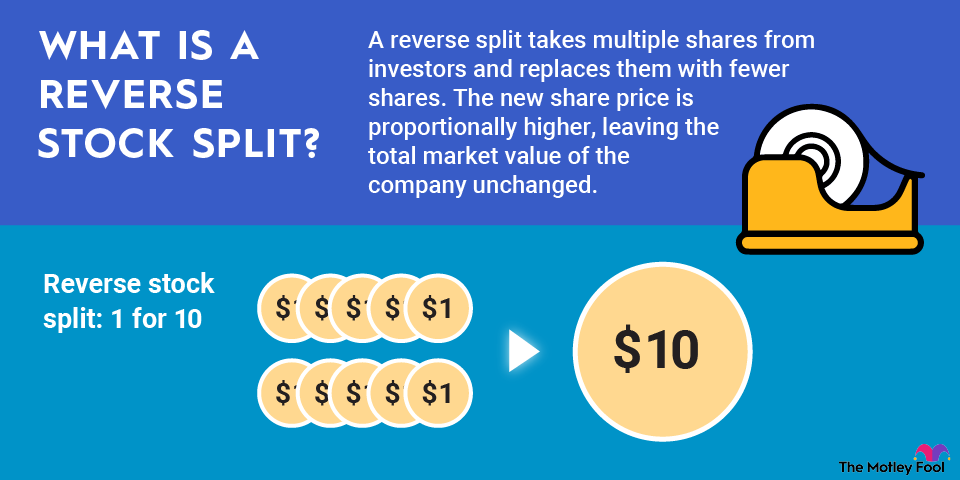

In June 2021, General Electric announced a 1-for-8 reverse stock split to reduce its share count and raise its price. According to the press release announcing the reverse split, "GE plans to file an amendment to its certificate of incorporation to effectuate the reverse stock split after the close of trading on July 30, 2021, and GE common stock will begin trading on a split-adjusted basis on August 2, 2021."

The effective date is more of an accounting issue and isn't too important for investors to know. In simple terms, if you owned 800 shares of GE before Aug. 2, you owned 100 shares when trading opened on that date.

Of course, in the real world not all GE shareholders owned shares in a multiple of eight prior to the reverse split. In these situations, cash was given for any fractional shares that were left over after the 1-for-8 ratio was applied. For example, if you had 20 shares of GE prior to the split, 16 of them would convert into two shares of the split-adjusted stock. The remaining four shares would be removed from your brokerage account, and you would receive cash for their value.