With Illinois Tool Works (ITW +0.60%) and 3M Company (MMM 1.93%) now trading for valuations at or near historic highs, it's time for investors to take a long hard look at whether they are still a good value. So let's analyze the key takeaways from Illinois Tool Works' latest earnings call, look at how and why the company is outperforming, and ask whether the stock is a good value or not.

The story so far

As you can see above both stocks have notably outperformed the S&P 500 this year, and on an enterprise value (market cap plus net debt) to EBITDA basis, their valuation multiples are starting to look high.

ITW EV to EBITDA (TTM) data by YCharts

Essentially, neither stock is getting much help from end markets -- moderate growth at best -- but management at both companies continues to execute well. Investors have become used to ongoing operating margin expansion, and impressive increases in return on equity, as both companies have wrung every bit of earnings growth they could out of low-single-digit revenue growth.

ITW Operating Margin (TTM) data by YCharts

Management delivers, end markets don't

The theme in the subhead is on display in the recent results from both companies. 3M's operating margin increased 40 basis points to 24.7% compared to the same period last year, even as revenue was flat and organic revenue declined 0.8% on a constant-currency basis.

In a sign of how difficult industrial market conditions are, 3M's revised outlook is now for full-year organic local-currency sales growth to be flat, compared to a previous range of flat to 1% growth.

Next, let's look at how Illinois Tool Works makes money.

DATA SOURCE: ILLINOIS TOOL WORKS PRESENTATIONS. CHART BY AUTHOR. FIGURES IN MILLIONS OF U.S. DOLLARS.

Turning to Illinois Tool Works' third-quarter earnings, there are five key takeaways.

-

The economy still isn't helping much, and management's outlook remains for organic growth in 2016 to be in the range of 1% to 2%.

-

Operating income margin expanded 40 basis points to 23.1%, but 120 points of the total came from enterprise initiatives; an acquisition diluted margin by 80 points, with price (10 point increase) offsetting a 10 point decline from lower volume.

-

Management expects its leading segment, Automotive OEM, to grow by 2% to 4% over the next three years even if auto production flattens out -- as many investors fear it will in future.

-

Full-year guidance for operating margin to exceed 22.5% (around 23% excluding impact from product line simplification) represents an increase on the 22.5% expected at the start of the year.

-

Reported operating margin increased strongly at the two segments that have suffered the greatest cyclical weakness in recent times: welding, and test & measurement.

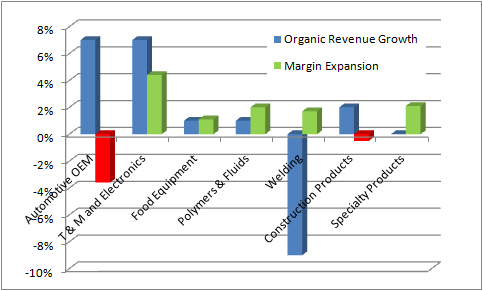

The revenue and margin movements in the third quarter can be seen below. Don't worry too much about the margin decline in the automotive segment, as an acquisition diluted margin there by 370 basis points.

DATA SOURCE: ILLINOIS TOOL WORKS PRESENTATIONS. CHART BY AUTHOR. THIRD QUARTER FIGURES

Enterprise strategy

Illinois Tool Works is now in the fourth of year of its 2013-2017 enterprise strategy to simplify its businesses, narrow the focus of its business, and use strategic sourcing to reduce costs. As you can see above, those efforts are clearly working. On the earnings call, CEO Scott Santi proudly informed investors, "The third quarter marked the 12th quarter in a row that our enterprise strategy initiatives delivered more than 100 basis points of margin expansion."

ILLINOIS TOOL WORKS' AUTOMOTIVE SEGMENT IS THE COMPANY'S BIGGEST INCOME EARNER. IMAGE SOURCE: ILLINOIS TOOL WORKS WEBSITE

Why Illinois Tool Works isn't a buy

Putting it all together, does this make the stock worth buying? Frankly, for three reasons, I think the answer has to be "no."

First, management's excellent performance is now baked into the valuation, and just as with 3M Company, the pressure is building for continued execution.

Second, the rise in the stock price after Donald Trump's election victory suggests investors are now expecting an improvement in the kind of heavy industries that Illinois Tool Works sells into -- particularly the welding, construction and polymers & fluids segments. Unfortunately, there is no guarantee that will come.

Third, the stretched valuation now means there is very little margin of safety to deal with any disappointments in future.

All told, it's been a great year for the stock, but investors might consider cashing some gains.