Since going public as a separate company from Arconic Inc. (HWM 2.50%) on Nov. 1, shares of Alcoa Corporation (AA) have rocketed up more than 31%, outpacing the rest of the market and leaving shares of Arconic in the dust.

Alcoa is now a pure-play materials company. Investors should understand what that really means. Image source: Getty Images.

So what should investors do now? Is Alcoa still worth buying even after the run-up, or should investors who've profited sell now? Let's take a closer look.

The case for selling now

Aluminum prices have inched higher over the past year, but the reality is that nothing has really changed over the past six weeks to improve Alcoa's prospects. Aluminum prices, though improved, are still down on a general oversupply of bauxite and alumina, the precursor materials used to produce aluminum. Furthermore, Alcoa Corp. still hasn't reported financial or operating results as a stand-alone company.

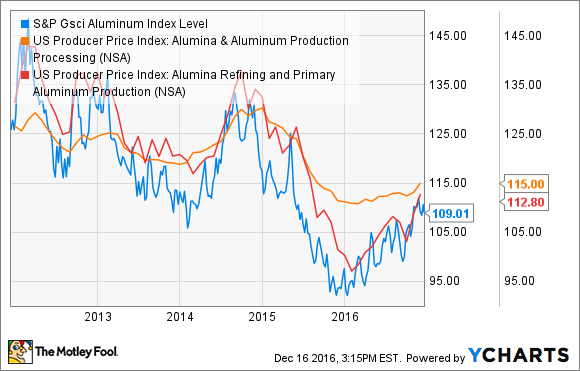

This is particularly true considering that alumina and aluminum prices remain well down, even factoring in a 17% increase over the past year:

S&P GSCI Aluminum Index data by YCharts.

The reality is, the market may have gotten far ahead of itself on Alcoa's ability to generate strong profits or cash flows at current commodity prices. And until we've seen how the company's corporate structure really affects its cash flows, shareholders could be in for a rude awakening when the company starts reporting financial results next quarter.

This is particularly relevant for investors who may be depending on the money they have invested in Alcoa in the next few years. Investing in a company whose prospects are heavily tied to commodity prices, when that commodity is still beaten-down and there's a lot of supply in the market, could end badly.

The case for holding -- or even buying

The case for selling, above, is largely about timing -- and humans are pretty terrible at timing things like the stock market. And while that's exactly why investors who will be counting on that money in the short term should consider selling now, it's also part of the case for why Alcoa could be worth buying now, if you're thinking longer-term.

Here's what we know:

- Aluminum and alumina prices have climbed 16% or so over the past year, but remain well below historical levels due to a global oversupply.

- That global oversupply has been reduced significantly, however, with a deficit in production in 2016 versus growth in consumption taking a bite out of global stocks.

- Alcoa has reduced its production costs significantly; it can produce alumina and bauxite cheaper than three-fourths of global production, and aluminum cheaper than 62% of global production.

Furthermore, shares of Alcoa trade for around 0.6 times book value, a steep discount to the book-value multiple it traded at when it and Arconic were a single company:

AA Price to Book Value data by YCharts.

And historically speaking, often the best time to invest in Alcoa -- and this is no different from any stock which is heavily dependent on commodity prices -- is when both the commodity price and valuation of Alcoa were relatively low.

Well, there's no arguing that aluminum and alumina prices are still low, and there's a case to be made that even after the run-up since the spinoff, Alcoa's shares are reasonably valued, if not cheap.

It all depends on commodity prices (which depends on a lot of other stuff)

Both the upside and downside for Alcoa and its stock will be products of what happens with aluminum, bauxite, and alumina prices. The good news on this front is that there are positive trends. Not only have prices improved over the past year, but there's also evidence that producers aren't ramping up output simply because prices have improved. This second part is a big deal, since it provides some evidence that prices could continue to rise -- a real boon for Alcoa and other producers.

That's just half the equation, of course, since demand is just as critical. There's good news on that front as well, with expectations for steady and strong demand from major aluminum-consuming industries such as aerospace and automotive likely to last for years to come. But those markets can be very "lumpy," with demand moving around from quarter to quarter.

Put it all together, and there's a case to be made that buying Alcoa today -- and holding it while the aluminum market improves -- could pay off. The caveat, of course, is that prices may not continue to steadily improve, and it could take some time for Alcoa investors to see another 32% increase in the stock price. But if you're not willing to ride out the potential ups and downs of the commodity market, or able to take on the risk of short-term losses, then Alcoa may not be the stock for you.