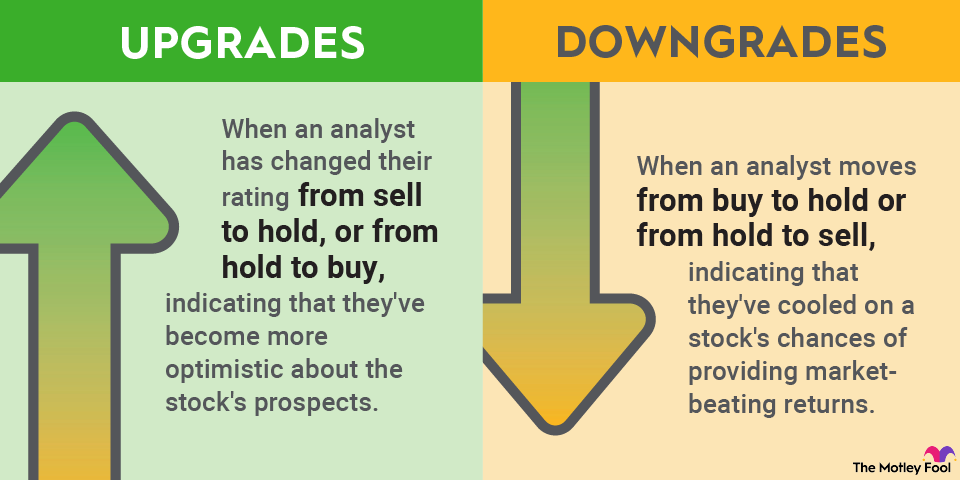

A downgrade can sting for investors who own a particular stock, since it often results in a lower stock price. But for long-term investors who disagree with the analyst's conclusion, the lower price offers an opportunity to buy the stock at a discounted price, potentially boosting returns if the analyst turns out to be wrong.

Downgrades can occur in reaction to news, just like upgrades -- for example, if a company whiffs an earnings report and misses expectations. Analysts also sometimes downgrade a stock due solely to valuation. If an analyst believes a stock has increased in price too much to be justified by the underlying company's profits, the analyst could downgrade the stock despite no change in the company's long-term prospects.

While stock upgrades and downgrades often drive trading activity in a stock, long-term investors should think for themselves. Analysts' opinions can be useful, but they're far from the only thing to consider.

Related investing topics