When one of the most profitable hedge fund managers of all time liquidates a large position in any company, smart investors take notice.

Late last year, that's precisely what happened with shares of Amazon.com (AMZN +1.62%). At some point in the fourth quarter of last year, Point72 Asset Management, the $10 billion-plus family office of infamous billionaire trader Steven A. Cohen, sold its entire stake in the e-commerce giant, a position worth roughly $200 million.

So why did Point72 sell Amazon stock, and what are the implications, if any, for the average investor? Let's dive into both questions.

Who sold Amazon stock?

Point72 Asset Management is a relative newcomer in the asset-management world. The firm manages the personal fortune of Stephen A Cohen, the star trader who built his former hedge fund, SAC Capital Advisors, into one of the best-performing hedge funds in the industry. The company and its boss fell from grace in recent years as an SEC case against the company and individual resulted in $1.8 billion in insider-trading fines, which effectively killed the company and banned the boss from managing outside investors' money until 2018.

In terms of the sale itself, Point72 liquidated its entire 266,668 shares of Amazon stock at some point during the fourth quarter of 2016, according to the firm's latest 13-F filing.

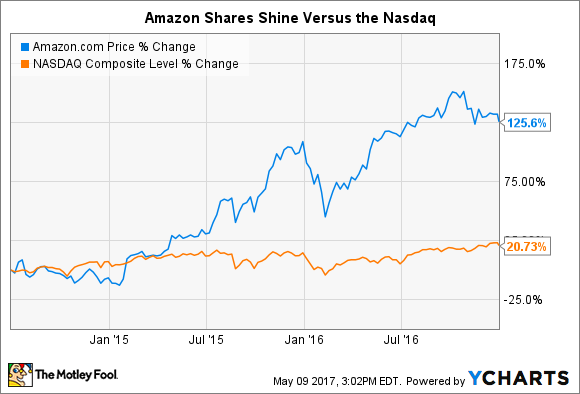

The fund manager first reported its investment in Amazon in its 13-F filing from the third quarter of 2014, a point from which Amazon shares have risen dramatically in the intervening years. Since we only know the quarters in which Point72 entered and exited the trade, it's impossible to tell how much the firm profited from buying Amazon, though it almost certainly doubled its money.

The preceding chart covers the period from the start of Q3 2014 to the end of Q4 2016, so it may not perfectly express the return Point72 yielded. What's most interesting, in any event, is the context for Point72's entry into Amazon stock.

The middle of 2014 found Amazon out of favor with the investing community. In fact, investors sent Amazon shares down more than 10% in a single day after the e-commerce titan's second-quarter results badly missed analysts' expectations, a moment that I told our readers presented a major buying opportunity. And while I agree with his decision to buy then, I wholeheartedly disagree with his decision to exit Amazon stock more recently.

Amazon stock remains a long-term buy and hold

Even as its shares trade near all-time highs, Amazon remains one of the most obvious long-term growth stocks to own. The company sits at the forefront of the ongoing global revolutions in retail and computing, each of which is earlier in its evolution than many investors seem to realize.

Image source: Amazon.com.

Both of these theses are fairly straightforward. The national and global data surrounding e-commerce as a percentage of retail sales suggests the trend has much farther to grow before all is said and done. For example, I frequently cite Commerce Department data that shows Q4 2016 e-commerce sales accounted for just 8.3% of all retail spending; global survey data pegs this figure at 8.7% worldwide. With e-commerce sales set to more than double to an estimated $4 trillion by 2020. there's plenty of growth still to come for Amazon's core business.

The same can be said for the Amazon Web Services cloud-computing platform. Research from IDC projects that revenue from two main types of cloud computing that AWS provides -- platform-as-a-service and infrastructure-as-a-service -- will rise from $70 billion in 2015 to $141 billion in 2019. With AWS sales only recently surpassing $10 billion in sales, here too it seems reasonable to expect Amazon to continue to grow rapidly alongside the industry's long-term expansion.

Equally important, Jeff Bezos has taken great pains to create and instill a culture within Amazon that emphasizes customer obsession and continued innovation in that pursuit. For example, in his 2016 shareholder letter, Bezos discussed at length the difference between what he calls "Day 1" and "Day 2" thinking; I highly recommend reading it.

Given the pace of innovation at the company, it seems safe to assume that Amazon is still as vibrant as ever, which only reiterates why this e-commerce pioneer remains a great option for long-term investors, even as some members of the hedge-fund community close their positions.