Interest and dividend income

The IRS deems dividend and interest payments received by investors as taxable income. However, there is a notable difference between the two. Dividends aren't an expense to a company but instead a distribution of its earnings to its investors. On the other hand, interest payments on a company's bonds or other debt are an expense; thus, these payments reduce its taxable income.

For individuals, the IRS treats interest income similar to nonqualified dividends, taxing both at the ordinary income tax rate. However, instead of a Form 1099-DIV, recipients will receive a 1099-INT to report this income on their taxes.

Dividend income doesn't have to be taxable

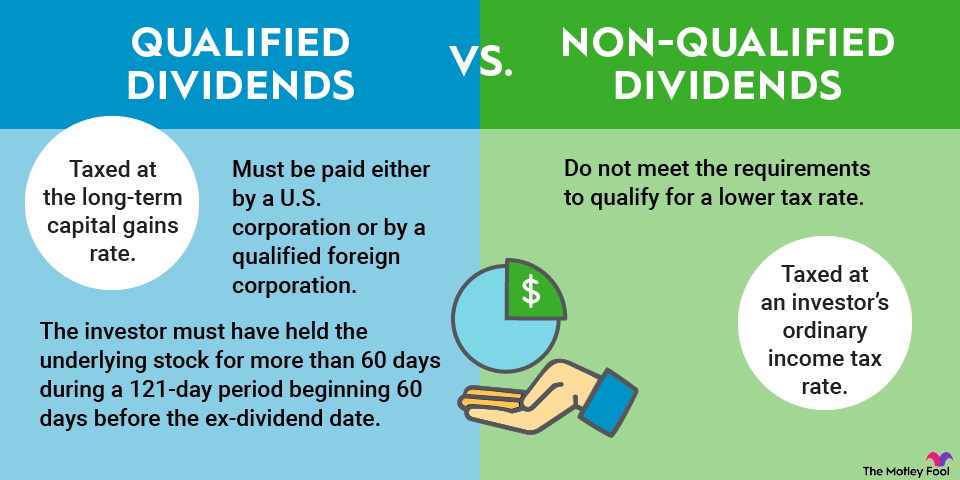

The IRS considers most distributions of cash, stock, or property from a company to its shareholders to be taxable income. The tax rate varies depending on the type of dividend and an investor's tax rate. However, investors can often defer or avoid taxes on this dividend income if they hold the investment in a retirement account, which is why it often makes sense to consider keeping dividend stocks in a tax-advantaged account.

Related investing topics