Tuesday was a bad day for investors in tiny drone manufacturer Kratos Defense & Security (KTOS +5.36%). The company that hopes to reinvent how the U.S. Air Force fights its battles -- namely, with jet-powered combat drones -- saw its stock plummet nearly 6% after reporting earnings (actually, losses) late Monday.

Here's how the news went down.

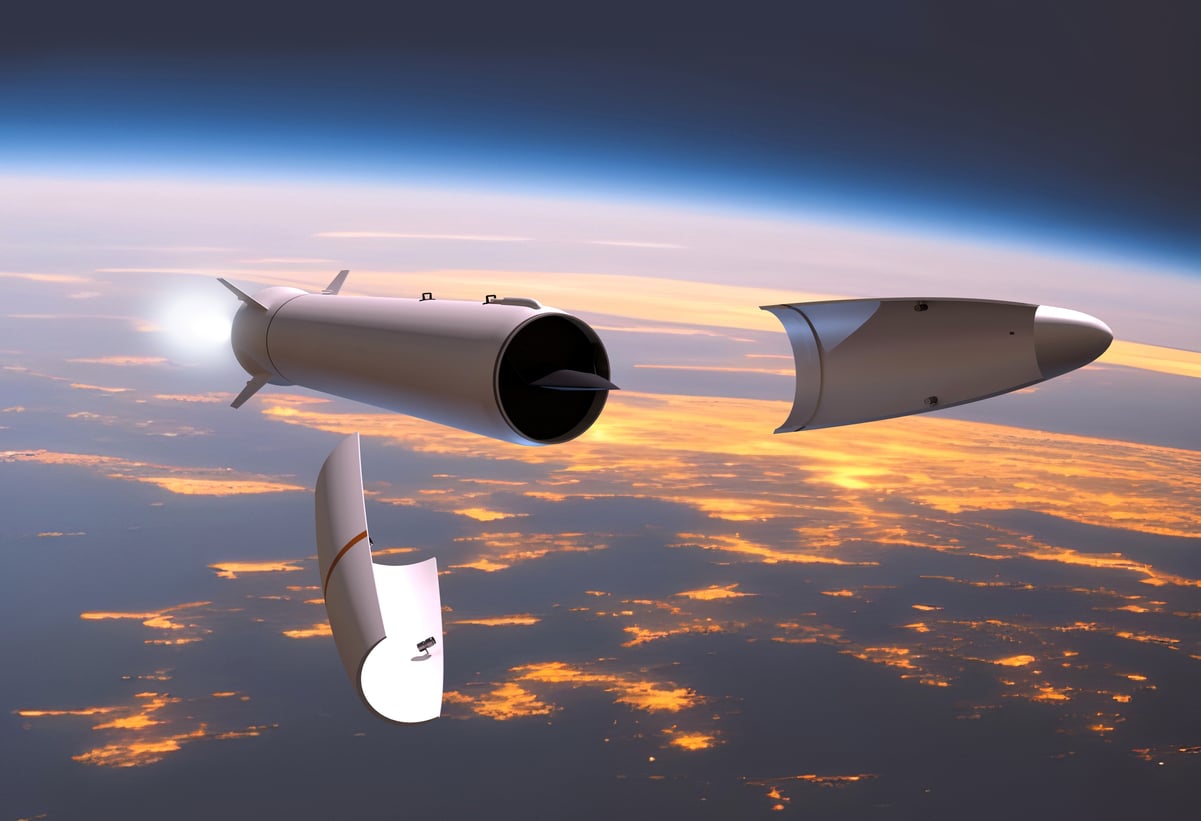

Kratos is the name, and jet-powered combat drones are its game. Image source: Getty Images.

The numbers

For fiscal Q4 2016, Kratos reported 10% sales growth versus Q4 2015, to $182.1 million. Profits, however, were nowhere to be found. Whereas Wall Street had expected Kratos to report a $0.02-per-share profit, the company actually lost $0.05 per share. The loss might even have been worse, but for one thing. Kratos completed an equity offering in Q4, diluting its shares outstanding. Consequently, the quarter's loss was spread out among more shares than would have been the case before the offering -- thus, the size of the per-share loss was less.

Operating cash flow, and consequently free cash flow as well, were both negative.

Even revenue may not be growing as strongly as investors have been hoping. Management noted that in Q4 its book-to-bill ratio was just 1.0, indicating that new contracts won in the quarter were just sufficient to replace revenues booked. Backlog thus held steady at $900 million. On the other hand, Kratos insists that its "bid and proposal pipeline" -- the contracts it hopes to bid on, win, and convert to backlog -- remains more than plump at $5.7 billion.

(On the third hand, just six months ago, that number was at $6.2 billion).

The business

Nevertheless, Kratos CEO Eric DeMarco insisted that "Kratos finished 2016 exceeding our expectations,"

Speaking of upcoming business, Kratos noted that in Q4 it continued to invest in its LCASD and UTAP-22 combat drone programs, and a new "satellite communication signal monitoring, signal intelligence, and location identification technology and product line" as well.

DeMarco also cited "progress" made in the company's DIUx and Gremlins programs, and noted that Kratos picked up one "large contract from a new customer for Kratos' high performance unmanned aerial target drone systems," and is expecting to win another such contract "in the next few months."

The upshot for investors

As far as guidance goes, Kratos promised only $700 million to $720 million in full-year revenues and said it would probably have "adjusted EBITDA" (a company-defined term, and thus infinitely malleable) of $52 million to $54 million. No GAAP profits guidance was given. Meanwhile, back in the world of real numbers, the company has just wrapped up its fourth money-losing year out of the past five.

So what's the upshot? For the time being, Kratos remains a story stock without profits to support it -- a stock with an exciting story to be sure. But until Kratos proves itself a business capable of earning steady profits, investors are probably right to be skeptical of Kratos stock.