Image source: Getty Images.

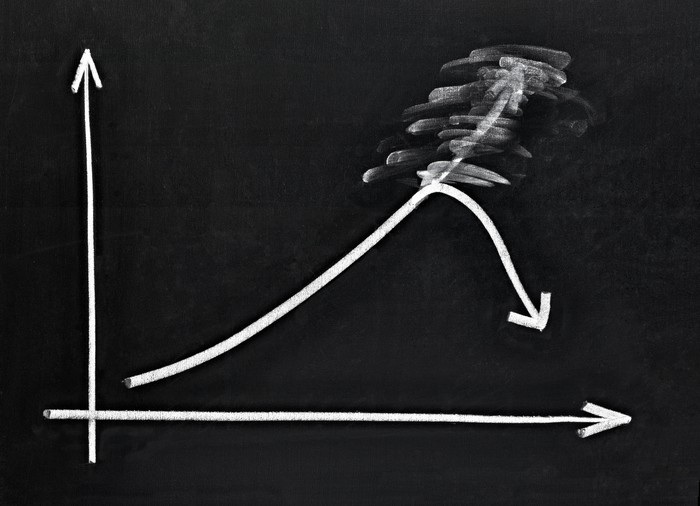

There's nothing worse for dividend investors than buying a high-yield dividend stock and then seeing its payout abruptly get cut. While there are certainly some high-yield investments out there that are worth looking into, you can also spot some that seem bound for a cut sooner rather than later.

Three companies that appear to be headed for cuts are FerrellGas Partners (FGP +0.00%), The Mosaic Company (MOS +1.80%), and Western Refining (WNR +0.00%). Here's a rundown on why none looks to be able to keep its payout going much longer.

They've said they're going to do it already

It's pretty easy to say that a high-yield stock is going to see its payout get cut when management comes straight out and says the company plans to cut the dividend. As bizarre as that statement sounds to investors, that is exactly what happened with FerrellGas Partners when it announced earnings earlier this week.

For propane wholesalers and distributors, last year was a tough year. Record-high winter temperatures drove down heating demand and thus propane deliveries. If that was the only issue the company faced this past year, it might have been able to eke by with its current payout and wait for what this winter brought. But with the additional debt it took on during its blundered acquisition of Bridger Logistics, the company is now breaching its debt covenants and, as a result, plans to cut its distribution starting next quarter.

We don't know exactly what the new payout will be, because management wants to see what the weather brings around November, to get a gauge of what this winter might look like. However, CFO Alan Heitmann said the company expects the dividend to be in the $1.00 range for the year -- half the $2.04 annualized payment of today.

Dragged down by a yet another tough commodity market

The agriculture market has hit a tough patch as of late -- so much so that many of the largest players are consolidating. In the past year alone, we have seen mergers between Potash Corp. and Agrium; Monsanto and Bayer; Syngenta and ChemChina; and Dow Chemical and DuPont. One company that still stands alone, after all of this merger mania, is Mosaic. If it wants to make it on its own, though, it may need to cut its payout -- today, a rather tempting 4.45%.

To be fair to Mosaic, the company has done a decent job of maintaining balance-sheet discipline over the years, and has been able to lower costs over the past few. But lowered costs haven't been enough to make up for the massive decline in fertilizer prices that has depressed Mosaic's revenue by 25% over the past three-plus years. Many fixed costs related to fertilizers -- think mines and factories -- have eaten away at profits pretty hard. Between fiscal-year 2012 and the trailing twelve months, Mosaic's dividend payout ratio has skyrocketed from a modest 15% to a more troubling 69%. It's even worse on the cash flow side, as the company is now burning through cash and raising debt to cover its capital spending and dividend payments.

A quick rebound in fertilizer prices could repair this situation, but a catalyst for those kinds of gains hasn't really emerged yet. If the fertilizer market were to maintain its current course a while longer, Mosaic would need to seriously consider its current dividend policy.

Ghosts of a debt-laden past

It wasn't that long ago that Western Refining was sitting on a mountain of debt and was one of the most hated stocks on all of Wall Street. The not-quite-successful acquisition of Giant Industries in 2007 put the company in a financial hole that was compounded by the Great Recession.

The company just completed another big acquisition: This time it was the much more promising Northern Tier Energy. Still, there are parallels between the situation in 2007 and the one today. The company had to borrow quite a bit of money to complete the deal, and its debt-to-capital levels are getting a little higher than desired. Then there is the issue of lower refining margins, as crude oil prices rise and refined product inventories remain high. To add insult to injury, costs to comply with the U.S. Environmental Protection Agency's Renewable Fuels Standard (RFS) are becoming prohibitively expensive.

With these headwinds facing the company, it would not be surprising if Western Refining's management were a little spooked. During the company's most recent conference call, management did say that there was ample cash on hand to pay its dividend as is. But priority No. 1 in the near term is to cut down its debt load, and the board of directors, in the words of CEO Jeff Stevens, "evaluates the dividend every quarter." If refining margins remain weak for a while and RFS compliance costs don't come down soon, Western Refining may have to reevaluate paying a 5.8% dividend.