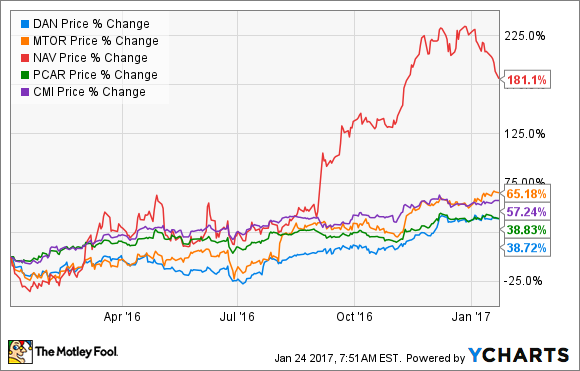

As was the case for many other companies exposed to trucking and light-vehicle markets, last year was a very good one for stockholders in axles, driveshaft, and transmission manufacturer Dana Incorporated (DAN +0.13%). As you can see in the chart below, the whole sector -- including Dana's customers such as Navistar International Corporation (NAV +0.00%) and Cummins Inc. (CMI 2.02%), and rivals such as Meritor, Inc. (MTOR +0.00%) -- reported very strong gains. The question is: Can its run continue in 2017?

Introducing Dana Incorporated

Before analyzing the company's growth drivers, let's look at how Dana makes money. A good way to start is by breaking out its EBITDA (earnings before interest, tax, depreciation, and amortization) for the first nine months of 2016. As you can see, most of Dana's EBITDA comes from its light-vehicles segment.

Data source: Dana Incorporated presentations. Chart by author. Amounts in millions of U.S. dollars.

Key customers for Dana's axles and driveshafts in the light-vehicle market include Ford -- its largest customer, contributing 20% of total 2015 sales -- and, to a lesser extent, Hyundai, Nissan, and Tata. Within commercial vehicles, customers include PACCAR (PCAR 1.26%) -- Dana's second-largest customer, contributing 8% of total sales in 2015 -- Ford, and Navistar. AGCO and Deere are customers in off-highway, and the power technologies segment sells to Ford, Cummins, Caterpillar, and others. Meritor is a key competitor.

Its customer list is almost a who's-who of the automotive industry. That said, I would pick out three key customers/end markets worth closely following:

- Ford, particularly in light trucks such as the Super Duty

- PACCAR in commercial vehicles

- Navistar in commercial vehicles

Ford and PACCAR are obviously important because of their contribution to current sales/earnings, but Navistar is likely to be in the future, too. Dana and Navistar recently signed a multiyear sales agreement granting Navistar access to all Dana's driveline product offerings. Volkswagen's investment in and collaboration with Navistar is rejuvenating the company's growth prospects and product range, and Dana looks like it's also set to benefit.

Image source: Dana Incorporated.

Growth drivers

The three near- and long-term growth drivers are as follows:

- Light-vehicle and trucking sales

- Growth from acquisitions and deals

- Organic growth due to industry trends such as growth in all-wheel-drive vehicles and increasing efficiency requirements

It's been a pretty good environment for light-vehicle sales in the last few years, although industry forecasters such as the National Automobile Dealers Association's chief economist Steven Szakaly believe the light-vehicle market is headed for stability rather than growth in 2017. North America accounts for more than half of Dana's sales.

Data source: Federal Reserve. Chart by author. Seasonally adjusted annual rate. Amounts in millions of units.

However, the outlook for heavy-duty truck sales is mixed. Many forecasters, including Dana, are predicting another decline in class 8 North American truck production in 2017, to around 200,000 units from 228,000 in 2016, only to bounce back to double-digit growth in 2018. In other words, conditions will get worse before they get better.

Acquisitions and deals, such as the Navistar agreement discussed above, are also expected to spur growth. For example, Dana is in the process of purchasing the power transmission and fluid power businesses of Brevini Group, adding off-highway technologies for tracked vehicles, which is forecast to add around $400 million in sales in 2017, on top of Dana's continuing business revenue of around $5.9 billion.

Finally, in the long term, Dana's management sees its technologies benefiting from the drive toward greater efficiency created by increasing sales of all-wheel-drive vehicles (which tend to be heavier) and toward automakers' needs to meet fuel-efficiency standards.

One of Dana Incorporated's axles used in the agricultural sector. Image source: Dana Incorporated.

Is it enough to make Dana Incorporated a buy?

Frankly speaking, if you can say with a high degree of confidence that Dana will hit its 2019 targets of $360 million in free cash flow and diluted adjusted EPS of $2.60, then the stock is a buy. Those figures would mean Dana trades at a 2019 P/E ratio of 7.4 times earnings and that it would generate 9.7% of its enterprise value in free cash flow in 2019.

The problem is that this belief requires confidence in current forecasts for light-vehicle and truck sales -- not an easy thing to have when both appear to be faltering in the near term. It also needs Dana to have a trouble-free year in terms of completing acquisitions and integrations. Furthermore, 2017 is set to be a year of heavy capital spending, and therefore a dip in free cash flow to around $60 million, representing just 1% of sales compared to 2% in 2016.

In other words, the stock looks like a good long-term value, but anxious investors, beware: It's going to take at least a couple of years of solid execution and favorable market conditions before the stock looks cheap on a headline basis. This isn't a stock for an impatient investor.