Invest better with The Motley Fool. Get stock recommendations, portfolio guidance, and more from The Motley Fool's premium services.

It is common knowledge among investors that a bull market is one in which stocks have gone up, and a bear market is one in which stocks have fallen. But what exactly defines a bear market?

Let's take a look at the actual definition of a bear market, what causes a bear market to occur, the difference between a bull market and a bear market rally, and other key concepts investors should know.

A bear market is typically defined as a 20% drop from recent highs. The most common usage of the term is to refer to the S&P 500's performance, which is generally considered a benchmark indicator of the entire stock market.

However, the term bear market can be used to refer to any stock index or to an individual stock that has fallen 20% or more from recent highs. For example, we could say that the Nasdaq Composite plunged into a bear market during the bursting of the dot-com bubble in 1999 and 2000. Or, let's say that a particular company reports poor earnings, and its stock drops by 30%. We could say that the stock's price has fallen into bear market territory, even if the overall market is doing fine.

The terms bear market and stock market correction are often used interchangeably, but they refer to two different magnitudes of negative performance. A correction occurs when stocks fall by 10% or more from recent highs, and a correction can be upgraded to a bear market once the 20% threshold is met.

The usual cause of a bear market is investor fear or uncertainty, but there are a multitude of possible causes. While the global COVID-19 pandemic caused the 2020 bear market, other historical causes have included widespread investor speculation, irresponsible lending, oil price movements, over-leveraged investing, and more.

A bull market is essentially the opposite of a bear market. Bull markets occur when there is a sustained rise in stock prices, and they are typically accompanied by elevated consumer confidence, low unemployment, and strong economic growth.

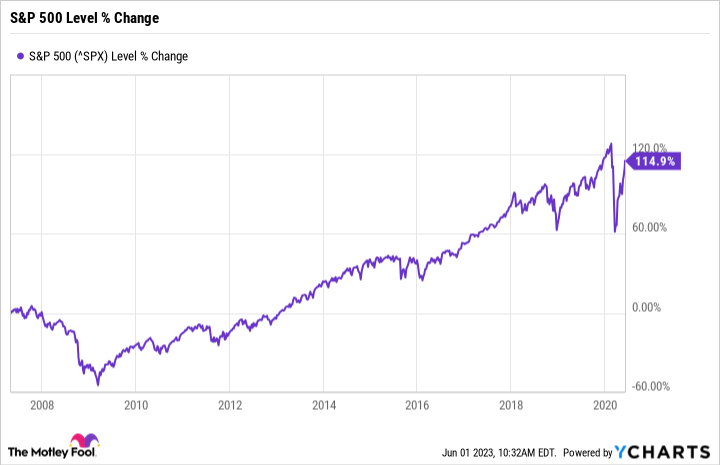

Generally speaking, a bull market is defined as a 20% rise from the lows reached in a bear market, but the definition isn't as strict as that of a bear market. Investors typically mark the start of a bull market at the market bottom of a bear market, and as a result, you generally won't know we're in a bull market until it's already well underway. For example, the S&P 500 reached the lows of the financial crisis in March 2009, so that is considered the start of the bull market that lasted until early 2020.

To be precise, two things generally need to occur before a new bull market can be declared: A recovery of 20% or more from recent bear market lows and new all-time highs in the benchmark indexes.

One important distinction is the difference between a bull market and a bear market rally. A bull market is a sustained uptrend in stocks -- and one that typically results in new all-time highs being reached.

On the other hand, a bear market rally refers to a rise in stock prices after the plunge into a bear market, but one that is just a temporary rise before stocks fall once again. To envision this concept, consider how the 2007-09 bear market unfolded. After reaching new highs in 2007, the stock market collapsed in 2008 after the subprime lending crisis resulted in several major bank failures. After bailouts were announced in late 2008, the market started to rise, but it ultimately reversed course and reached fresh bear market lows in March 2009.

Bear markets can certainly be scary times for investors, and nobody enjoys watching the value of their portfolios go down. On the other hand, these can be opportunities to put money to work for the long run while stocks are trading at a discount.

With that in mind, here are some rules you can use for investing in a bear market the right way:

Bear markets are quite common. Since 1900, there have been 34 of them, including the one that started in 2022, so they occur every 3.6 years on average. Just to name the most recent notable examples: