What happened

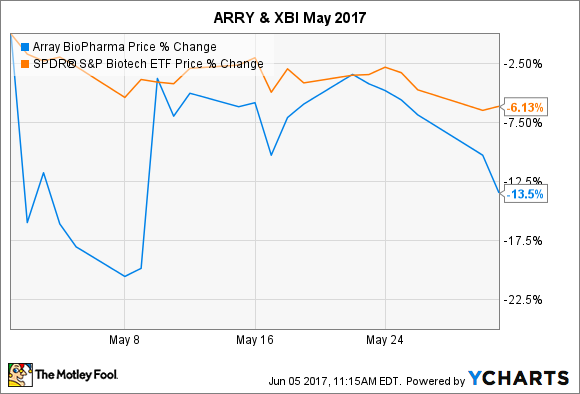

Shares of Array BioPharma (ARRY +0.00%), a clinical-stage biotech focused on cancer, dropped 13% in May, according to data from S&P Global Market Intelligence. The big drop has this Fool scratching his head, given all the positive announcements made during the period.

Image source: Getty Images.

So what

Here's a look back at the most important news items during the month:

- Array and pharma giant Merck (MRK +0.40%) entered into an agreement to study Array's binimetinib with Merck's top-selling drug Keytruda, in treating metastatic colorectal cancer patients with microsatellite-stable tumors. A study is expected to kick off later this year, and next steps will be determined based on the results. The agreement calls for the trial to be funded by Merck.

- The company announced upbeat results from part 2 of its COLUMBUS study. This trial was testing the combination of Array's clinical compounds binimetinib and encorafenib as a treatment for BRAF-mutant melanoma. The data showed that the combination therapy increased progression-free survival to 12.9 months, compared to only 9.2 months in patients who used encorafenib as a monotherapy. The company stated that a New Drug Application filing remains on track for the summer of this year.

- Array reported a net loss of $35.3 million, or $0.21 per share, in its fiscal third quarter. The company ended March with $207 million in cash on its balance sheet.

- The company announced a clinical partnership with Bristol-Myers Squibb (BMY +1.61%) to study binimetinib in combination with Bristol's Opdivo and Yervoy, as a potential treatment for metastatic colorectal cancer in patients with microsatellite-stable tumors. This early-stage study is expected to start later this year, and the results will determine next steps. Both Array and Bristol will be funding the study.

- Array entered into a licensing and commercialization agreement with Ono Pharmaceutical (NASDAQOTH: OPHLY). The deal provides Ono with the right to develop and commercialize both binimetinib and encorafenib in Japan and South Korea. In return, Array received a $31.6 million payment up front; it could be entitled to receive up to $156 million in milestone payments and double-digit royalties if the drugs prove to be a hit.

And yet, despite all of this positive news, shares still ended the month down by double digits. My hunch is that Array's stock simply got caught up in the mini-sell-off in the biotech sector, as measured by the SPDR S&P Biotech ETF:

Now what

Clinical-stage biotechs like Array are always prone to big intra-month moves, so I wouldn't place too much emphasis on the stock's recent fall. Instead, investors should stay focused on the long-term potential of pipeline drugs such as binimetinib and encorafenib, both of which appear to have decent shots at finding their way to market in the not-too-distant future. If they ultimately get the green light, then the stock price will take care of itself.