Small wonder Tesla (TSLA -3.49%) is planning a five-for-one stock split: its stock has skyrocketed more than 270% since the start of the year! With the split imminent, many investors are thinking about piling into the company's expensive shares in hopes that a lower post-split share price will encourage more investment.

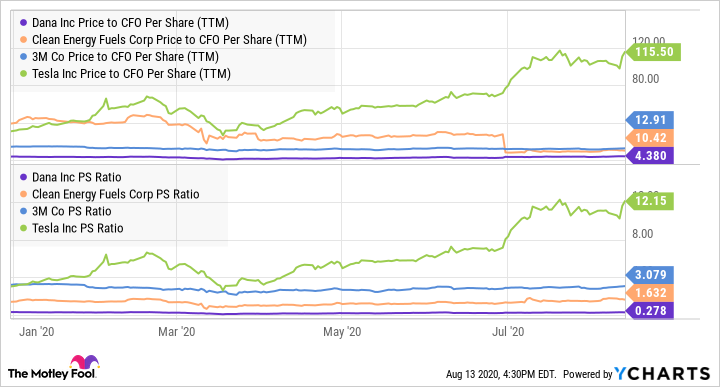

However, Tesla's shares are currently trading at 97 times operating cash flow and 12.2 times sales, meaning it looks astronomically overpriced. With that in mind, we asked three of our Motley Fool contributors what automotive industry-related stocks they'd recommend instead. They came back with Dana Incorporated (DAN -1.01%), Clean Energy Fuels (CLNE 1.07%), and 3M (MMM -0.96%). Here's why.

Image source: Getty Images.

An experienced automotive parts provider to be charged up about

Scott Levine (Dana Incorporated): Given how pricey Tesla looks right now, investors with an appetite for an electric vehicle (EV) stock -- in addition to a bargain -- would be better-suited to look elsewhere. Fortunately, they need not look for long. Dana Incorporated is a worthy consideration -- and one that has a connection to Tesla. In 2018, Diarmuid B. O'Connell, who had served as Tesla's vice president of business development for 11 years, joined Dana's board of directors.

For more than 115 years, Dana has provided drivetrain solutions to the auto industry, but it's hardly mired in the past. Since 2017, Dana has closed on eight acquisitions, strengthening its position as a supplier to the EV market. Two months ago, for example, Dana acquired Rational Motion, which specializes in battery-electric vehicle integration for trucks and buses. And the acquisitions appear to be bearing fruit. In addition to other components, Dana is supplying Hyliion, which plans to go public in 2020 via a merger with Tortoise Acquisition (SHLL), with auxiliary system motors gained from its January 2019 acquisition of SME Group.

Currently, Dana's stock is trading at 4.5 times operating cash flow, a discount to its five-year average multiple of 5.8, as investors are pessimistic about the company's ability to prosper through the remainder of a challenging 2020. Through the first half of the year, for example, the company has reported sales of $3 billion -- about 33% lower than what they reported during the same period in 2019. However, the company has certainly weathered previous downturns in its 115-year history, and I believe that the company will recover. Analysts seem to agree, forecasting the company to report earnings per share of $0.24 in 2020 and $1.82 in 2021. For patient investors with a yearning for exposure to the EV market, Dana seems like a compelling opportunity.

Beating Tesla to clean trucking

John Bromels (Clean Energy Fuels): Tesla CEO Elon Musk has his sights set on the trucking industry, hoping to begin production of the all-electric Tesla Semi in 2021. Rival Nikola is hoping to roll out a hydrogen fuel cell-powered semi truck of its own in 2023.

However, you don't have to wait that long to invest in clean fuel for trucking, thanks to Clean Energy Fuels. The company sells the only zero-emission truck fueling option that's available today: renewable natural gas (RNG). While Clean Energy Fuels also offers regular natural gas fuel for the specialty trucks that can use it, its hottest product right now is Redeem, an RNG diesel substitute. Clean Energy Fuels captures methane from big emitters like dairies and landfills, then processes it into cleaner-burning RNG fuel. Because burning the fuel generates less greenhouse gas than the captured emissions, the entire process is often carbon-negative.

Redeem has been popular with companies that have big truck fleets but are trying to lower their carbon footprints. Shipper UPS, for example, ordered 170 million gallon-equivalents of Redeem in 2019. Clean Energy Fuels has also been successful in introducing its fuels to trucks serving the Port of Los Angeles. A recently announced RNG partnership with oil major Chevron sent Clean Energy's stock price upward. But this green energy specialist still has plenty of room to run, now that the market for clean transportation fuel seems to finally be taking off.

All three of these picks are trading at much lower valuations than Tesla. DAN Price to CFO Per Share (TTM) data by YCharts.

An unconventional automotive pick

Lee Samaha (3M): The industrial conglomerate might not strike you as being the most obvious of automotive related stocks, but the industry is one of the key swing factors in its revenue and earnings prospects. As such, 3M stock offers a good, and relatively safe, way to gain exposure to an improving automotive market in 2021. Throw in a 3.6% dividend yield and the fact that the stock trades on 18.2 times estimated free cash flow in 2020, and 3M is a good option for value-oriented investors.

3M's exposure to the automotive market is indicated in the table below. The business groups with heavy exposure to the automotive markets were reasonable for 57% of the $995 million year-over-year decline in revenue. 3M's automotive businesses tend to be tied to production, and the COVID-19-related automotive plant shutdowns led 3M to disappoint investors in the second quarter.

|

3M Business Group Revenue |

Q2 2020 |

Q2 2019 |

Change |

|---|---|---|---|

|

Automotive aftermarket |

$203 million |

$304 million |

($101) million |

|

Industrial adhesives and tapes |

$552 million |

$674 million |

($122) million |

|

Advanced materials |

$236 million |

$331 million |

($95) million |

|

Automotive and aerospace |

$268 million |

$478 million |

($210) million |

|

Transportation safety |

$222 million |

$265 million |

($43) million |

|

Total |

$7,176 million |

$8,171 million |

($995) million |

Data source: 3M presentations.

That said, automotive production is expected to improve strongly in 2021 and 3M is likely to be a beneficiary. In addition, it's worth noting the highly unusual nature of the COVID-19-inspired recession. There wasn't any kind of graduated decline, so 3M's customers are highly likely to have been carrying an elevated level of inventory (relative to what second-quarter sales would be). As such, it might take a quarter or two before customers start to replenish inventory, and when they do, the snapback in orders could be sharp.

Meanwhile, 3M's management told investors that it was seeing a broad-based improvement in sales as it started the third quarter. In addition, it also appears to be regaining pricing power with its products -- selling prices increased 0.5% in the second quarter, even as the company suffered a 12.2% decline in year-over-year sales. Finally, management continues to reposition the company as it tries to return to its former glories.

All told, 3M still has a lot of work ahead to convince investors it's back on the right track, but on a risk/reward basis it looks like a good value.