Welcome to the Fool’s Plan for Financial Freedom!

Investing is an important part of any financial plan, but it’s not the only part. If you don’t know what your financial goals are and where you want to be months or years from now, it will be that much harder to get there. And that’s where a financial plan comes in.

This report presents a simplified approach to assessing many of the different areas of any investor’s financial life. Our hope is that our members can use it as a reset for their financial situation and a jumping-off point for further development of their own personal financial plans.

Below, we present a checklist that highlights the most important areas for you to consider in this process. Let’s dive right in!

We generally recommend for those who are working to focus on saving 15%-20% of their income. But, if you are retired, we’d generally recommend individuals ensure their withdrawal strategy is sustainable.

One of the most impactful things anyone can do to ensure their financial success is to save early and save often. Living within your means is hard to do, but it is vital to ensure a comfortable retirement.

For investors still in their working years, we generally recommend aiming to sock away 15%-20% of their income. It’s OK if you’re not at that level yet, but you could make it a goal to increase your savings rate every year. If your employer has a 401(k), it's best to make sure you are contributing enough to fully capture any employer match. You may be eligible to contribute to an IRA, and remember that after you make any tax-advantaged retirement plan contributions, you can save in a taxable account as well.

|

Percentage of Income Saved Monthly ($80K Annual Salary) |

Total Accumulated After 30 Years (Assuming 7% Annual Return) |

|---|---|

| 10% | $755,000 |

| 15% | $1.13 Million |

| 20% | $1.51 Million |

If you are retired, you’re likely managing your portfolio with a different purpose in mind -- namely, funding living expenses over your lifetime. That means targeting an appropriate withdrawal rate from your portfolio to ensure that you don’t outlive your money. While financial professionals have traditionally used a 4% annual withdrawal rate as a quick benchmark for retirees, that number may be too aggressive (or even too conservative), depending on your situation. You can use that 4% figure as a broad starting point but be sure to run more specific numbers yourself to get a sense of your portfolio’s longevity.

Pay off high-interest debt

Investing in stocks is a great way to build long-term wealth, but there are times when socking away money in stocks may not be the best option for your money. It’s best to put money where it can earn the highest return. And while the stock market has historically returned about 9%-10% annually over the past century, if you’ve got credit card debt that you are paying 15% interest on, your money is likely going to be better spent paying down that debt rather than buying stocks. Getting rid of any high-interest debt should be a priority for any investor.

Build your emergency fund or cash cushion

Cash certainly isn’t an exciting investment, but it should be a vital part of every investor’s financial plan. For investors who are still working, we generally recommend having cash set aside in an emergency fund to cover any unexpected expenses such as medical bills or car repairs, or to cover living expenses in the event of a job loss. Having a secure stash of cash can help ensure you don’t have to sell your stocks at an inopportune time (like when the market is already down). The ideal size of an emergency fund will vary from person to person, but we recommend aiming to have 3-6 months of living expenses set aside if you are still in the working world.

For investors who are already retired, we generally recommend not investing any money needed in the next 3-5 years in the stock market. Any living expenses or money that needs to be accessible in the near future should be kept safe and liquid in cash or cash equivalents. No, money that sits on the sidelines won’t earn much of anything, but it can help avoid having to sell off stocks to cover emergency expenses during a market downtown.

Commit to a long-term investing approach

If there is one thing we want you to remember about investing, it is this: Investing is a long-term sport. We measure results over long periods of time (five years or more), and that’s how we choose stocks. Focusing on the long run means that we won’t be rattled by short-term volatility, which will occur from time to time. When you keep in mind that cashing out and missing even just a few good days in the market could significantly impair long-term returns, it’s clear why long-term investing is the key to success.

Over the Fool’s long history, our approach to investing has been proven to be successful -- but only if one commits to following our Foolish Investing Principles. And that means following those rules in both good times and bad. So the sooner you can adjust to focusing on the long run when investing, the more likely you are to be successful.

Start learning about stocks and how stock investing can benefit you

Investing in individual stocks isn’t for every investor, but for those folks who want the opportunity to earn above-average market returns and who enjoy owning companies that could become tomorrow’s big winners, The Motley Fool offers a wealth of free resources. In addition to a wide range of company-specific news and commentary, we also offer educational articles to help just about anyone learn about investing and become a better investor. No matter what your background, skill level, or interest level, we’ve got the tools to help you get up to speed on how to make stock-picking a part of your investment strategy. Make sure you take advantage of all the Fool has to offer in the way of stock market investing resources!

Check out our Beginner’s Guide to Investing in Stocks and read up on our 5 Top Tips for Investing Beginners

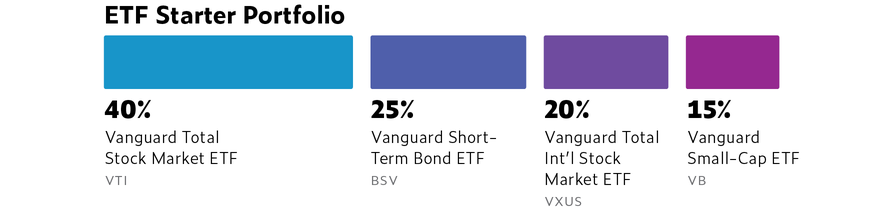

Consider investing in an ETF Starter Portfolio

If you’re just getting started as an investor -- or if you are more experienced and want a blueprint for a solid, diversified portfolio -- you may want to consider investing in exchange-traded funds (ETFs) as a starting point. These funds are generally available at a low cost and offer broad diversification in a convenient package. With just a few funds, you can gain access to wide swaths of the market. And when you are ready to dive into stock investing, ETFs such like those listed below can serve as a great complement to any individual stocks you may choose to buy.

Financial planning is a complex process, but our hope is that this checklist can help you organize your financial life and provide a better understanding of what you may need to do to begin the process of building a successful investing portfolio and a more comprehensive financial plan.

Plan on, Fool!

The Motley Fool has a disclosure policy.