Beer is a big worldwide business, and Anheuser-Busch InBev (BUD +0.58%) has made itself one of the most important companies in the beer industry globally. With a history that dates back to the mid-19th century, Anheuser-Busch became an American icon, and its Bavarian Brewery in St. Louis came to be the foundation of a beer empire that steadily grew over time.

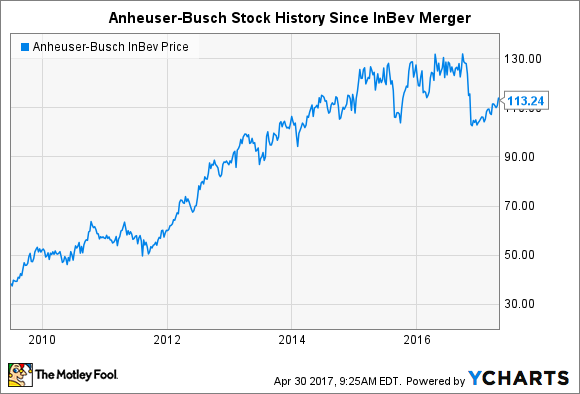

For investors, the big step forward came when InBev decided to buy out Anheuser-Busch in 2008, dramatically expanding the reach of the two companies. Since then, Anheuser-Busch InBev has seen its stock soar, and many have sought to analyze what the next step forward for the beer company will be.

The history of Anheuser-Busch

Before its merger with InBev, Anheuser-Busch grew alongside the U.S. economy. The company had a vision for uniting what had traditionally been a fragmented market, with most beer being provided by local breweries with distinct regional flavors. Anheuser-Busch sought to create a more unified experience, ensuring that customers could get a high-quality beer with which they were familiar across the country. That idea took hold and fostered Anheuser-Busch's growth. Although prohibition created a huge obstacle to the company in the 1910s to the 1930s, the Budweiser maker survived and eventually emerged stronger than many of its competitors.

Anheuser-Busch was the largest U.S. brewer by the 1950s, but it saw the international potential of its business. The company created an international unit to drive expansion, both through the opening and operation of its own breweries and through investments in other popular beer makers, including Grupo Modelo and Tsingtao.

Image source: Anheuser-Busch.

The InBev merger

As an American icon, the thought of a foreign company seeking to acquire Anheuser-Busch was unpleasant for many U.S. investors and beer drinkers. That's one reason why the company initially resisted InBev's $46 billion offer to buy the brewer, wanting instead to maintain Anheuser-Busch's St. Louis headquarters by restructuring the company. A proxy battle and legal fight briefly ensued. In the end, Anheuser-Busch finally agreed to a sweetened deal that paid its shareholders $70 per share, or $52 billion, in cash.

The result of the merger was to create the largest brewer in the world. Combined, the two companies brought together the power of brands like Budweiser, Beck's, and Stella Artois. Partnerships with other beer makers were strained because of the InBev merger, but Anheuser-Busch nevertheless retained many of those relationships and used them to bolster growth even further. Between 2009 and 2015, the stock tripled in value.

Getting even bigger

Yet Anheuser-Busch still saw the need for further consolidation in the industry. That prompted the company's offer to buy rival SABMiller, which eventually exceeded $100 billion. Numerous divestitures were necessary in order for the deal to pass antitrust scrutiny in various markets around the world, and with the merger having just closed late last year, Anheuser-Busch InBev is still working to integrate SABMiller's operations and find all the synergies and efficiency gains that it believes are available.

With the SABMiller merger complete, investors have turned back to fundamentals, and a challenging environment has held back A-B InBev's stock. Revenue has stalled out in recent years, and it took improving conditions to produce even a modest increase in year-over-year sales during 2016. Earnings have taken a hit from transaction-related costs, but even discounting those figures, sizable declines in total sales volumes have highlighted the weakness of the beer industry overall. Even though A-B InBev has continued to capture market share, the company still has to figure out how to navigate tough industry conditions and find ways to spur absolute growth going forward. Company management is confident that the SABMiller merger is the key to that growth, but the stock price reflects some uncertainty among shareholders as to whether that will prove to be the case.

Anheuser-Busch has been a key part of American economic landscape for decades, and in its current form, it dominates the world. To keep succeeding, Anheuser-Busch will have to find ways not just to beat its competitors but also to drive demand for its beverages among a growing audience of potential customers across the globe.