Interest and dividend income

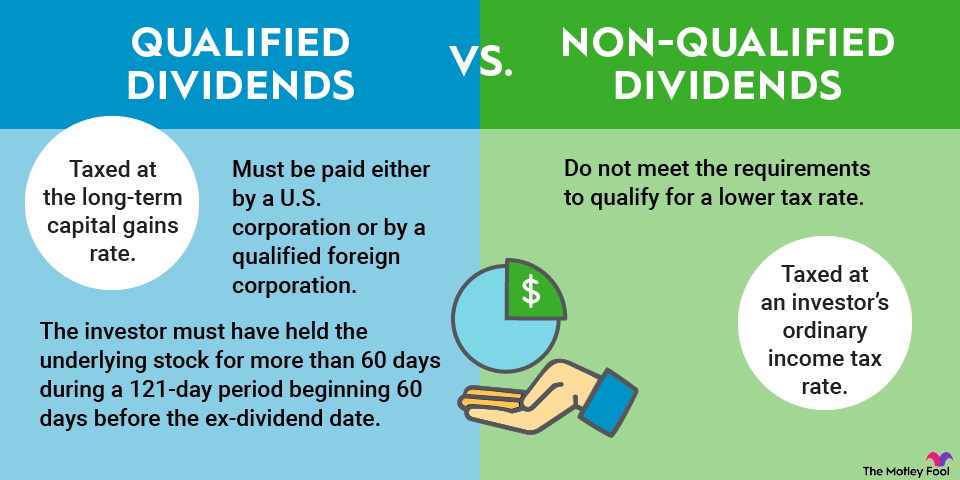

The IRS deems dividend and interest payments received by investors as taxable income. However, there is a notable difference between the two. Dividends aren't an expense to a company but instead a distribution of its earnings to its investors. On the other hand, interest payments on a company's bonds or other debt are an expense; thus, these payments reduce its taxable income.

For individuals, the IRS treats interest income similar to nonqualified dividends, taxing both at the ordinary income tax rate. However, instead of a Form 1099-DIV, recipients will receive a 1099-INT to report this income on their taxes.