Image source: Getty Images.

U.S. stocks pulled a reversal during late trading Friday, and instead of breaking the eight-day losing streak, it turned into a nine-day losing streak -- the longest losing streak since the depths of the financial crisis. The Dow Jones Industrial Average and S&P 500 traded lower for the week by 1.49% and 1.93%, respectively.

In other news, the U.S. economy added 161,000 jobs in October, which was below expectations, but still good enough for the Federal Reserve to again consider raising interest rates in December. This is the "will we, won't we" saga that seems to have no end.

Putting all of that aside, here are some stocks making big moves or big headlines this week.

Nobody likes reduced guidance

Shares of gaming retailer, GameStop (GME +4.69%) were down 13% this week after the company released some preliminary third-quarter information, though official results aren't due out until November 22, 2016.

More specifically, GameStop expects its third-quarter revenue to check in at roughly $2 billion, and same-store sales to decline between 6% and 7%. The same-store sale guidance is now much worse than the original estimate of a 1% to 2% decline. GameStop also expects earnings per share to check in between $0.45 and $0.49, lower than the previous guidance range of $0.53 to $0.58.

The cause for the upcoming poor results is that new game titles released in October didn't perform as well as was hoped for, and failed to provide a catalyst for software sales. GameStop CEO Paul Raines did his best to spin things positive, and noted that the company remains optimistic about upcoming virtual-reality products and consoles: Nintendo Switch, Microsoft's Project Scorpio and Playstation 4 Pro.

We'll see how much upside those products will actually provide, but for long-term investors, the GameStop brick-and-mortar growth story may not work in an era where online downloads and streaming are the future.

Image source: Getty Images.

Swipe right

Shares of Match Group Inc. (MTCH +0.00%) tumbled 15% this week after the markets weren't impressed with the company's third-quarter results. The results weren't that bad, but the stock price had a high run up, and still sits at a price-to-earnings ratio around 30. Investors needed a blowout quarter to hold that valuation.

Match Group's top-line revenue increased 18%, to $316 million, compared to the prior quarter, with dating revenue increasing 22%, to $287 million. The online dating company's operating income soared 57%, to nearly $92 million, thanks to strong growth in Tinder and PlentyOfFish. That drove earnings per share to $0.23, $0.04 above analyst estimates.

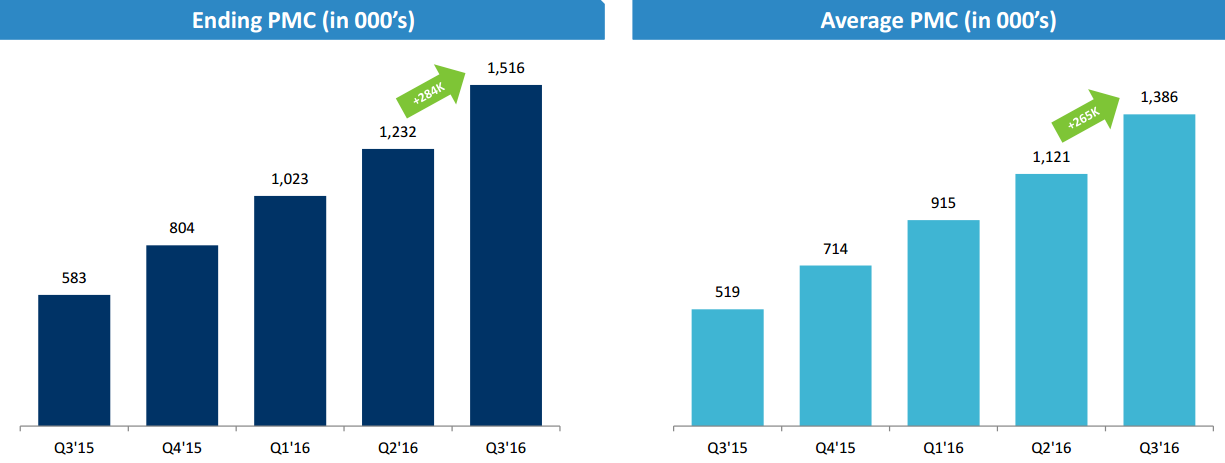

Match Group is on track to more than double ending paid member count (PMC) in 2016, and you can see the sequential strength below.

Graphic source: Match Group's third-quarter presentation.

For long-term investors, the dating business seems like a safe bet. That's especially true as Match Group makes investments in Tinder to make it faster, more reliable, more secure, and opening the top of the funnel by allowing people an alternative to signing up with Facebook. Sadly, we don't have much info on Tinder's next step other than management noting "other cool stuff we can't talk about" during the third-quarter call. Stay tuned.

Let the good times roll

General Motors (GM 2.62%) makes a vast majority of its profits right here in the U.S., but it often sells more vehicles in China. Friday, General Motors released its October sales results in China, and they were solid. More specifically, GM delivered an October record of 345,733 units, a 5.7% increase compared to the prior year. That result pushed GM's year-to-date sales beyond 3 million vehicles more quickly than it had ever previously done.

General Motors' Buick Envision. Image source: General Motors.

Another positive development for investors is that GM's Cadillac brand continues to build momentum. Cadillac delivered more than 12,502 units last month compared to the prior year, which marked the fourth-consecutive month of sales gains topping 50%. That's pretty impressive.

Buick's deliveries in China were up 3.4% in October and topped 105,000 units. The brand's best-selling SUV, the Envision, continued to be popular with Chinese consumers, and posted a 28% increase in sales compared to the prior year.

For long-term investors, China will continue to be extremely important for volume. It will be interesting to see how the next few months trend, in terms of sales. That's because the government's tax incentive, which was put in place during the summer of 2015 as sales stalled, ends as the calendar flips to 2017

This gives incentive for consumers on the fence to purchase now, rather than wait, and could mean a slower sales pace once January hits. We'll just have to wait and see.