Intuitive Surgical (ISRG 3.56%) stock is on a roll so far in 2017. Shares of the robotic surgical system developer are up more than 40% year to date, and recently hit an all-time high.

The obvious question for investors when a stock has been enjoying the kind of tremendous momentum that Intuitive Surgical has recently is: Can it last? The answer depends on the level of risk that's associated with investing in the stock. How risky is Intuitive Surgical right now?

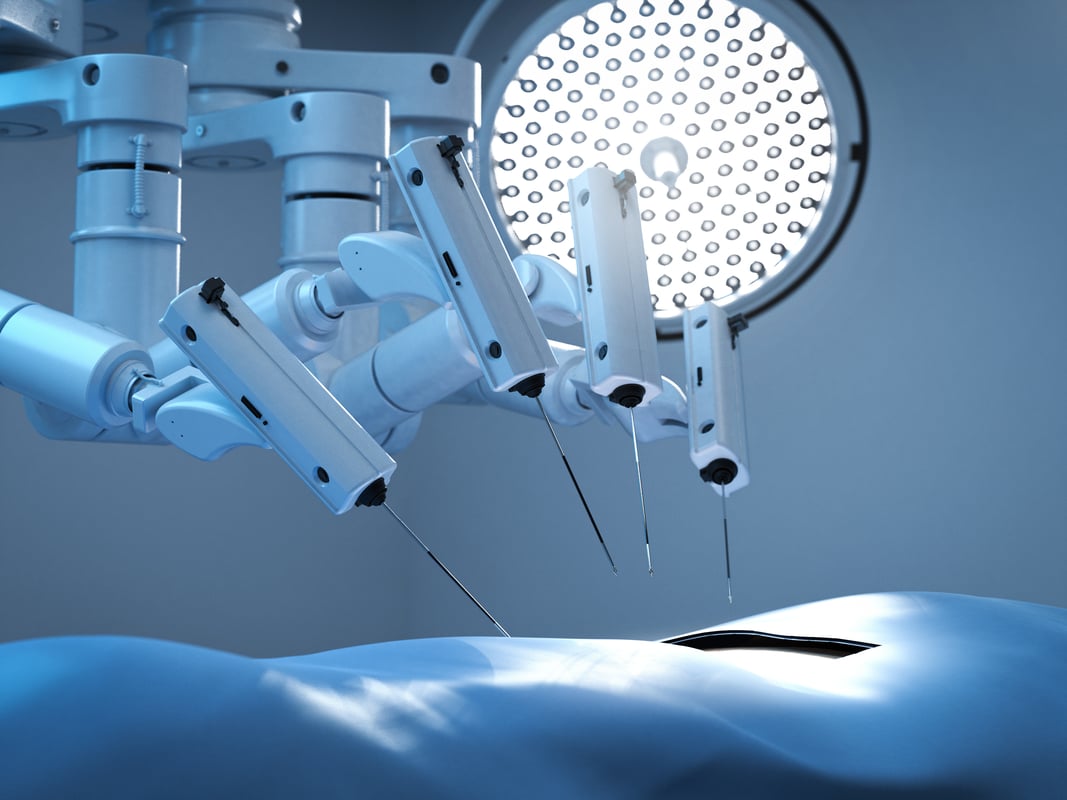

Image source: Getty Images.

Not too risky?

There's a good case to be made that Intuitive Surgical isn't very risky at all from a business perspective. Demand for its da Vinci robotic surgical systems is growing steadily. In 2016, around 753,000 surgical procedures were performed across the world with da Vinci, up more than 15% from the prior year. In the U.S., general surgery is the system's fastest-growing specialty. This includes hernia repair, colorectal procedures, and gallbladder removal. Outside of the U.S., urology procedures generated the most growth.

Hospitals that buy the da Vinci system have an inherent motivation to maximize the value of their investment. As a result, they perform as many procedures as they can using it. This benefits Intuitive Surgical because the company sells instruments and accessories for the system that either wear out frequently or are disposable. Last year, recurring revenue primarily from these sales accounted for 71% of its total revenue.

The company also stands to benefit from demographic trends. Over the next few years, the two largest U.S. generations -- baby boomers and millennials -- will hit the age ranges in which several of the most common da Vinci-assisted procedures are most likely to be required.

While Intuitive Surgical should be able to count on growing recurring revenue from these factors, it should also be in good position to sell plenty of new systems. Less than 35% of da Vinci surgical systems sold have been installed outside of the U.S., which means a large international market remains for the company to pursue. Intuitive Surgical is also exploring new and more complex types of procedures for da Vinci, which should open the door to additional sales opportunities.

Image source: Intuitive Surgical.

Very risky?

Investors with a bearish view on Intuitive Surgical would be quick to point out that the company's growth was achieved during a period where there wasn't much competition. That's about to change -- and it could mean that Intuitive Surgical is at more risk than it's ever been before.

Medtronic (MDT +0.46%) could be the most formidable rival waiting in the wings. The medical-device company's market cap is more than three times that of Intuitive Surgical, and it expects to launch its own robotic surgical system next year. And the company has inroads with more hospitals across the world than Intuitive Surgical does.

Then there's the potential disruptive innovator, Verb Surgical. It's a joint venture between Google parent Alphabet (GOOG 1.19%) (GOOGL 1.16%) and healthcare giant Johnson & Johnson (JNJ +1.02%). Verb Surgical probably won't have a product on the market until 2020, but when it arrives, it could be a game-changer. The company plans to connect machine learning, robotic surgery, instrumentation, advanced visualization, and data analytics together in a way no other company has attempted.

While competitors could present a business risk to Intuitive Surgical, the hazard to its stock price could be even greater. Intuitive Surgical shares trade at a premium valuation of more than 33 times expected earnings. Its growth prospects are solid, but they don't make the stock look more attractive. Intuitive Surgical's PEG ratio is 3.55 -- a very high level. Given the stock's ambitious valuation, it could take a steep hit if the broader market goes through a correction.

The best answer

My view is that the best way to assess Intuitive Surgical's risk is to look at the question in terms of short-term risk versus long-term risk. Over the short term, its business seems to be at low risk, thanks to the solid recurring revenue and trends discussed earlier. It's possible that the stock could decline, but smart investors won't be too concerned about temporary pullbacks.

Over the long term, the company does face increased risk as more competitors enter the market. However, my guess at this point is that the risk is only moderate. Intuitive Surgical enjoys a long history in the robotic surgical systems market that should give it a competitive advantage. I expect the company to continue to develop new technologies that will allow it to compete effectively against new rivals.

How risky is Intuitive Surgical? For now, I'd say not too risky. But investors should keep their eyes on Medtronic and Verb Surgical.