Example of how a DRIP works

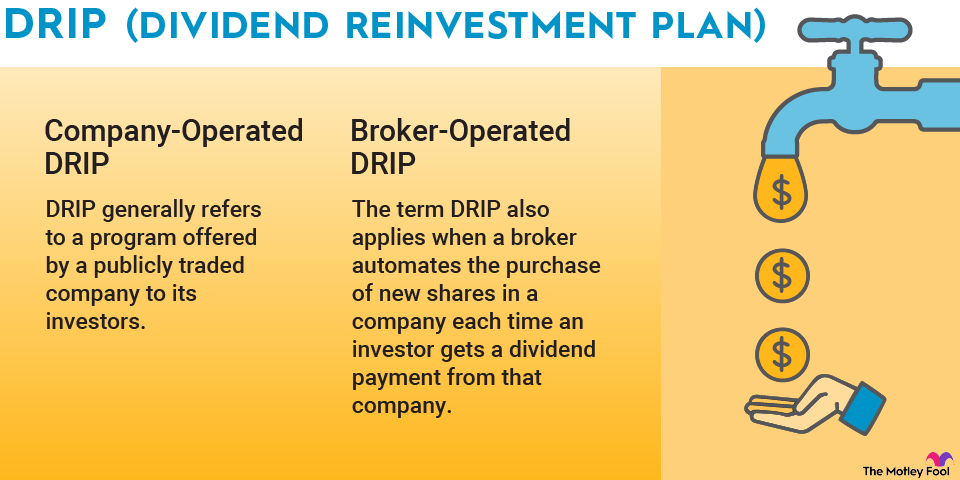

A DRIP is a very simple program, no matter who is offering it. First, you purchase a stock in a company you believe in as a long-term asset. Next, when that company issues its dividends, the money will be automatically used to buy more shares of its stock.

So, if you bought XYZ, Inc. for $5,000 and got $250 in dividends (5%) at the end of the first quarter, you'd have $5,250 in XYZ, Inc. When the second quarter rolls around, if the dividend is unchanged (still 5%), you'll get $262.50 more to add in, making your value $5,512.50 at the end of the second quarter.

As long as the dividend continues to be paid, the amount continues to grow. This is why so many investors like real estate investment trusts, for example -- they always pay dividends.

Related investing topics