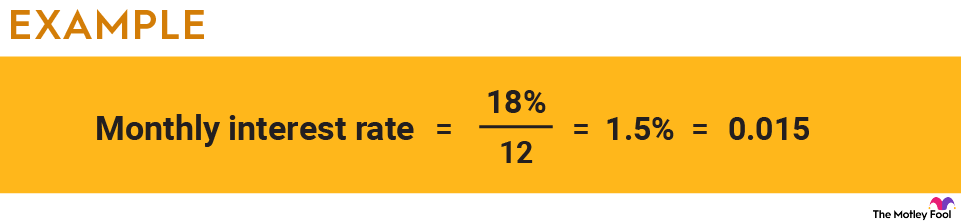

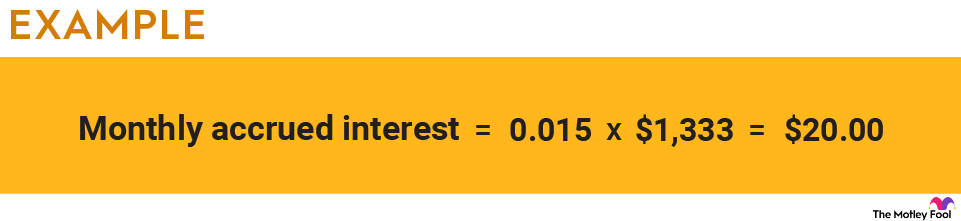

- Monthly accrued interest is calculated using the average daily balance method.

- Bond sellers should include accrued interest in their price to reflect unpaid earnings.