After a weak start to 2016, airline stocks surged in the second half of the year. The rally was primarily driven by optimism that airlines' unit revenue would soon start growing again. The revelation that Warren Buffett's Berkshire Hathaway (BRK.B 0.83%) had invested in American Airlines (AAL 1.50%), Delta Air Lines (DAL -0.48%), United Continental (UAL -1.55%), and Southwest Airlines (LUV 0.81%) drove the stocks even higher beginning in mid-November.

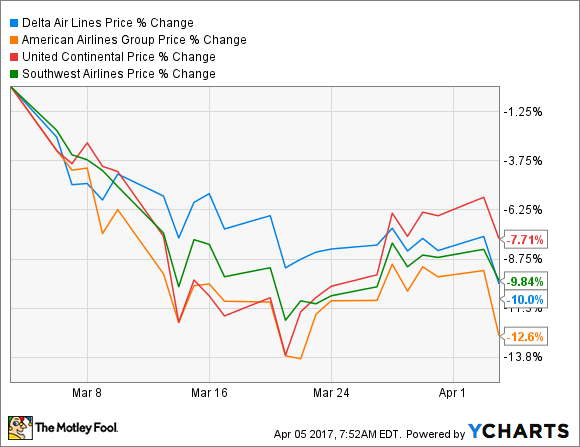

Berkshire Hathaway continued its airline stock buying spree in the last few months of 2016. However, Buffett's newfound interest in the sector hasn't been enough to keep airline stocks afloat. Shares of American, Delta, United, and Southwest have all plunged in the past month.

Airline Stock 1 Month Performance, data by YCharts.

It's not very surprising that these stocks are taking a breather. The huge rally in airline stocks during the second half of 2016 left very little room for error. And unfortunately, airlines' unit revenue hasn't been improving as fast as investors had hoped.

Unit revenue falls short at Delta (again)

Delta Air Lines has been the main culprit behind airline stocks' recent woes, as it failed to meet its Q1 unit revenue guidance.

In January, Delta had projected that passenger revenue per available seat mile (PRASM) would rise 0%-2% during the first quarter. However, while fares for last-minute bookings are starting to rebound from last year's slump, they didn't improve as quickly as expected. As a result, Delta cut its Q1 unit revenue guidance last month, saying that PRASM would be roughly flat.

Even that revised outlook was a bit too optimistic. On Tuesday, Delta announced that PRASM rose 0.5% last month, marking the first monthly increase since November 2015. Yet that was less than what the company (and most analysts) had expected. Delta's management now estimates that PRASM fell 0.5% year over year in the first quarter.

Delta's Q1 unit revenue fell short of management's initial forecast. Image source: Delta Air Lines.

A 0.5% unit revenue decline wouldn't normally be cause for alarm. However, fuel and labor costs are both up significantly relative to a year ago. As a result, even with flattish unit revenue, Delta's operating margin will decline significantly year over year in Q1.

Other airlines are struggling with unit revenue, too

Delta Air Lines was not the only airline to miss its revenue expectations in Q1. In March, American Airlines and Southwest Airlines joined Delta in cutting their forecasts.

Among those three carriers, American Airlines is the only one that still expects unit revenue to be positive for the first quarter. It now projects that revenue per available seat mile (RASM) will rise 1.5%-3.5%, compared to its initial guidance for a 2.5%-4.5% increase.

Southwest Airlines cut its revenue guidance even more. Originally, the company had forecast that RASM would slip 0%-1%, but it now expects to report a 2%-3% RASM decline for the quarter.

Southwest expects to report the worst Q1 unit revenue performance of the top four airlines. Image source: Southwest Airlines.

United has distinguished itself as one of the few carriers to maintain its original guidance. That's why United Continental stock hasn't fallen quite as much as shares of American, Delta, and Southwest.

Still, United's forecast that PRASM will be roughly flat in Q1 and that its pre-tax margin will be a puny 0.5%-2.5% is hardly impressive. Furthermore, the company's plans to aggressively increase capacity later this year could threaten its future unit revenue trajectory.

Look before you leap

Warren Buffett and his lieutenants at Berkshire Hathaway are long-term investors. They certainly aren't panicking about the airlines' recent share price declines. By and large, U.S. airlines are making the right moves to stabilize their unit revenue and get profit growing again. Meanwhile, airline stocks remain relatively cheap compared to the rest of the market.

That said, the recent turbulence for airline stocks highlights the danger of blindly copying famous investors' trades after they become public. The best time to buy airline stocks was last summer, when they were out of favor and investors still believed that Warren Buffett would never invest in an airline stock.

By contrast, Berkshire Hathaway's investments in the top four airlines helped drive those stocks to levels that made them less attractive, even for long-term investors. The "Buffett premium" is finally fading for American Airlines, Delta Air Lines, Southwest Airlines, and United Continental. This could make it a good time to give these stocks another look.